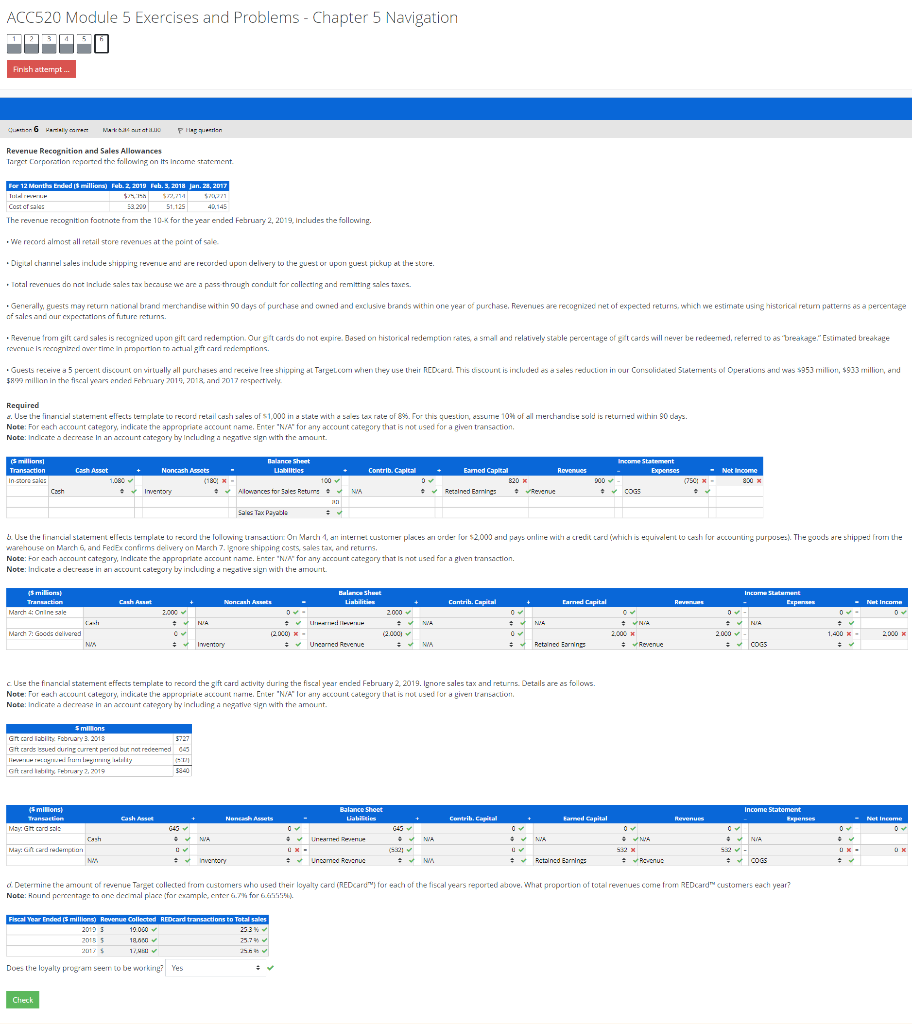

Question: ACC520 Module 5 Exercises and Problems - Chapter 5 Navigation 12 Finish attempt... 6 anys Muto FH Revenue Recognition and Sales Allowances Targer Corporation reported

ACC520 Module 5 Exercises and Problems - Chapter 5 Navigation 12 Finish attempt... 6 anys Muto FH Revenue Recognition and Sales Allowances Targer Corporation reported the following on It Income statement Por 12 Month Ended 5 milliona) Feb 2, 2019 Feb. 3, 2018 Jan. 28, 2017 $ $74771 Cost cas 53.200 51.125 40,145 The revenue recognition footnote from the 10-k for the year ended February 2, 2019, Includes the following. K 2, , We record almost all retail store revenues at the point of sale Digical channel sales include stipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. Total revenues do not include sales tax because we are a pass through conduit for collecting and remitting sales taxes. Generally guests may return national brand merchandise within 90 days of purchase and owned and exclusive brands within one year of purchase. Revenues are recognized net of expected returns, which we estimate using historical retum patterns as a percentage of sales and our expectations of future returns. Revenue from gift card sales is recognized upon gift card redemption. Our gift cards do not expire. Based on historical redemption rates, a small and relatively stable percentage of gift cards will never be redeemed, referred to as 'breakage." Estimated breakage revenue is recognized over time in amortion to actual gift card redemptions. Guests receive a 5 percent discount on virtually all purchases and receive free shipping at Targel.com when they use their necaru. This discount is included as a sales reduction in our Consolidated Statements of Operations and was $953 million, $933 million, and $899 million in the fiscal years onder February 2018, 2018, and 2017 respectively Required 2. Use the financial platerent effects template to recoru retail cash sales of $1,000 in a state with a sales tax rate of 89. For this question, assume 10% of all merchandise old is returned within 30 days. Note: For each account category, indicate the appropriate account name. Enter "NA" for any account Category that is not used for a given transaction, Note: Indicate a decrease in an account category by including a negative sign with the amount is millions Transaction in coor sales Contrib. Capital Revenues Income Statement Expenses Cash Asset Noncash Assets 1.080 (1967 Twentory Balance Sheet Liabilities 100 Alowances for Sales Retur Earned Capital B2D Retained Earnings - Net Income (75CM 800 x 0 . 000 Cach WA tenue COGS Sales Tax Payable . & Use the financial statement effects template to record the following transaction On March 1, an internet customer places are under for $2.000 and ways online with a credit card which is equivelerillo cech for accounting purposes. The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipaing costs, sales tax, and returns Note: For each account category, Indicate the appropriate account name. Enter "NA" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount (5 millions) Transaction March 4: Onine sale Cash Asset Income Statement Expres Noncash Assas Contrib. Capital + Earned Capital Reves - Net Income 2.000 0 Balance Sheet Liabilities 2000 . (2.000) Unearned Reve NA NA NA (2.000) X - + NIA 2.000 # Revenue Marc 7. Goods delines NU 1,400 x 2.000 . 2.000 x Inwentary WA Retained Earning COGS Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2 2019. Ignore sales tax and returns. Details are as follows. Note: Tor esch Lour calegory, indicate the appropriate account Hame Encer "N/A" loranty alcuni category that is not used for a given ansaction Note: Indicate a decrease in an account category by including a negative sign with the amount. 5 millions Git card alty February 2018 5727 Git cards sued during current period burno redeemed 025 Gift red bary 2, 2019 5 millions Transactions May Git cordele Cash AS Balance Sheet Liabilities Noncash Assets Contrib, Capital tarmed Capital Income Statement Expenses Revenue - Net Income 0 Cash NA NA NA NIA May Gitarreman oneren UX Uncamad Rechua NU 532 x Revenus OX Inventory . Rctained Earnings COGS o Determine the amount of revenue Target collected from customers who used their loyalty card (REDxardu for each of the fiscal years reported above. What proportion of total revenues come from REDcard customers each year? Note: Round percentage to ona de malplan for example, enter 6.7% for 6.69554 Fiscal Year Ended millions) Revenue Collected REDcard transactions to Total sales 2017 3 19.000 253 2015 5 18.000 357 12 : Does the loyalty program seem to be working? Yes Check ACC520 Module 5 Exercises and Problems - Chapter 5 Navigation 12 Finish attempt... 6 anys Muto FH Revenue Recognition and Sales Allowances Targer Corporation reported the following on It Income statement Por 12 Month Ended 5 milliona) Feb 2, 2019 Feb. 3, 2018 Jan. 28, 2017 $ $74771 Cost cas 53.200 51.125 40,145 The revenue recognition footnote from the 10-k for the year ended February 2, 2019, Includes the following. K 2, , We record almost all retail store revenues at the point of sale Digical channel sales include stipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. Total revenues do not include sales tax because we are a pass through conduit for collecting and remitting sales taxes. Generally guests may return national brand merchandise within 90 days of purchase and owned and exclusive brands within one year of purchase. Revenues are recognized net of expected returns, which we estimate using historical retum patterns as a percentage of sales and our expectations of future returns. Revenue from gift card sales is recognized upon gift card redemption. Our gift cards do not expire. Based on historical redemption rates, a small and relatively stable percentage of gift cards will never be redeemed, referred to as 'breakage." Estimated breakage revenue is recognized over time in amortion to actual gift card redemptions. Guests receive a 5 percent discount on virtually all purchases and receive free shipping at Targel.com when they use their necaru. This discount is included as a sales reduction in our Consolidated Statements of Operations and was $953 million, $933 million, and $899 million in the fiscal years onder February 2018, 2018, and 2017 respectively Required 2. Use the financial platerent effects template to recoru retail cash sales of $1,000 in a state with a sales tax rate of 89. For this question, assume 10% of all merchandise old is returned within 30 days. Note: For each account category, indicate the appropriate account name. Enter "NA" for any account Category that is not used for a given transaction, Note: Indicate a decrease in an account category by including a negative sign with the amount is millions Transaction in coor sales Contrib. Capital Revenues Income Statement Expenses Cash Asset Noncash Assets 1.080 (1967 Twentory Balance Sheet Liabilities 100 Alowances for Sales Retur Earned Capital B2D Retained Earnings - Net Income (75CM 800 x 0 . 000 Cach WA tenue COGS Sales Tax Payable . & Use the financial statement effects template to record the following transaction On March 1, an internet customer places are under for $2.000 and ways online with a credit card which is equivelerillo cech for accounting purposes. The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipaing costs, sales tax, and returns Note: For each account category, Indicate the appropriate account name. Enter "NA" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount (5 millions) Transaction March 4: Onine sale Cash Asset Income Statement Expres Noncash Assas Contrib. Capital + Earned Capital Reves - Net Income 2.000 0 Balance Sheet Liabilities 2000 . (2.000) Unearned Reve NA NA NA (2.000) X - + NIA 2.000 # Revenue Marc 7. Goods delines NU 1,400 x 2.000 . 2.000 x Inwentary WA Retained Earning COGS Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2 2019. Ignore sales tax and returns. Details are as follows. Note: Tor esch Lour calegory, indicate the appropriate account Hame Encer "N/A" loranty alcuni category that is not used for a given ansaction Note: Indicate a decrease in an account category by including a negative sign with the amount. 5 millions Git card alty February 2018 5727 Git cards sued during current period burno redeemed 025 Gift red bary 2, 2019 5 millions Transactions May Git cordele Cash AS Balance Sheet Liabilities Noncash Assets Contrib, Capital tarmed Capital Income Statement Expenses Revenue - Net Income 0 Cash NA NA NA NIA May Gitarreman oneren UX Uncamad Rechua NU 532 x Revenus OX Inventory . Rctained Earnings COGS o Determine the amount of revenue Target collected from customers who used their loyalty card (REDxardu for each of the fiscal years reported above. What proportion of total revenues come from REDcard customers each year? Note: Round percentage to ona de malplan for example, enter 6.7% for 6.69554 Fiscal Year Ended millions) Revenue Collected REDcard transactions to Total sales 2017 3 19.000 253 2015 5 18.000 357 12 : Does the loyalty program seem to be working? Yes Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts