Question: ACCE Mining is considering a project that will result in cash flows from operations (before taxes and depreciation of $600,000 at the end of each

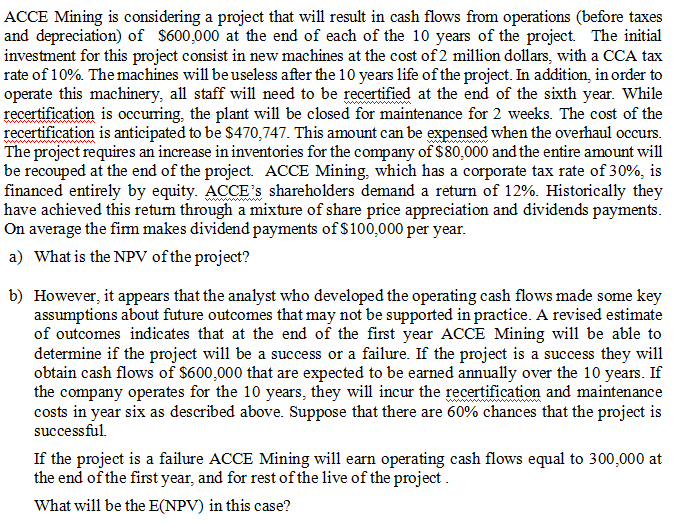

ACCE Mining is considering a project that will result in cash flows from operations (before taxes and depreciation of $600,000 at the end of each of the 10 years of the project. The initial investment for this project consist in new machines at the cost of 2 million dollars, with a CCA tax rate of 10%. The machines will be useless after the 10 years life of the project. In addition, in order to operate this machinery, all staff will need to be recertified at the end of the sixth year. While recertification is occurring, the plant will be closed for maintenance for 2 weeks. The cost of the recertification is anticipated to be $470,747. This amount can be expensed when the overhaul occurs. The project requires an increase in inventories for the company of $80,000 and the entire amount will be recouped at the end of the project. ACCE Mining, which has a corporate tax rate of 30%, is financed entirely by equity. ACCE's shareholders demand a return of 12%. Historically they have achieved this retum through a mixture of share price appreciation and dividends payments. On average the firm makes dividend payments of $100,000 per year. a) What is the NPV of the project? b) However, it appears that the analyst who developed the operating cash flows made some key assumptions about future outcomes that may not be supported in practice. A revised estimate of outcomes indicates that at the end of the first year ACCE Mining will be able to determine if the project will be a success or a failure. If the project is a success they will obtain cash flows of $600,000 that are expected to be earned annually over the 10 years. If the company operates for the 10 years, they will incur the recertification and maintenance costs in year six as described above. Suppose that there are 60% chances that the project is successful If the project is a failure ACCE Mining will earn operating cash flows equal to 300,000 at the end of the first year, and for rest of the live of the project. What will be the E(NPV) in this case? ACCE Mining is considering a project that will result in cash flows from operations (before taxes and depreciation of $600,000 at the end of each of the 10 years of the project. The initial investment for this project consist in new machines at the cost of 2 million dollars, with a CCA tax rate of 10%. The machines will be useless after the 10 years life of the project. In addition, in order to operate this machinery, all staff will need to be recertified at the end of the sixth year. While recertification is occurring, the plant will be closed for maintenance for 2 weeks. The cost of the recertification is anticipated to be $470,747. This amount can be expensed when the overhaul occurs. The project requires an increase in inventories for the company of $80,000 and the entire amount will be recouped at the end of the project. ACCE Mining, which has a corporate tax rate of 30%, is financed entirely by equity. ACCE's shareholders demand a return of 12%. Historically they have achieved this retum through a mixture of share price appreciation and dividends payments. On average the firm makes dividend payments of $100,000 per year. a) What is the NPV of the project? b) However, it appears that the analyst who developed the operating cash flows made some key assumptions about future outcomes that may not be supported in practice. A revised estimate of outcomes indicates that at the end of the first year ACCE Mining will be able to determine if the project will be a success or a failure. If the project is a success they will obtain cash flows of $600,000 that are expected to be earned annually over the 10 years. If the company operates for the 10 years, they will incur the recertification and maintenance costs in year six as described above. Suppose that there are 60% chances that the project is successful If the project is a failure ACCE Mining will earn operating cash flows equal to 300,000 at the end of the first year, and for rest of the live of the project. What will be the E(NPV) in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts