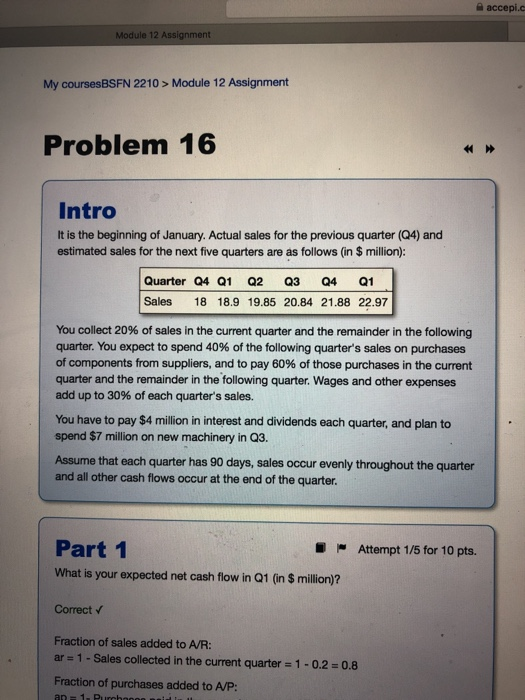

Question: accepi.c Module 12 Assignment My coursesBSFN 2210 > Module 12 Assignment Problem 16 Intro It is the beginning of January. Actual sales for the previous

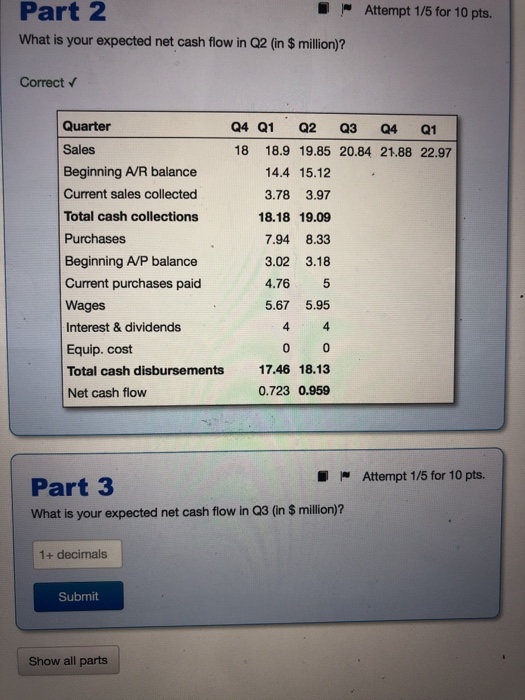

accepi.c Module 12 Assignment My coursesBSFN 2210 > Module 12 Assignment Problem 16 Intro It is the beginning of January. Actual sales for the previous quarter (Q4) and estimated sales for the next five quarters are as follows (in $ million): Quarter Q4 Q1 Q2 Q3 Q4 Q1 Sales 18 18.9 19.85 20.84 21.88 22.97 You collect 20% of sales in the current quarter and the remainder in the following quarter. You expect to spend 40% of the following quarter's sales on purchases of components from suppliers, and to pay 60% of those purchases in the current quarter and the remainder in the following quarter. Wages and other expenses add up to 30% of each quarter's sales. You have to pay $4 million in interest and dividends each quarter, and plan to spend $7 million on new machinery in Q3. Assume that each quarter has 90 days, sales occur evenly throughout the quarter and all other cash flows occur at the end of the quarter. Attempt 1/5 for 10 pts. Part 1 - What is your expected net cash flow in Q1 (in $ million)? Correct Fraction of sales added to A/R: ar = 1 - Sales collected in the current quarter = 1 -0.2 = 0.8 Fraction of purchases added to A/P: an=1 - Pueba Part 2 . Attempt 1/5 for 10 pts. What is your expected net cash flow in Q2 (in $ million)? Correct Quarter Q4 Q1 Q2 Q3 Q4 Q1 Sales 18 18.9 19.85 20.84 21.88 22.97 Beginning A/R balance 14.4 15.12 Current sales collected 3.78 3.97 Total cash collections 18.18 19.09 Purchases 7.94 8.33 Beginning A/P balance 3.02 3.18 Current purchases paid 4.76 5 Wages 5.67 5.95 Interest & dividends 4 4 Equip. cost 0 0 Total cash disbursements 17.46 18.13 Net cash flow 0.723 0.959 Attempt 1/5 for 10 pts. Part 3 What is your expected net cash flow in Q3 (in $ million)? 1+ decimals Submit Show all parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts