Question: acc #q2 please help QUESTION / SOALAN 2 Marks / Markah The comparative Balance Sheet and Income Statement of Wise Sdn. Bhd. is as follows:

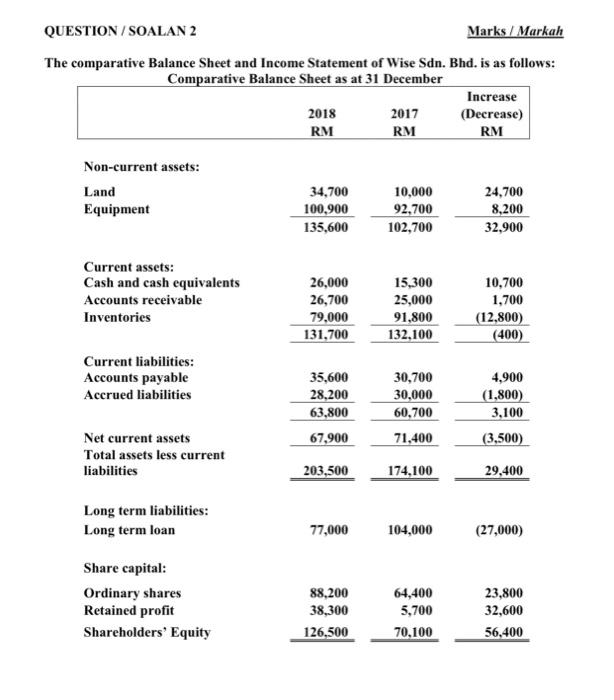

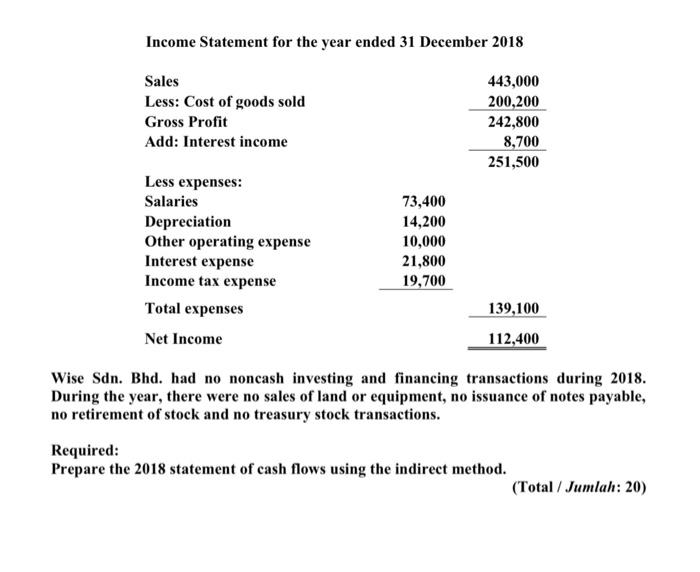

QUESTION / SOALAN 2 Marks / Markah The comparative Balance Sheet and Income Statement of Wise Sdn. Bhd. is as follows: Comparative Balance Sheet as at 31 December Increase 2018 2017 (Decrease) RM RM RM Non-current assets: Land Equipment 34,700 100,900 135,600 10,000 92,700 102,700 24,700 8,200 32,900 Current assets: Cash and cash equivalents Accounts receivable Inventories 26,000 26,700 79,000 131,700 15,300 25,000 91,800 132,100 10,700 1,700 (12,800) (400) Current liabilities: Accounts payable Accrued liabilities 35,600 28,200 63,800 67,900 30,700 30,000 60,700 71,400 4,900 (1,800) 3,100 (3,500) Net current assets Total assets less current liabilities 203,500 174,100 29,400 Long term liabilities: Long term loan 77,000 104,000 (27,000) Share capital: Ordinary shares Retained profit Shareholders' Equity 88,200 38,300 126,500 64,400 5,700 70,100 23,800 32,600 56,400 Income Statement for the year ended 31 December 2018 Sales Less: Cost of goods sold Gross Profit Add: Interest income 443,000 200,200 242,800 8,700 251,500 Less expenses: Salaries Depreciation Other operating expense Interest expense Income tax expense Total expenses 73,400 14,200 10,000 21,800 19,700 139,100 Net Income 112,400 Wise Sdn. Bhd. had no noncash investing and financing transactions during 2018. During the year, there were no sales of land or equipment, no issuance of notes payable, no retirement of stock and no treasury stock transactions. Required: Prepare the 2018 statement of cash flows using the indirect method. (Total / Jumlah: 20)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts