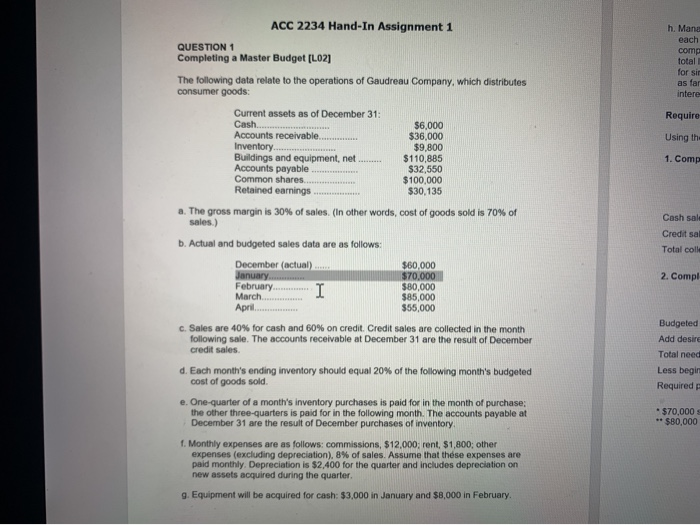

Question: ACC 2234 Hand-In Assignment 1 QUESTION 1 Completing a Master Budget [LO2] The following data relate to the operations of Gaudreau Company, which distributes consumer

![[LO2] The following data relate to the operations of Gaudreau Company, which](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e9822ac0b04_24166e9822a00782.jpg)

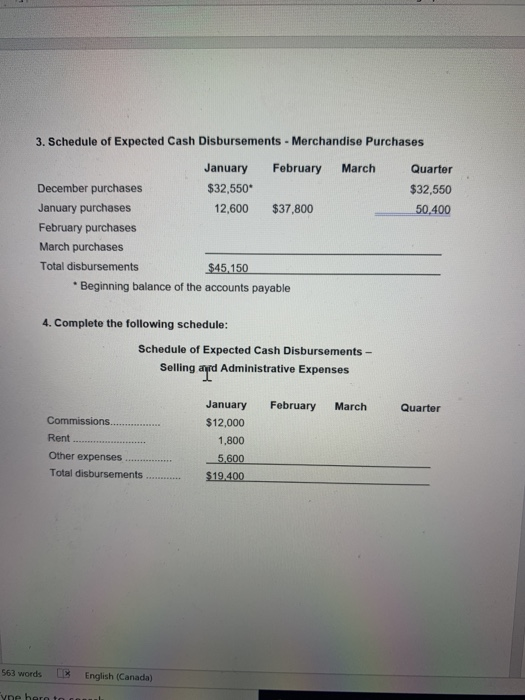

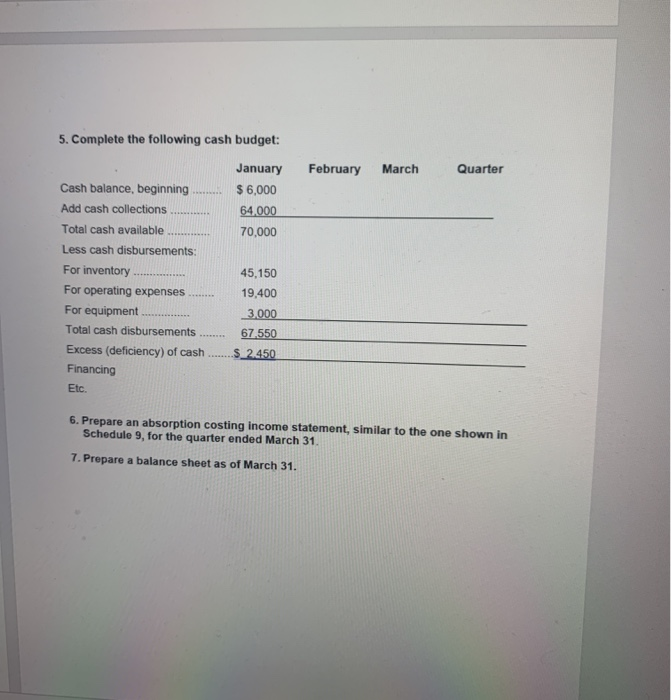

ACC 2234 Hand-In Assignment 1 QUESTION 1 Completing a Master Budget [LO2] The following data relate to the operations of Gaudreau Company, which distributes consumer goods: h. Mana each come total for si as far intere Require Using th: Current assets as of December 31: Cash.... Accounts receivable Inventory... Buildings and equipment, net Accounts payable Common shares Retained earnings $6,000 $36,000 $9,800 $110.885 $32,550 $100,000 $30,135 1. Comp a. The gross margin is 30% of sales. (In other words, cost of goods sold is 70% of sales.) Cash sale Credit sal Total colle b. Actual and budgeted sales data are as follows: 2. Compl December (actual) January February March April I $60,000 $70,000 $80,000 $85,000 $55,000 Budgeted Add desire Total need Less begin Required c. Sales are 40% for cash and 60% on credit. Credit sales are collected in the month following sale. The accounts receivable at December 31 are the result of December credit sales d. Each monty's ending inventory should equal 20% of the following month's budgeted cost of goods sold e. One-quarter of a month's inventory purchases is paid for in the month of purchase; the other three-quarters is paid for in the following month. The accounts payable at December 31 are the result of December purchases of inventory 1. Monthly expenses are as follows: commissions, $12,000; rent, $1,800; other expenses (excluding depreciation). 8% of sales. Assume that these expenses are paid monthly. Depreciation is $2,400 for the quarter and includes depreciation on new assets acquired during the quarter. g. Equipment will be acquired for cash: $3,000 in January and $8,000 in February $70,000 ** $80,000 Styles h. Management would like to maintain a minimum cash balance of $6,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $50,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. The company would, as far as it is able, repay the loan (also in increments of $1,000) plus accumulated interest at the end of the quarter. Required: Using the data above: 1. Complete the following schedule: Schedule of Expected Cash Collections January February March Quarter Cash sales $28,000 Credit sales 36,000 Total collections $64.000 2. Complete the following: Merchandise Purchasing Budget February March Quarter Budgeted cost of goods sold Add desired ending inventory Total needs Less beginning inventory Required purchases January $49,000 11.200** $60,200 9.800 $50,400 $70.000 sales X 70% - $49.000 ** $80,000 X 70% X 20% - $11,200. 3. Schedule of Expected Cash Disbursements - Merchandise Purchases March Quarter $32,550 50,400 January February December purchases $32,550 January purchases 12,600 $37,800 February purchases March purchases Total disbursements $45,150 * Beginning balance of the accounts payable 4. Complete the following schedule: Schedule of Expected Cash Disbursements - Selling and Administrative Expenses February March Quarter Commissions Rent January $12,000 1,800 5,600 $19.400 Other expenses Total disbursements 563 words LE English (Canada) yne here to com 5. Complete the following cash budget: February March Quarter January $ 6,000 64.000 70,000 Cash balance, beginning Add cash collections Total cash available Less cash disbursements: For inventory For operating expenses For equipment Total cash disbursements Excess (deficiency) of cash Financing Etc. 45,150 19,400 3.000 67.550 $ 2.450 6. Prepare an absorption costing income statement, similar to the one shown in Schedule 9, for the quarter ended March 31. 7. Prepare a balance sheet as of March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts