Question: ACC1020_Instructions_STUDENT_Comp Problem 2 P15-10B Additional Instructions to what is stated on page 608 in the text. Read all instructions before starting your work. This assessment

ACC1020_Instructions_STUDENT_Comp Problem 2

P15-10B Additional Instructions to what is stated on page 608 in the text.

Read all instructions before starting your work. This assessment is worth 150 points.

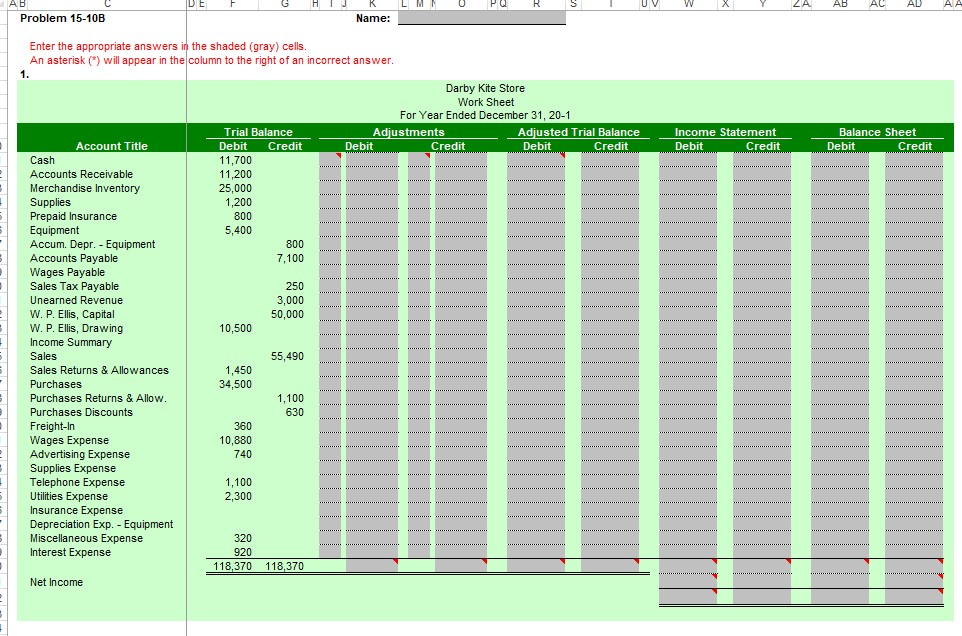

Use the worksheet file as provided for Darby Kite Store as of December 31, 20X1.

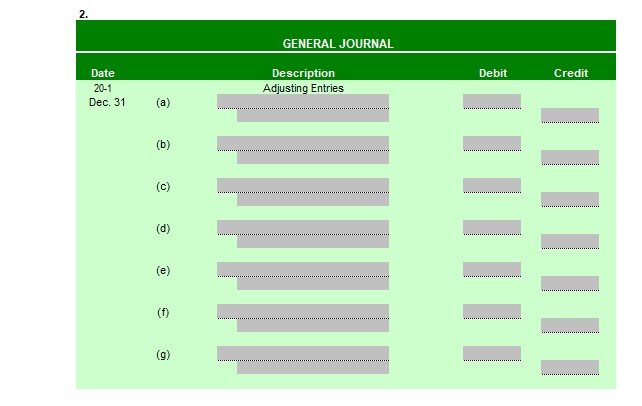

Perform the Adjustments at the end of the year:

A and b): Merchandise Inventory as of December 31, 20X1 = $ 23,600.00

C) Unused supplies on hand $ 1,050.00

D) Insurance expired $ 250.00

E) Depreciation expense for the year: $ 400.00

F) Wages earned but not paid $ 360.00

G) Unearned revenues on December 31: $ 500.00

REQUIRED: (NOTE that this is slightly changed from the text book; added prepare the Income Statement on sheet 1 in the file)

1) Prepare the worksheet as provided in the separate file.

2) Prepare the adjusting entries in the separate file.

3) Prepare the Income Statement after making the adjustments. (SEE SHEET 1 on the file as provided)

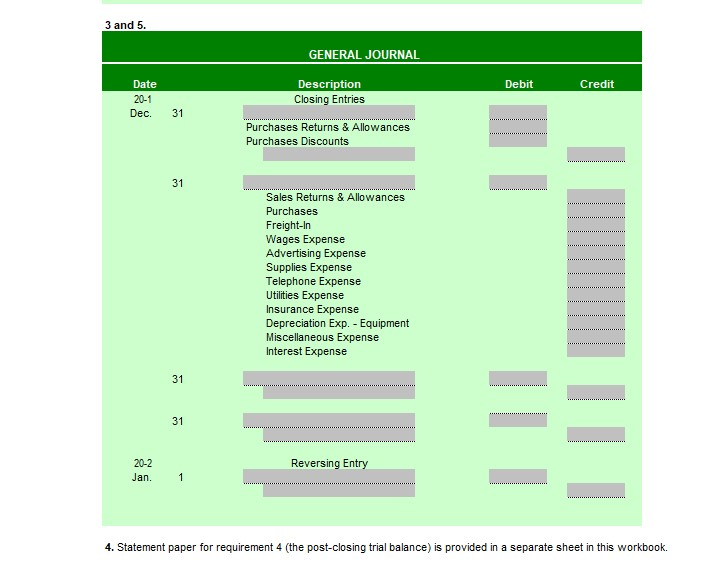

4) Prepare the closing entries (these are NOT posted to the worksheet).

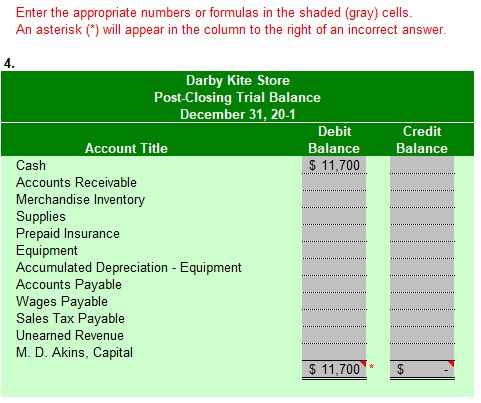

5) Prepare a post- closing trial balance and Post-closing Balance Sheet.

6) Prepare the reversing entries as required.

A B D E UV ZAAB ACAD AA Problem 15-10B Name: Enter the appropriate answers in the shaded (gray) cells An asterisk() will appear in the column to the right of an incorrect answer. Darby Kite Store Work Sheet For Year Ended December 31, 20-1 Adjustments Adjusted Trial Balance Trial Balance Debit Credit Income Statement Debit Balance Sheet Debit Account Title Debit Credit Debit Credit Credit Credit 11,700 11,200 25,000 1,200 800 5,400 Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Equipment Accum. Depr. Equipment Accounts Payable Wages Payable Sales Tax Payable Unearned Revenue W. P. Ellis, Capital W. P. Elis, Drawing Income Summary Sales Sales Returns & Allowances Purchases Purchases Returns & Allow Purchases Discounts Freight-In Wages Expense Advertising Expense Supplies Expense Telephone Expense Utilities Expense Insurance Expense Depreciation Exp. Equipment Miscellaneous Expense Interest Expense 800 7,100 250 3,000 50,000 10,500 55,490 1,450 34,500 1,100 630 360 10,880 740 1,100 2,300 320 920 118,370 118,370 Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts