Question: Accessibility Mode Open in Desktop App Question 1 On 1 July 2019, Burger Ltd acquired 80% of the shares (cum div.) of Sandwich Ltd for

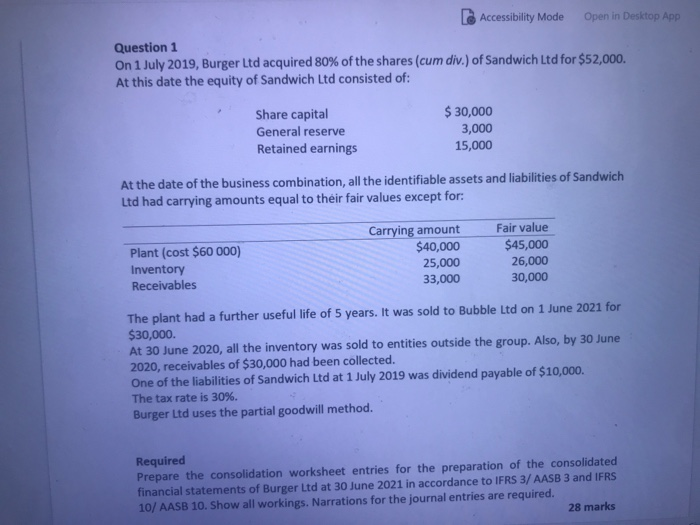

Accessibility Mode Open in Desktop App Question 1 On 1 July 2019, Burger Ltd acquired 80% of the shares (cum div.) of Sandwich Ltd for $52,000. At this date the equity of Sandwich Ltd consisted of: Share capital General reserve Retained earnings $ 30,000 3,000 15,000 At the date of the business combination, all the identifiable assets and liabilities of Sandwich Ltd had carrying amounts equal to their fair values except for: Plant (cost $60 000) Inventory Receivables Carrying amount $40,000 25,000 33,000 Fair value $45,000 26,000 30,000 The plant had a further useful life of 5 years. It was sold to Bubble Ltd on 1 June 2021 for $30,000 At 30 June 2020, all the inventory was sold to entities outside the group. Also, by 30 June 2020, receivables of $30,000 had been collected. One of the liabilities of Sandwich Ltd at 1 July 2019 was dividend payable of $10,000. The tax rate is 30%. Burger Ltd uses the partial goodwill method. Required Prepare the consolidation worksheet entries for the preparation of the consolidated financial statements of Burger Ltd at 30 June 2021 in accordance to IFRS 3/ AASB 3 and IFRS 10/AASB 10. Show all workings. Narrations for the journal entries are required. 28 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts