Question: ACC 3 3 0 - Tax Return # 1 Required: You are employed by a public accounting firm and are asked to complete Keith and

ACC Tax Return #

Required:

You are employed by a public accounting firm and are asked to complete Keith and Jennifer Hamilton's federal income tax return from the information they provided to your firm in January and March of This is the first year your firm is preparing their return; they provided a copy of their tax return.

Use the provided forms and schedules as well as the applicable instructions on the IRS websites

As applicable, to calculate line of Form you may need to use the Tax Rate Schedule, Qualified Dividends & Capital Gain Tax Worksheet, Schedule D Tax Worksheet, andor the Tax Computation Worksheet.

Assume the only other tax and credits to report in the Tax and Credits section is from Form You do not need to complete the Credit Limit Worksheet A for Line ; you can just enter the amount from Line of Form If they do not have a child tax credit, include Form in their return so the Hamiltons can see you completed it

Prepare an Assumptions page to note any assumptions with an accompanying questionsconfirmations you have for the Hamiltons. You must have at least two sets.

Prepare a Tax Planning page to provide at least two comments or suggestions for Keith and Jennifer to consider for the tax year.

I am not expecting questions, but if you do have any, assume I am your supervisor and pose them to me via email or in person accordingly. If there are questions from classmates in both course sections, I will post the questions and answers on Canvas in the Q&A TR document in the Tax Returns & Memos Module. I will post an announcement in Canvas when a Q&A is added. You are required to take those into consideration in preparing your return.

Submission Requirements:

The return must be handwritten using the forms provided.

It is your responsibility to monitor Canvas Q&A posts and include information through three days prior to your submission date. For example, if the submit date on your TR # is you must have considered Q&A content through the Q&A date.

Submit onbefore the due date. It can be turned in to me beforeafter class or in my office or submitted in Canvas.

Format: Assume you are submitting it to your supervisor who will review it prior to presenting it to the Hamiltons.

Page : Cover Sheet with a line heading including your name, ACC Tax Return # and Submit Date MMDDYY

Page : Assumption page with a line heading including Assumptions, Taxpayers Keith & Jennifer Hamilton, and Tax Year.

Page : Tax Planning page with a line heading including Tax Planning, Taxpayers Keith & Jennifer Hamilton, and Tax Year.

Page should be page of Form followed by the remaining formsschedules in the proper order.

Information from the Taxpayers:

Keith and Jennifer dropped off an envelope with the following notesforms enclosed.

We own our home and live in it with our children. We are thinking about purchasing a lake home next year.

We have children: Bryant, Joshua, Danielle, and Sara. Bryant is a fulltime student at Arizona State University. He lives with us in the summer and in his apartment during the school year. He is interviewing for a fulltime job after he graduates. We hope he graduates in May, but it is more likely it will be early August or midDecember.

Our children's dates of birth dob and SSNs are:

Bryant's dob is and SSN is

Joshua's dob is and SSN is

Danielle's dob is and SSN is

Sara's dob is and her SSN is

Keith is an airline pilot and his dob is

Jennifer is a teacher's assistant and her dob is

Our prior year return is enclosed. Information about our return follows:

We want to file MFJ We agree that Keith can be listed as the spouse.

Contribute to Presidential election campaign: Keith does not, and Jennifer does.

We have never had digital assets.

We do not have a foreign bank account or trust.

We have never had any virtual currency.

If we have an overpayment, we do not want it applied to next year. We want it refunded. If we owe, we want out return extended so we can pay what we owe in October.

We did not make estimated payments.

We enclosed the s we have. Postit note from Jennier: I received a Int from Clark County Credit Union that I couldn't find; I checked my statement, and it said I had $ of taxexempt interest income in I had $ at the end of February.

Postit note from Jennifer: We earned $ of interest income in our jointly owned checking account with One Nevada Credit Union. I don't think we received an interest form.

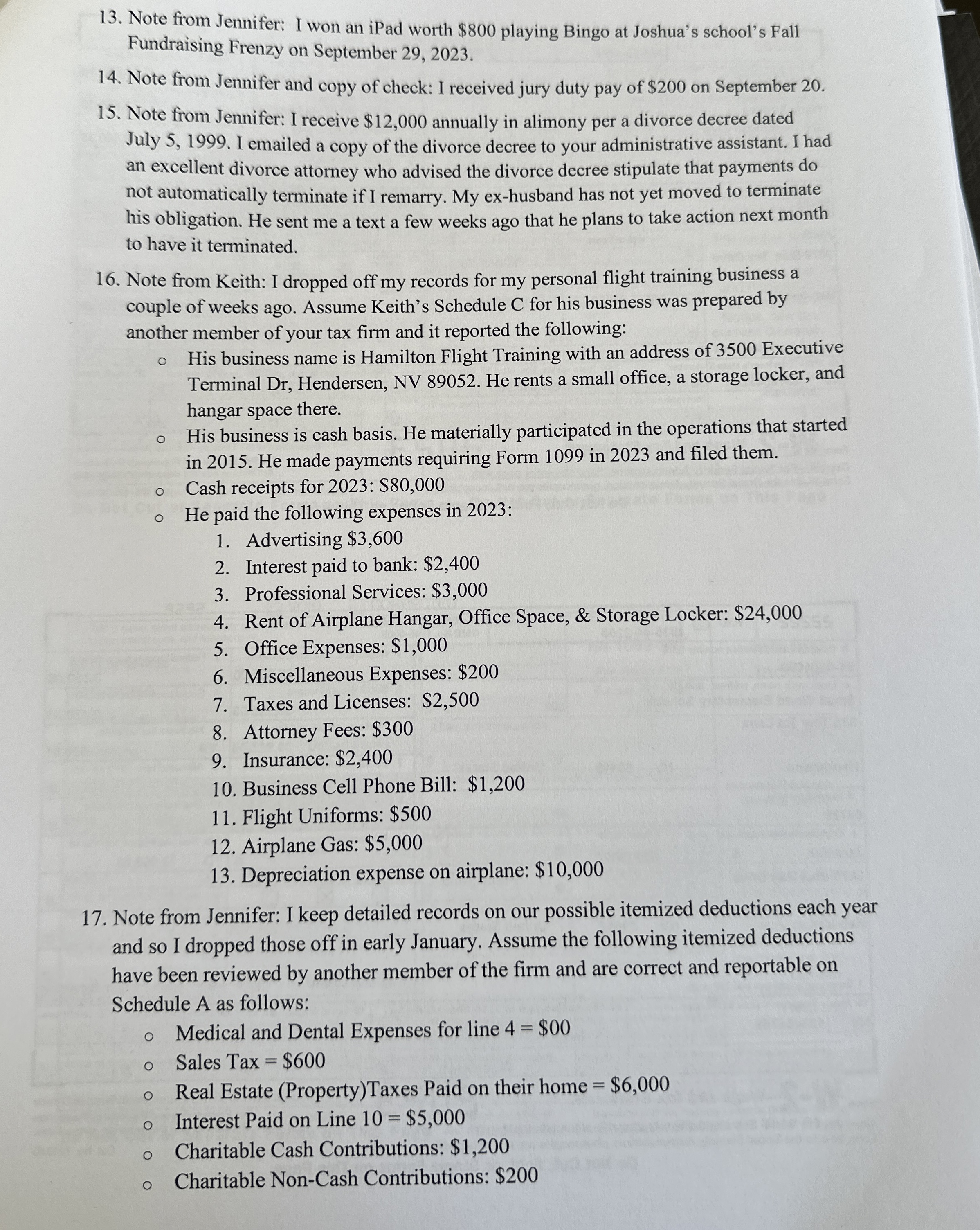

Note from Jennifer: I was involved in a car accident on January last year. It wasn't my fault, and I wasn't physically h

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock