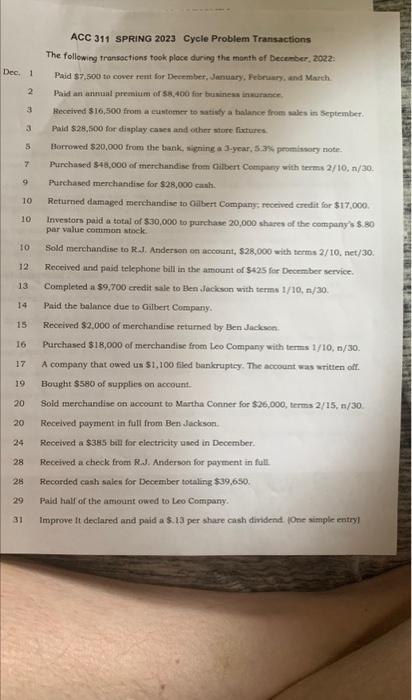

Question: ACC 311 SPRING 2023 Cycle Problem Transactions The following transoctions took ploce during the month of December, 202z: Dec, 1 Paid $7,500 to cover rent

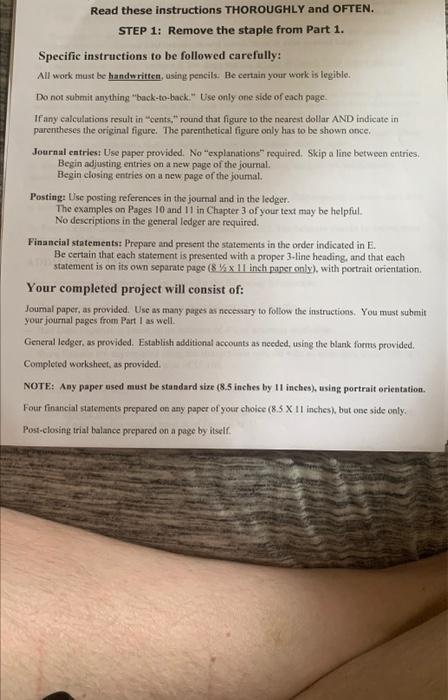

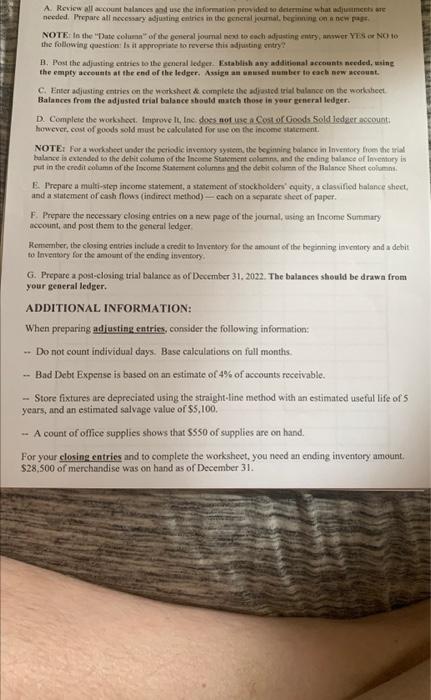

ACC 311 SPRING 2023 Cycle Problem Transactions The following transoctions took ploce during the month of December, 202z: Dec, 1 Paid $7,500 to cover rent for Dearmber, Jenuary, Februnry, and Marth. 2. Paid an anmaal premium of $8,400 fur business innurance. Received $16,500 from a cuntomtr to satisfy a halance from asles in September. Paid $28,500 for display casen and other store fixtures. Borrowed $20,000 froen the bank, wigning a 1 -ycar, 5.3\%, prominsoty note Purchased $48,000 of theichundise froen Cibert Compary with terms 2/10,n/30. Purchased merchandise for $28,000 camh. 10 Returned damaged reerchandise ta Oilbert Company- recelved eredit for $17,000. 10. Investorn paid a total of $30,000 to purchave 20,000 shares of the company's $.80 par value common stiek 10 Sold merchandise to R.A. Anderson on account, $28,000 with terms 2/10, net/30. 12. Received and paid telephone bill in the amount of $425 for Dectmber service. 13. Completed a $9,700 crodit sale to Ben Jackson with terms 1/10, n/30. 14 Paid the balance due to Gilbert Company. 15. Received $2,000 of merchandise returned by Ben Jackson. 16 Purchased $18,000 of merchandise from Leo Company with terms 1/10, n/30. 17 A company that owed us $1,100 filed bankruptcy. The account was written off. 19 Bought $580 of supplies on account. 20 Sold merehandise on uccount to Martha Conner for $26,000, terms 2/15, n/30 20 Recelved payment in full from Ben Jackson. 24 Received a \$385 bill for electncity usod in Docember. 28 Received a check from R.a. Anderson for payment in full. 26 Recarded cash sales for December totaling $39,680 Pald half of the amount owed to Leo Company. 31 Improve it declared and paid a 5.13 per share cash dividend. [One simple entry) STEP 1: Remove the staple from Part 1. Specific instruetions to be followed carefully: All work must be handwritten, using pencils. Be certain your work is legible. Do not submit anything "back-to-back". Use only one side of each page. If any calculations result in "cents", round that figure to the nearest dollar AND indicate in parentheses the original figure. The parenthetical figure only has to be shown once. Journal entries: Use paper provided. No "explanations" required. Skip a line between entries, Begin adjusting entries on a new page of the journal. Begin closing entries on a new page of the joumat. Posting: Use posting references in the journal and in the ledger. The examples on Pages 10 and 11 in Chapter 3 of your text may be helpful. No descriptions in the general ledger are required. Financial statements: Prepare and present the statements in the order indicated in E. Be certain that each statement is presented with a proper 3-line heading, and that each statement is on its own separate page ( 81/211 inch paper only), with portrait orientation. Your completed project will consist of: Joumal paper, as provided. Use as many pages as neceevary to follow the instructions, You must submit your jourmal pages from Part 1 as well. General ledger, as prowided. Establish additional accounts as needed, using the blank forms provided. Completed worksheet, as provided. NOTE: Any paper ased must be standard size (8.5 inches by 11 inches), using portrait orientation. Four financial satements prepared on any paper of your choice (8.5X11 inches), but one side only. Post-closing trial bulance pecpared on a pase by itself. A. Review all account bulances agd ure ihe informarion peovideit oo deiermine what sliummech we needed. Propare all necessary asfuating eniriet in the ecneral ixarnal, hegining con a new paft. NOTE ts the "Date columa" of the general joumal nesi to each adrutini emtry, arswer YTs or NC to the followity qoestion: Is it appropriate to reverie this adjuntiny stitry? B. Pou the adjusting catties bo ihe ecneral lodfer. Establith any additional accounts necded, taing the empty acceuats at the end of the lederr. Asize an entesel eumber to cacb new mrrount. Balances from the adjosted trial balance sbould matel those in yeer wencral ledger. D. Compleie the workihert. Improse le, Ins, dass not usc. a Gont or Goods Fold Jedeer ascount. however, cost of goods sold must be calculated for we oe the imcome itatement. pet in the credit columin of the Incume Sasement columnt and the debit colume of the Balance Shoct columnit. E. Pregare a malti-step income statement, a statement of stoekholders' equity, a clasuified balance sheet. and a starement of eash flows (indirect method) - each on a separate sheet of paper. F. Pripare the necessary closing entries on a new page of the joumal, aseng an Income Stmmary account, and poot them to the gencral ledger. Fernember, the closing entries include a cresit to laventory for the amount of the heginning inventocy and a debit to taventiry for the amoant of the ending inventody. G. Prepare a posi-closing trial balance as of Deccmber 31.2022. The balances sheuld be drawa from your general ledger. ADDITIONAL INFORMATION: When preparing adjustieg entries, consider the following information: . Do not count individual days. Base calculations on foll months. - Bad Debt Expense is based on an estimate of 4% of accounts reccivable. - Store fixtures afe depreciated using the straight-line method with an estimated useful life of 5 years, and an estimated salvage value of $5,100. -. A count of office supplies shows that $550 of supplies are on hand. For your closing entries and to complete the worksheet, you need an ending inventory amount. $28,500 of merchandise was on hand as of December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts