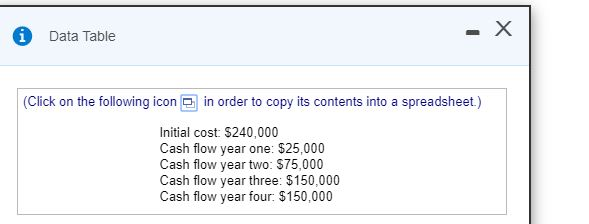

Question: Accept or reject? 0 Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cost: $240,000 Cash flow

Accept or reject?

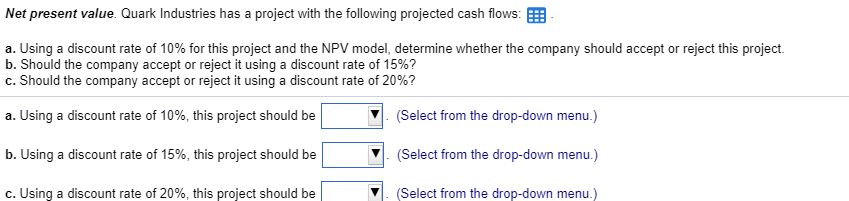

0 Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cost: $240,000 Cash flow year one: $25,000 Cash flow year two: $75,000 Cash flow year three: $150,000 Cash flow year four. $150,000 Net present value. Quark Industries has a project with the following projected cash flows: a. Using a discount rate of 10% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 15%? c. Should the company accept or reject it using a discount rate of 20%? a. Using a discount rate of 10%, this project should be . (Select from the drop-down menu.) b. Using a discount rate of 15%, this project should be (Select from the drop-down menu.) c. Using a discount rate of 20%, this project should be V. (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts