Question: ACC 645 Project One Guidelines and Rubric Competencies In this project, you will demonstrate your mastery of the following competencies: Apply Standards for Accounting and

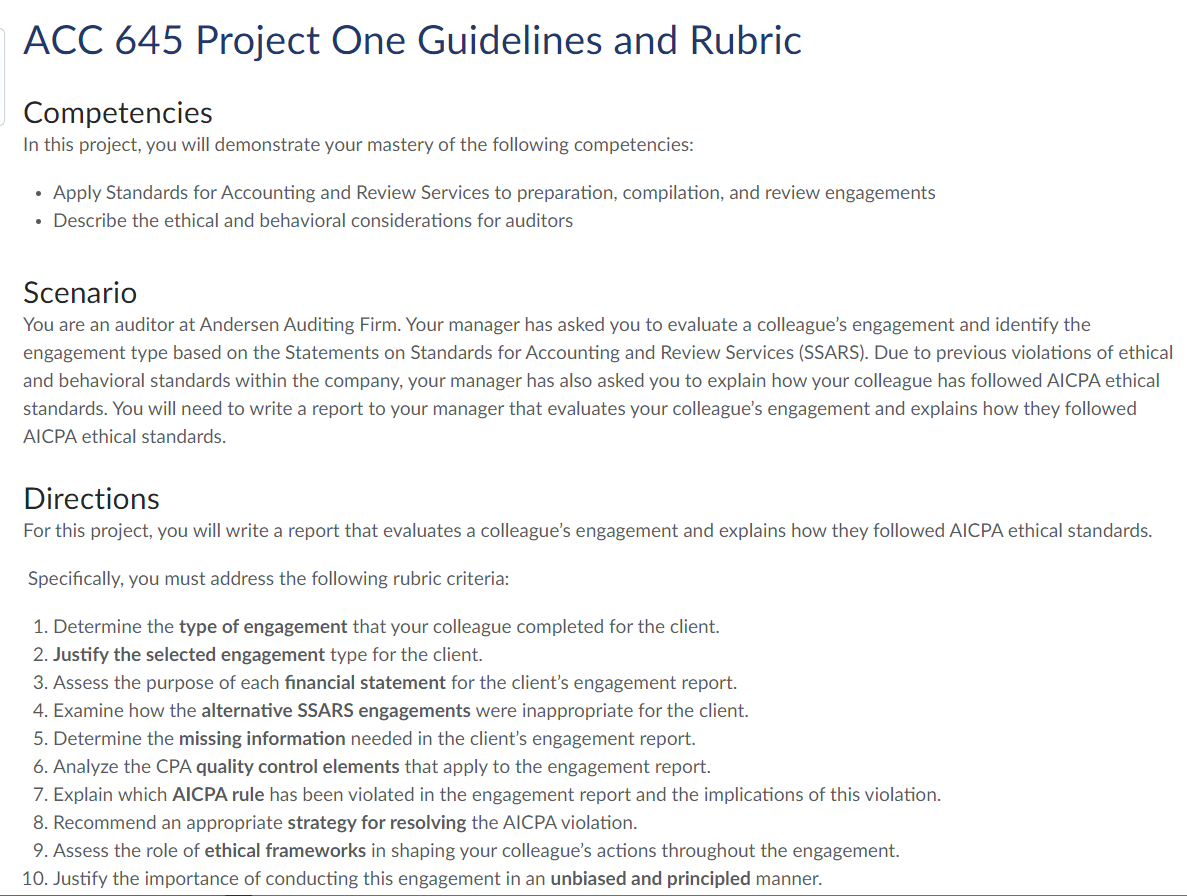

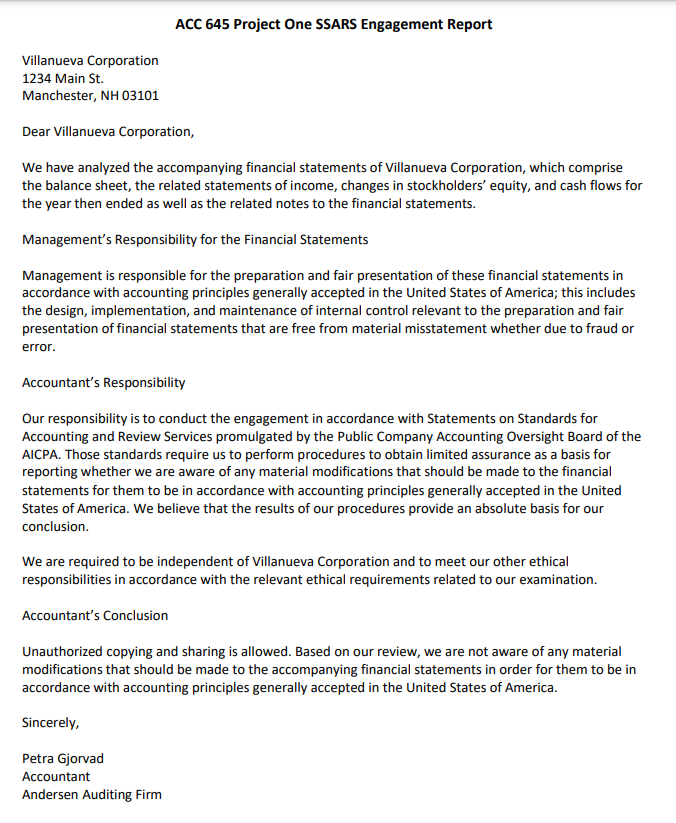

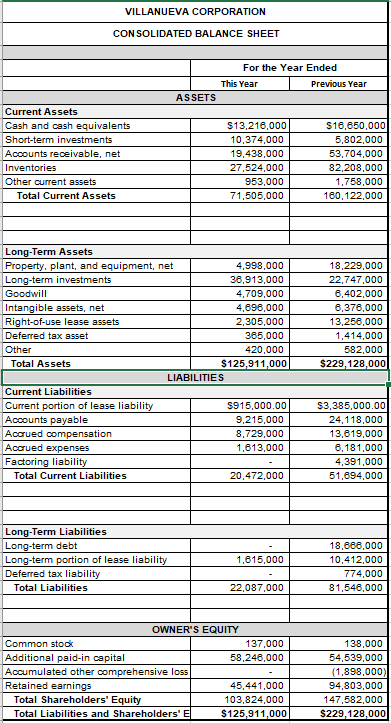

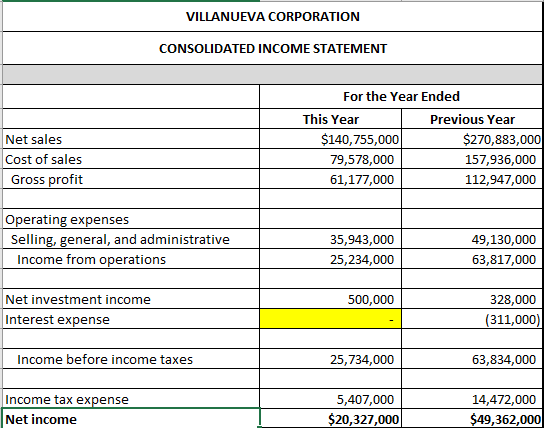

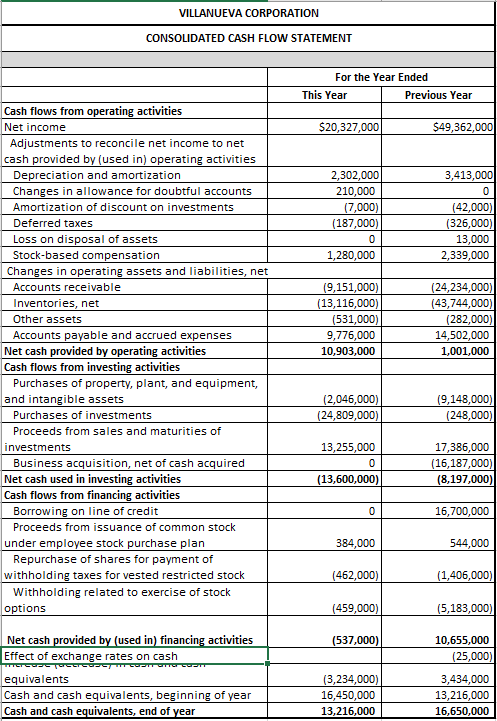

ACC 645 Project One Guidelines and Rubric Competencies In this project, you will demonstrate your mastery of the following competencies: Apply Standards for Accounting and Review Services to preparation, compilation, and review engagements Describe the ethical and behavioral considerations for auditors Scenario You are an auditor at Andersen Auditing Firm. Your manager has asked you to evaluate a colleague's engagement and identify the engagement type based on the Statements on Standards for Accounting and Review Services (SSARS). Due to previous violations of ethical and behavioral standards within the company, your manager has also asked you to explain how your colleague has followed AICPA ethical standards. You will need to write a report to your manager that evaluates your colleague's engagement and explains how they followed AICPA ethical standards. Directions For this project, you will write a report that evaluates a colleague's engagement and explains how they followed AICPA ethical standards. Specifically, you must address the following rubric criteria: 1. Determine the type of engagement that your colleague completed for the client. 2. Justify the selected engagement type for the client. 3. Assess the purpose of each financial statement for the client's engagement report. 4. Examine how the alternative SSARS engagements were inappropriate for the client. 5. Determine the missing information needed in the client's engagement report. 6. Analyze the CPA quality control elements that apply to the engagement report. 7. Explain which AICPA rule has been violated in the engagement report and the implications of this violation. 8. Recommend an appropriate strategy for resolving the AICPA violation. 9. Assess the role of ethical frameworks in shaping your colleague's actions throughout the engagement. 10. Justify the importance of conducting this engagement in an unbiased and principled manner. ACC 645 Project One SSARS Engagement Report Villanueva Corporation 1234 Main 5t. Manchester, NH 03101 Dear Villanueva Corporation, We have analyzed the accompanying financial statements of Villanueva Corporation, which comprise the balance sheet, the related statements of income, changes in stockholders' equity, and cash flows for the year then ended as well as the related notes to the financial statements. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement whether due to fraud or error. Accountant's Responsibility Our responsibility is to conduct the engagement in accordance with Statements on Standards for Accounting and Review Services promulgated by the Public Company Accounting Oversight Board of the AICPA. Those standards require us to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. We believe that the results of our procedures provide an absolute basis for our conclusion. We are required to be independent of Villanueva Corporation and to meet our other ethical responsibilities in accordance with the relevant ethical requirements related to our examination. Accountant's Conclusion Unauthorized copying and sharing is allowed. Based on our review, we are not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in accordance with accounting principles generally accepted in the United 5tates of America. Sincerely, Petra Gjorvad Accountant Andersen Auditing Firm VILLANUEVA CORPORATION CONSOLIDATED BALANCE SHEET For the Year Ended This Year Previous Year ASSETS Current Assets Cash and cash equivalents $13,216,000 $16.650,000 Short-term investments 10,374.000 5,802.000 Accounts receivable, net 19,438,000 53,704,000 Inventories 27.524,000 82,208,000 Other current assets 953,000 1,758,000 Total Current Assets 71,505,000 160, 122,000 Long-Term Assets Property, plant, and equipment, net 4,998,000 18,229,000 Long-term investments 36,913,000 22.747.000 Goodwill 4,709,000 3,402,000 Intangible assets, net 4,698,000 8.376.000 Right-of-use lease assets 2.305,000 13,256,000 Deferred tax asset 365,000 1.414.000 Other 420.000 682.000 Total Assets $125,911,000 $229,128,000 LIABILITIES Current Liabilities Current portion of lease liability 3915,000.00 33,385,000.00 Accounts payable 9,215,000 24.118,000 Accrued compensation 8.729,000 13.619,000 Accrued expenses 1,613,000 6.181,000 Factoring liability 4.391,000 Total Current Liabilities 20.472.000 51,694,000 Long-Term Liabilities Long-term debt 18.686,000 Long-term portion of lease liability 1.615,000 10,412,000 Deferred tax liability 774.000 Total Liabilities 22.087,000 81.546.000 OWNER'S EQUITY Common stock 137,000 138,000 Additional paid-in capital 58,246.000 54,539,000 Accumulated other comprehensive loss (1.898,000) Retained earnings 45,441,000 94.803,000 Total Shareholders' Equity 103,824,000 147.582,000 Total Liabilities and Shareholders' E $125,911,000 $229,128,000VILLANUEVA CORPORATION CONSOLIDATED INCOME STATEMENT For the Year Ended This Year Previous Year Net sales $140,755,000 $270,883,000 Cost of sales 79,578,000 157,936,000 Gross profit 61,177,000 112,947,000 Operating expenses Selling, general, and administrative 35,943,000 49,130,000 Income from operations 25,234,000 63,817,000 Net investment income 500,000 328,000 Interest expense (311,000 Income before income taxes 25,734,000 63,834,000 Income tax expense 5,407,000 14,472,000 Net income $20,327,000 $49,362,000VILLANUEVA CORPORATION CONSOLIDATED CASH FLOW STATEMENT For the Year Ended This Year Previous Year Cash flows from operating activities Net income $20,327,000 $49,362,000 Adjustments to reconcile net income to net cash provided by (used in) operating activities Depreciation and amortization 2,302,000 3,413,000 Changes in allowance for doubtful accounts 210,000 0 Amortization of discount on investments (7,000) (42,000) Deferred taxes (187,000) (326,000) Loss on disposal of assets 0 13,000 Stock-based compensation 1,280,000 2,339,000 Changes in operating assets and liabilities, net Accounts receivable (9,151,000) (24,234,000) Inventories, net (13,116,000) (43,744,000) Other assets (531,000) 282,000 Accounts payable and accrued expenses 9,776,000 14,502,000 Net cash provided by operating activities 10,903,000 1,001,000 Cash flows from investing activities Purchases of property, plant, and equipment, and intangible assets (2,046,000) (9,148,000) Purchases of investments (24,809,000) (248,000) Proceeds from sales and maturities of investments 13,255,000 17,386,000 Business acquisition, net of cash acquired 0 (16,187,000) Net cash used in investing activities (13,600,000) (8,197,000) Cash flows from financing activities Borrowing on line of credit 0 16,700,000 Proceeds from issuance of common stock under employee stock purchase plan 384,000 544,000 Repurchase of shares for payment of withholding taxes for vested restricted stock (462,000) (1,406,000) Withholding related to exercise of stock options (459,000) (5,183,000) Net cash provided by (used in) financing activities (537,000) 10,655,000 Effect of exchange rates on cash (25,000) equivalents (3,234,000) 3,434,000 Cash and cash equivalents, beginning of year 16,450,000 13,216,000 Cash and cash equivalents, end of year 13,216,000 16,650,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts