Question: ACC 3511 Decision Making and Control Case Analysis 1 - Performance Measurement System Youngblood international has its head office in Brisbane, and operates throughout Australia,

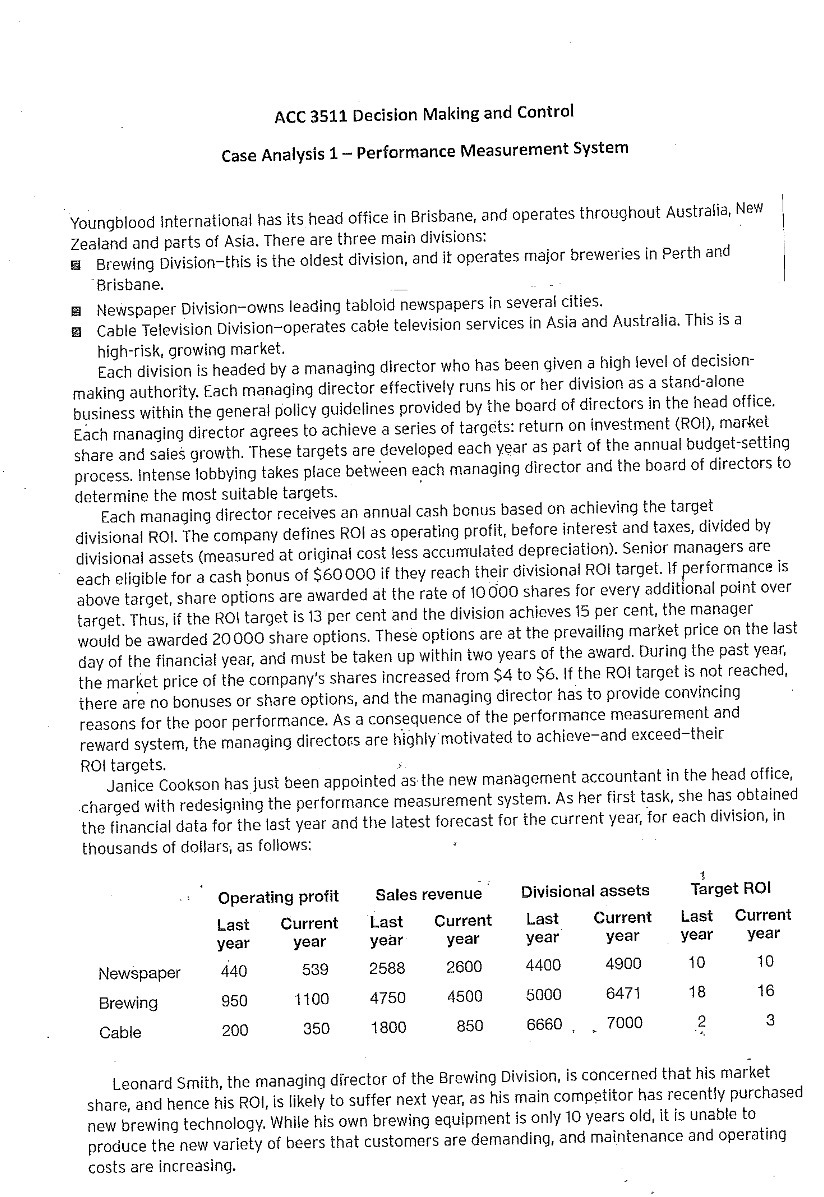

ACC 3511 Decision Making and Control Case Analysis 1 - Performance Measurement System Youngblood international has its head office in Brisbane, and operates throughout Australia, New Zealand and parts of Asia. There are three main divisions: Brewing Division-this is the oldest division, and it operates major breweries in Perth and Brisbane. Newspaper Division-owns leading tabloid newspapers in several cities. Cable Television Division-operates cable television services in Asia and Australia. This is a high-risk, growing market. Each division is headed by a managing director who has been given a high level of decision- making authority. Each managing director effectively runs his or her division as a stand-alone business within the general policy guidelines provided by the board of directors in the head office. Each managing director agrees to achieve a series of targets: return on investment (ROI), market share and sales growth. These targets are developed each year as part of the annual budget-setting process. Intense lobbying takes place between each managing director and the board of directors to determine the most suitable targets. Each managing director receives an annual cash bonus based on achieving the target divisional ROI. The company defines ROI as operating profit, before interest and taxes, divided by divisional assets (measured at original cost less accumulated depreciation). Senior managers are each eligible for a cash bonus of $60 000 if they reach their divisional ROI target. If performance is above target, share options are awarded at the rate of 10 000 shares for every additional point over target. Thus, if the ROI target is 13 per cent and the division achieves 15 per cent, the manager would be awarded 20000 share options. These options are at the prevailing market price on the last day of the financial year, and must be taken up within two years of the award. During the past year, the market price of the company's shares increased from $4 to $6. If the ROI target is not reached, there are no bonuses or share options, and the managing director has to provide convincing reasons for the poor performance. As a consequence of the performance measurement and reward system, the managing directors are highly motivated to achieve-and exceed-their ROI targets. Janice Cookson has just been appointed as the new management accountant in the head office, charged with redesigning the performance measurement system. As her first task, she has obtained the financial data for the last year and the latest forecast for the current year, for each division, in thousands of dollars, as follows: Operating profit Sales revenue Divisional assets Target ROI Last Current Last Current Last Current Last Current year year year year year year year year Newspaper 440 539 2588 2600 4400 4900 10 10 Brewing 950 1100 4750 4500 5000 6471 18 16 Cable 200 350 1800 850 6660 7000 2 3 Leonard Smith, the managing director of the Brewing Division, is concerned that his market share, and hence his ROI, is likely to suffer next year, as his main competitor has recently purchased new brewing technology. While his own brewing equipment is only 10 years old, it is unable to produce the new variety of beers that customers are demanding, and maintenance and operating costs are increasing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts