Question: ACC-213 Lab #6 Lab assignment #6 Lab assignment #6 focuses on the use of the aging of receivables method to calculate the company's necessary Allowance

ACC-213 Lab #6

Lab assignment #6

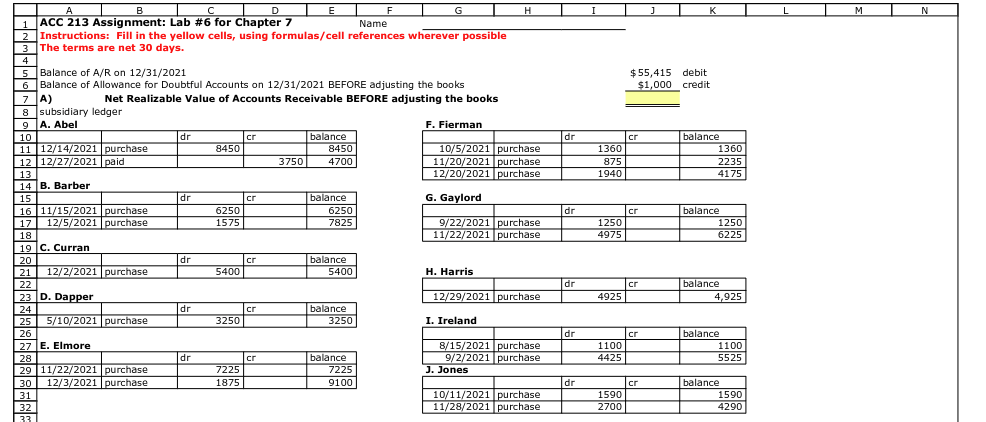

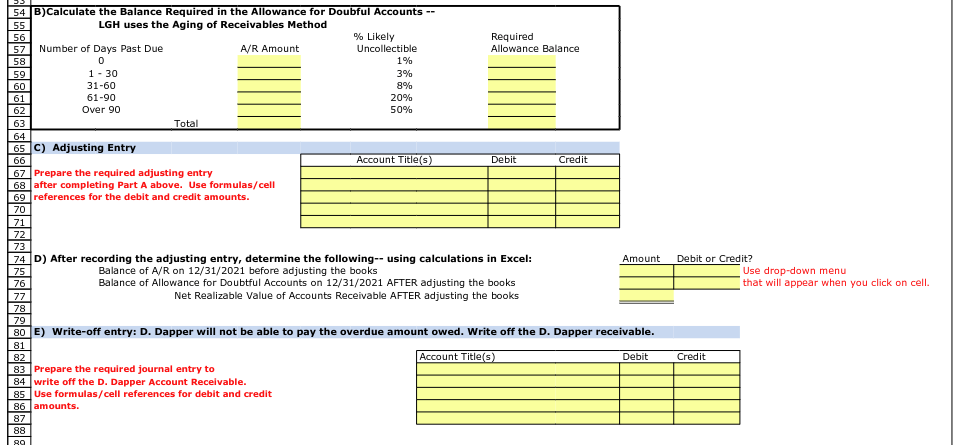

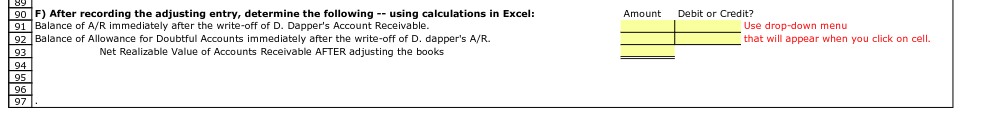

Lab assignment #6 focuses on the use of the aging of receivables method to calculate the company's necessary Allowance for Doubtful Accounts on the balance sheet. Calculating an allowance for receivables is required of public companies, as investors and creditors do not want to see overstated assets on the balance sheet. If an appropriate allowance was not calculated, it would be all too easy for companies to keep Accounts Receivables on their books, even if they will not be able to collect the funds in the future. This would make the Balance Sheet misleading and cause inappropriate decisions to be made. Before you are able to calculate the needed allowance within this lab, you will first need to prepare the company's aging schedule for their Accounts Receivable, as they will base the allowance on these various categories. After preparing the schedule and calculating the ending allowance balance, you will then need to prepare the necessary adjustments to update the company's accounts at the end of the period.

Name \begin{tabular}{ll} 2 & Instructions: Fill in the yellow cells, using formulas/cell references wherever possible \\ \hline 3 & The terms are net 30 days. \end{tabular} 5 Balance of A/R on 12/31/2021 6 Balance of Allowance for Doubtful Accounts on 12/31/2021 BEFORE adjusting the books 87 A) Net Realizable Value of Accounts Receivable BEFORE adjusting the books 8 subsidiary ledger 13 h. Barhar a Bavinnat 1018 tr rurran B)Calculate the Balance Required in the Allowance for Doubful Accounts - LGH uses the Aging of Receivables Method C) Adjusting Entry Prepare the required adjusting entry after completing Part A above. Use formulas/cell references for the debit and credit amounts. D) After recording the adjusting entry, determine the following-- using calculations in Excel: Balance of A/R on 12/31/2021 before adjusting the books Balance of Allowance for Doubtful Accounts on 12/31/2021 AFTER adjusting the books F) After recording the adjusting entry, determine the following using calculations in Excel: Balance of A/R immediately after the write-off of D. Dapper's Account Receivable. Amount Debit or Credit? Balance of Allowance for Doubtful Accounts immediately after the write-off of D. dapper's A/R. Use drop-down menu that will appear when you click on cell. Net Realizable Value of Accounts Receivable AFTER adjusting the books Name \begin{tabular}{ll} 2 & Instructions: Fill in the yellow cells, using formulas/cell references wherever possible \\ \hline 3 & The terms are net 30 days. \end{tabular} 5 Balance of A/R on 12/31/2021 6 Balance of Allowance for Doubtful Accounts on 12/31/2021 BEFORE adjusting the books 87 A) Net Realizable Value of Accounts Receivable BEFORE adjusting the books 8 subsidiary ledger 13 h. Barhar a Bavinnat 1018 tr rurran B)Calculate the Balance Required in the Allowance for Doubful Accounts - LGH uses the Aging of Receivables Method C) Adjusting Entry Prepare the required adjusting entry after completing Part A above. Use formulas/cell references for the debit and credit amounts. D) After recording the adjusting entry, determine the following-- using calculations in Excel: Balance of A/R on 12/31/2021 before adjusting the books Balance of Allowance for Doubtful Accounts on 12/31/2021 AFTER adjusting the books F) After recording the adjusting entry, determine the following using calculations in Excel: Balance of A/R immediately after the write-off of D. Dapper's Account Receivable. Amount Debit or Credit? Balance of Allowance for Doubtful Accounts immediately after the write-off of D. dapper's A/R. Use drop-down menu that will appear when you click on cell. Net Realizable Value of Accounts Receivable AFTER adjusting the books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts