Question: ACC 302 - Current Liabilities Case - 40 points Smyth Corpo Additional information. No adjustments have been made for any of the additional information. No

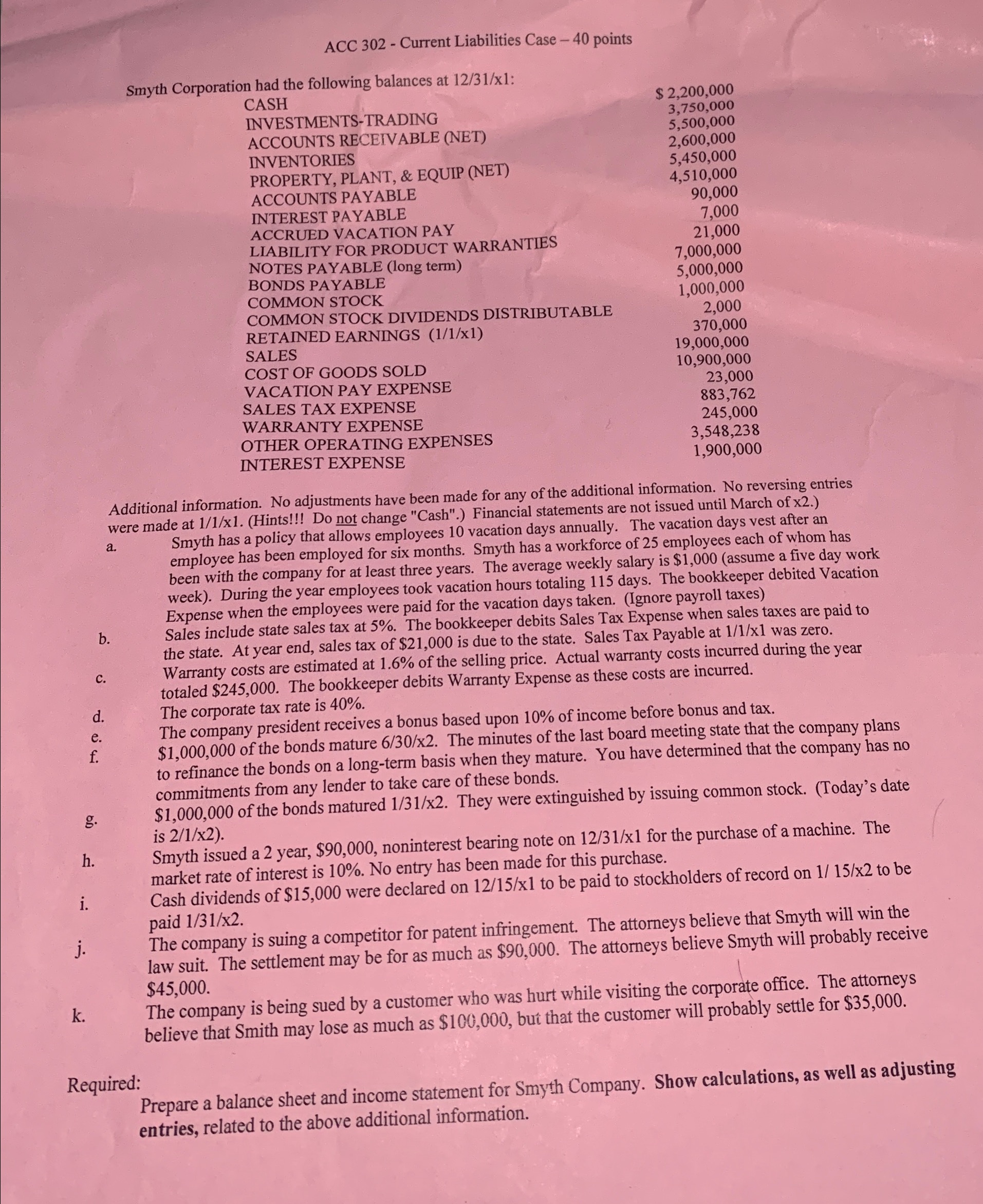

ACC 302 - Current Liabilities Case - 40 points Smyth Corpo Additional information. No adjustments have been made for any of the additional information. No reversing entries were made at 1/1/x1. (Hints!!! Do not change "Cash".) Financial statements are not issued until March of x2.) a. Smyth has a policy that allows employees 10 vacation days annually. The vacation days vest after an employee has been employed for six months. Smyth has a workforce of 25 employees each of whom has been with the company for at least three years. The average weekly salary is $1,000 (assume a five day work week). During the year employees took vacation hours totaling 115 days. The bookkeeper debited Vacation Expense when the employees were paid for the vacation days taken. (Ignore payroll taxes) b. Sales include state sales tax at 5\%. The bookkeeper debits Sales Tax Expense when sales taxes are paid to the state. At year end, sales tax of $21,000 is due to the state. Sales Tax Payable at 1/1/x1 was zero. Warranty costs are estimated at 1.6% of the selling price. Actual warranty costs incurred during the year c. totaled $245,000. The bookkeeper debits Warranty Expense as these costs are incurred. d. The corporate tax rate is 40%. e. The company president receives a bonus based upon 10% of income before bonus and tax. f. $1,000,000 of the bonds mature 6/30/2. The minutes of the last board meeting state that the company plans to refinance the bonds on a long-term basis when they mature. You have determined that the company has no commitments from any lender to take care of these bonds. g. $1,000,000 of the bonds matured 1/31/2. They were extinguished by issuing common stock. (Today's date is 2/1/2 ). h. Smyth issued a 2 year, $90,000, noninterest bearing note on 12/31/1 for the purchase of a machine. The market rate of interest is 10%. No entry has been made for this purchase. i. Cash dividends of $15,000 were declared on 12/15/1 to be paid to stockholders of record on 1/15/2 to be paid 1/31/x2. j. The company is suing a competitor for patent infringement. The attorneys believe that Smyth will win the law suit. The settlement may be for as much as $90,000. The attorneys believe Smyth will probably receive $45,000. k. The company is being sued by a customer who was hurt while visiting the corporate office. The attorneys believe that Smith may lose as much as $100,000, bui that the customer will probably settle for $35,000. Required: Prepare a balance sheet and income statement for Smyth Company. Show calculations, as well as adjustins entries, related to the above additional information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts