Question: Accepted a $10,400, 60-day, 7% note dated this day in granting Danny Todd a time extension his past-due account receivable. Made an adjusting entry to

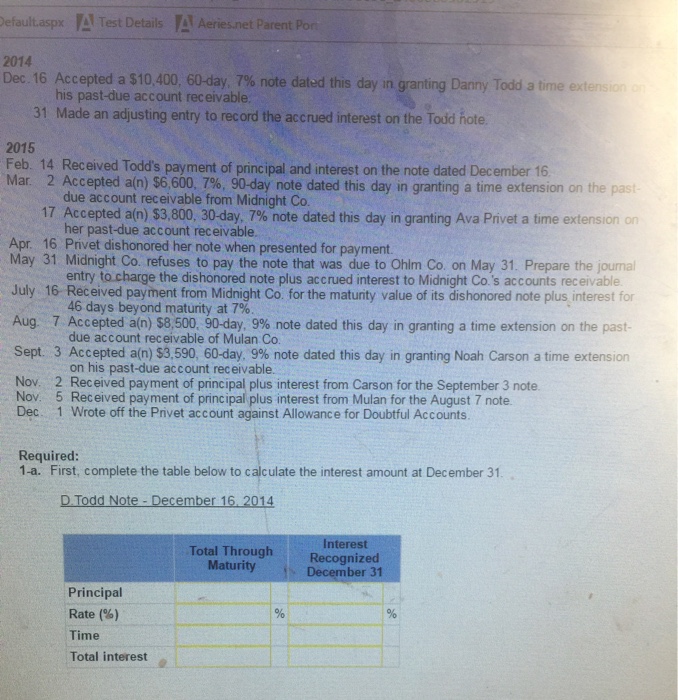

Accepted a $10,400, 60-day, 7% note dated this day in granting Danny Todd a time extension his past-due account receivable. Made an adjusting entry to record the accrued interest on the Todd note. Received Todd's payment of principal and interest on the note dated December 16 Mar 2 Accepted a(n) $6,600, 7%, 90-day note dated this day in granting a time extension on the past due account receivable from Midnight Co. 17 Accepted a(n) $3,800. 30-day. 7% note dated this day in granting Ava Privet a time extension on her past-due account receivable Apr 16 Privet dishonored her note when presented for payment May 31 Midnight Co. refuses to pay the note that was due to Ohm Co on May 31 Prepay entry to charge the dishonored note plus accrued interest to Midnight Co.'s accounts July 16 Received payment from Midnight Co for the maturity value of its dishonored note plus interest for 46 days beyond maturity at 7% Aug 7 Accepted a(n) $8,500. 90-day. 9% note dated this day in granting a time extension on due account receivable of Mulan Co. Sept. 3 Accepted a(n) $3,590. 60-day. 9% note dated this day in granting Noah Carson a time extension on the past- due account receivable. Nov 2 Received payment of principal plus interest from Carson for the September 3 note Nov 5 Received payment of principal plus interest from Mulan for the August 7 note Dec 1 Wrote off the Privet account against Allowance for Doubtful Accounts Required: First, complete the table below to calculate the interest amount at December 31 D Todd Note - December 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts