Question: ACC210 Tutor-Marked Assignment (b) Compare JV's net operating income using absorption costing for the years 20x2 and 20x3. Reconcile the difference in income for each

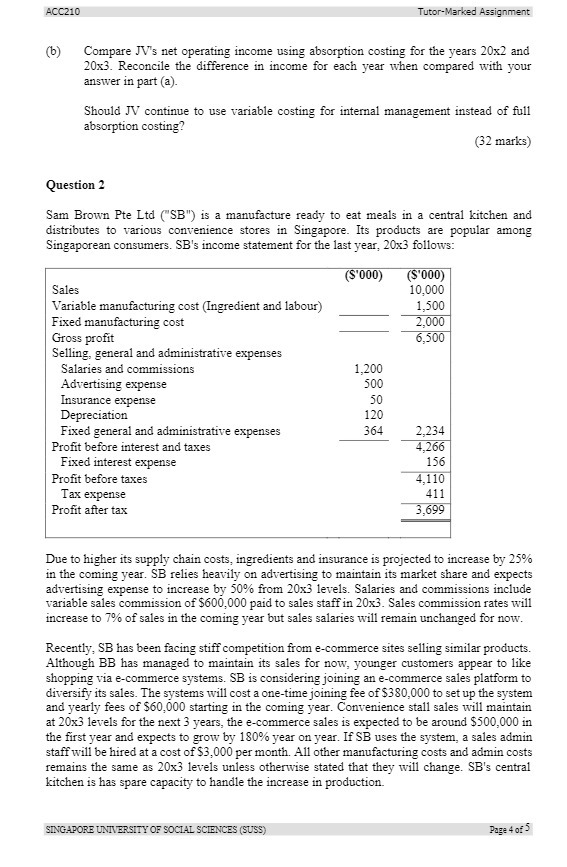

ACC210 Tutor-Marked Assignment (b) Compare JV's net operating income using absorption costing for the years 20x2 and 20x3. Reconcile the difference in income for each year when compared with your answer in part (a). Should JV continue to use variable costing for internal management instead of full absorption costing? (32 marks) Question 2 Sam Brown Pte Ltd ("SB") is a manufacture ready to eat meals in a central kitchen and distributes to various convenience stores in Singapore. Its products are popular among Singaporean consumers. SB's income statement for the last year, 20x3 follows: (S'000) (S'000) Sales 10,000 Variable manufacturing cost (Ingredient and labour) 1,500 Fixed manufacturing cost 2,000 Gross profit 6,500 Selling, general and administrative expenses Salaries and commissions 1,200 Advertising expense 500 Insurance expense 50 Depreciation 120 Fixed general and administrative expenses 364 2,234 Profit before interest and taxes 4,266 Fixed interest expense 156 Profit before taxes 4,110 Tax expense 411 Profit after tax 3,699 Due to higher its supply chain costs, ingredients and insurance is projected to increase by 25% in the coming year. SB relies heavily on advertising to maintain its market share and expects advertising expense to increase by 50% from 20x3 levels. Salaries and commissions include variable sales commission of $600,000 paid to sales staff in 20x3. Sales commission rates will increase to 7% of sales in the coming year but sales salaries will remain unchanged for now. Recently, SB has been facing stiff competition from e-commerce sites selling similar products. Although BB has managed to maintain its sales for now, younger customers appear to like shopping via e-commerce systems. SB is considering joining an e-commerce sales platform to diversify its sales. The systems will cost a one-time joining fee of $380,000 to set up the system and yearly fees of $60,000 starting in the coming year. Convenience stall sales will maintain at 20x3 levels for the next 3 years, the e-commerce sales is expected to be around $500,000 in the first year and expects to grow by 180% year on year. If SB uses the system, a sales admin staff will be hired at a cost of $3,000 per month. All other manufacturing costs and admin costs remains the same as 20x3 levels unless otherwise stated that they will change. SB's central kitchen is has spare capacity to handle the increase in production. SINGAPORE UNIVERSITY OF SOCIAL SCIENCES (SUSS) Page 4 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts