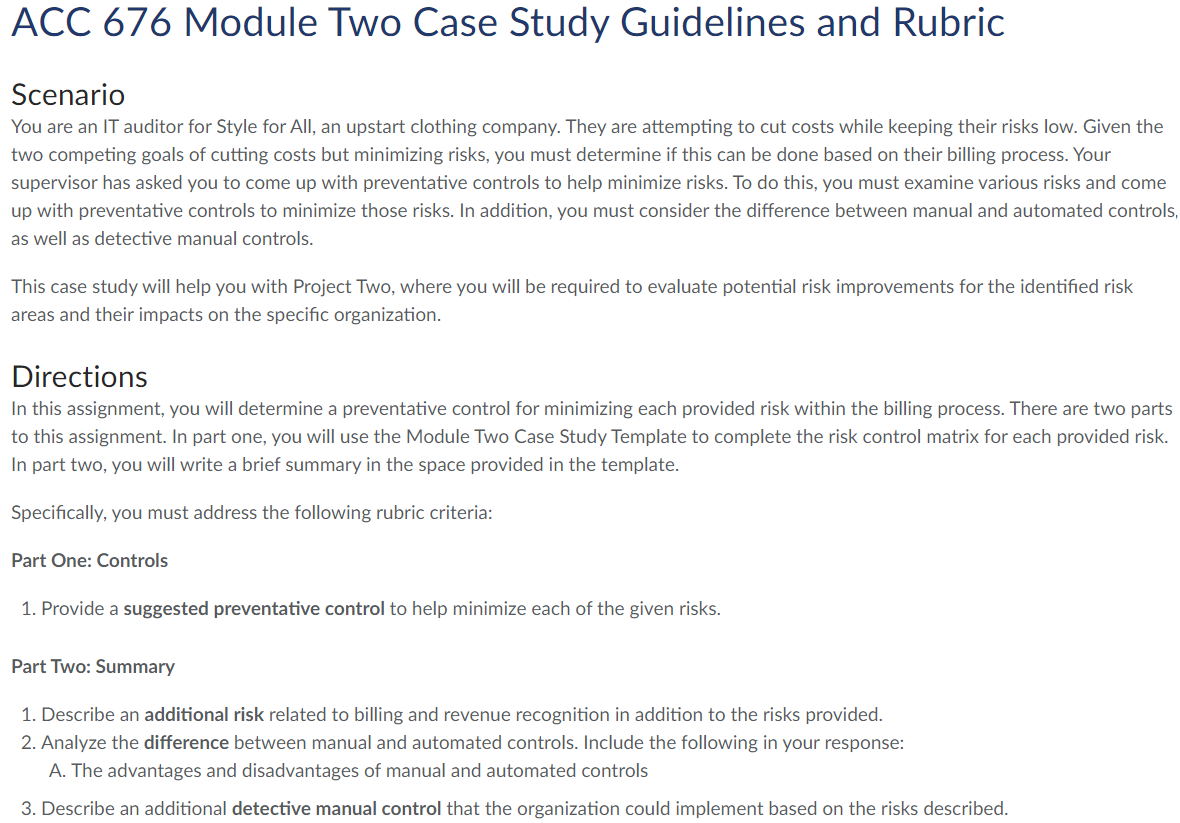

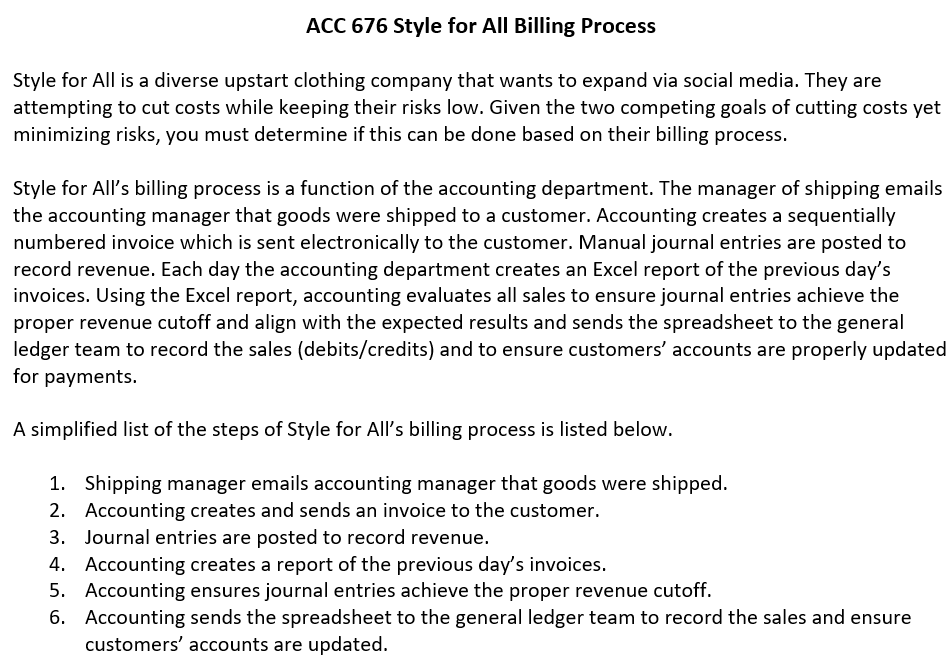

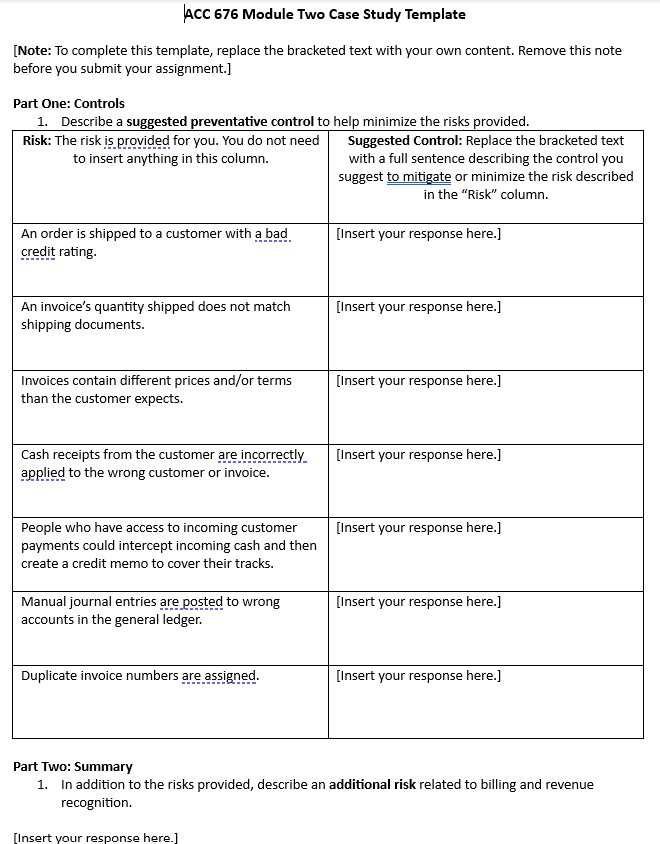

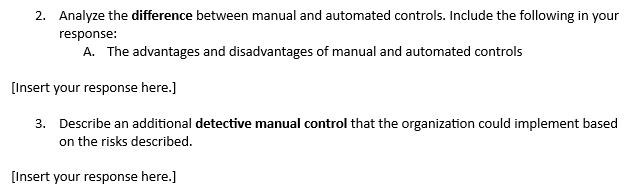

Question: ACC 676 Module Two Case Study Guidelines and Rubric Scenario You are an IT auditor for Style for All, an upstart clothing company. They are

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock