Question: Accepted a $6,000, 180-day, 8% note dated November 1 from Kelly White in granting a time extension on her past-due account receivable. Dec. 31 Adjusted

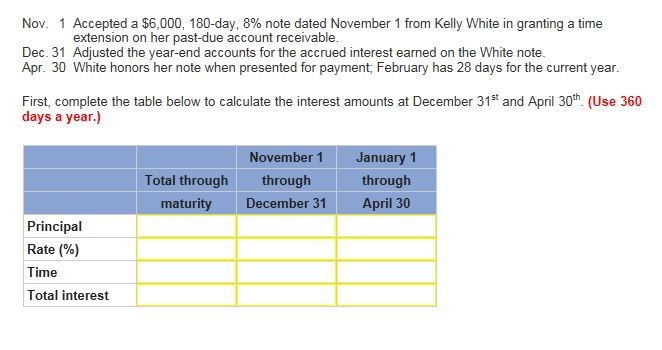

Accepted a $6,000, 180-day, 8% note dated November 1 from Kelly White in granting a time extension on her past-due account receivable. Dec. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. Apr. 30 White honors her note when presented for payment; February has 28 days for the current year. First, complete the table below to calculate the interest amounts at December 31^st and April 30^th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts