Question: ACC 3 1 8 Module Two Assignment Guidelines and Rubric Overview Financial ratios are used by organizations to analyze balances from different periods or against

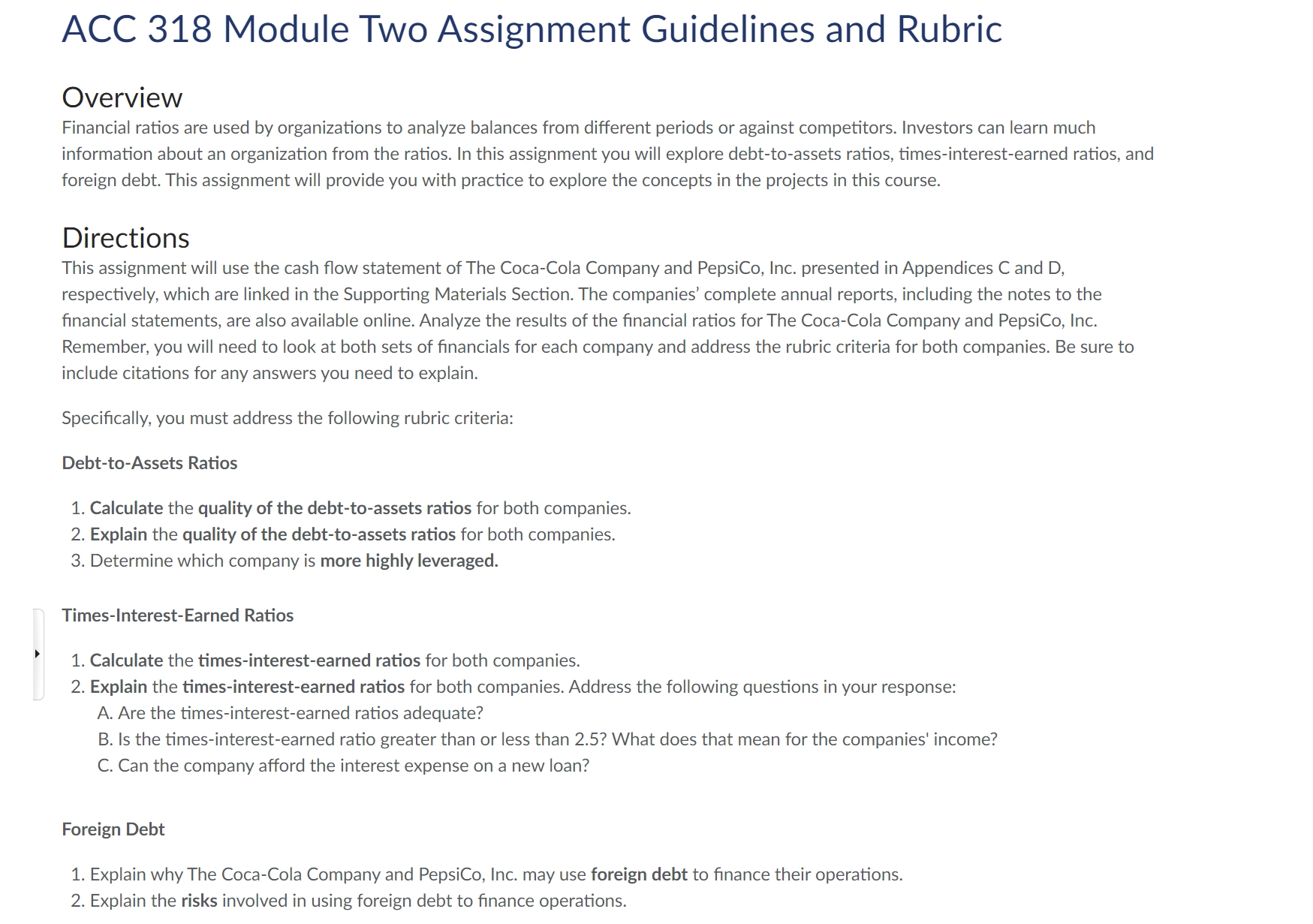

ACC Module Two Assignment Guidelines and Rubric

Overview

Financial ratios are used by organizations to analyze balances from different periods or against competitors. Investors can learn much information about an organization from the ratios. In this assignment you will explore debttoassets ratios, timesinterestearned ratios, and foreign debt. This assignment will provide you with practice to explore the concepts in the projects in this course.

Directions

This assignment will use the cash flow statement of The CocaCola Company and PepsiCo, Inc. presented in Appendices C and D respectively, which are linked in the Supporting Materials Section. The companies' complete annual reports, including the notes to the financial statements, are also available online. Analyze the results of the financial ratios for The CocaCola Company and PepsiCo, Inc. Remember, you will need to look at both sets of financials for each company and address the rubric criteria for both companies. Be sure to include citations for any answers you need to explain.

Specifically, you must address the following rubric criteria:

DebttoAssets Ratios

Calculate the quality of the debttoassets ratios for both companies.

Explain the quality of the debttoassets ratios for both companies.

Determine which company is more highly leveraged.

TimesInterestEarned Ratios

Calculate the timesinterestearned ratios for both companies.

Explain the timesinterestearned ratios for both companies. Address the following questions in your response:

A Are the timesinterestearned ratios adequate?

B Is the timesinterestearned ratio greater than or less than What does that mean for the companies' income?

C Can the company afford the interest expense on a new loan?

Foreign Debt

Explain why The CocaCola Company and PepsiCo, Inc. may use foreign debt to finance their operations.

Explain the risks involved in using foreign debt to finance operations. Complete this template by replacing the bracketed text with the relevant information.

DebttoAssets Ratios

Calculate the quality of the debttoassets ratios for both companies. Insert text.

Explain the quality of the debttoassets ratios for both companies.

Insert text.

Determine which company is more highly leveraged.

Insert text.

TimesInterestEarned Ratios

Calculate the timesinterestearned ratios for both companies.

Insert text.

Explain the timesinterestearned ratios for both companies. Address the following questions in your response:

A Are the timesinterestearned ratios adequate?

B Is the timesinterestearned ratio greater than or less than What does that mean for the companies' income?

C Can the company afford the interest expense on a new loan?

Insert text.

Foreign Debt

Explain why The CocaCola Company and PepsiCo, Inc. may use foreign debt to finance their operations.

Insert text.

Explain the risks involved in using foreign debt to finance operations.

Insert text.

References

Include any references used to complete this assignment. This section is for the full citation. Sources

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock