Question: ACCO 3520 tarea 7.1 Basic Exercises BE 23-1 Direct materials variances Obj. 3 Bellingham Company produces a product that requires 2.5 standard pounds per unit.

ACCO 3520 tarea 7.1

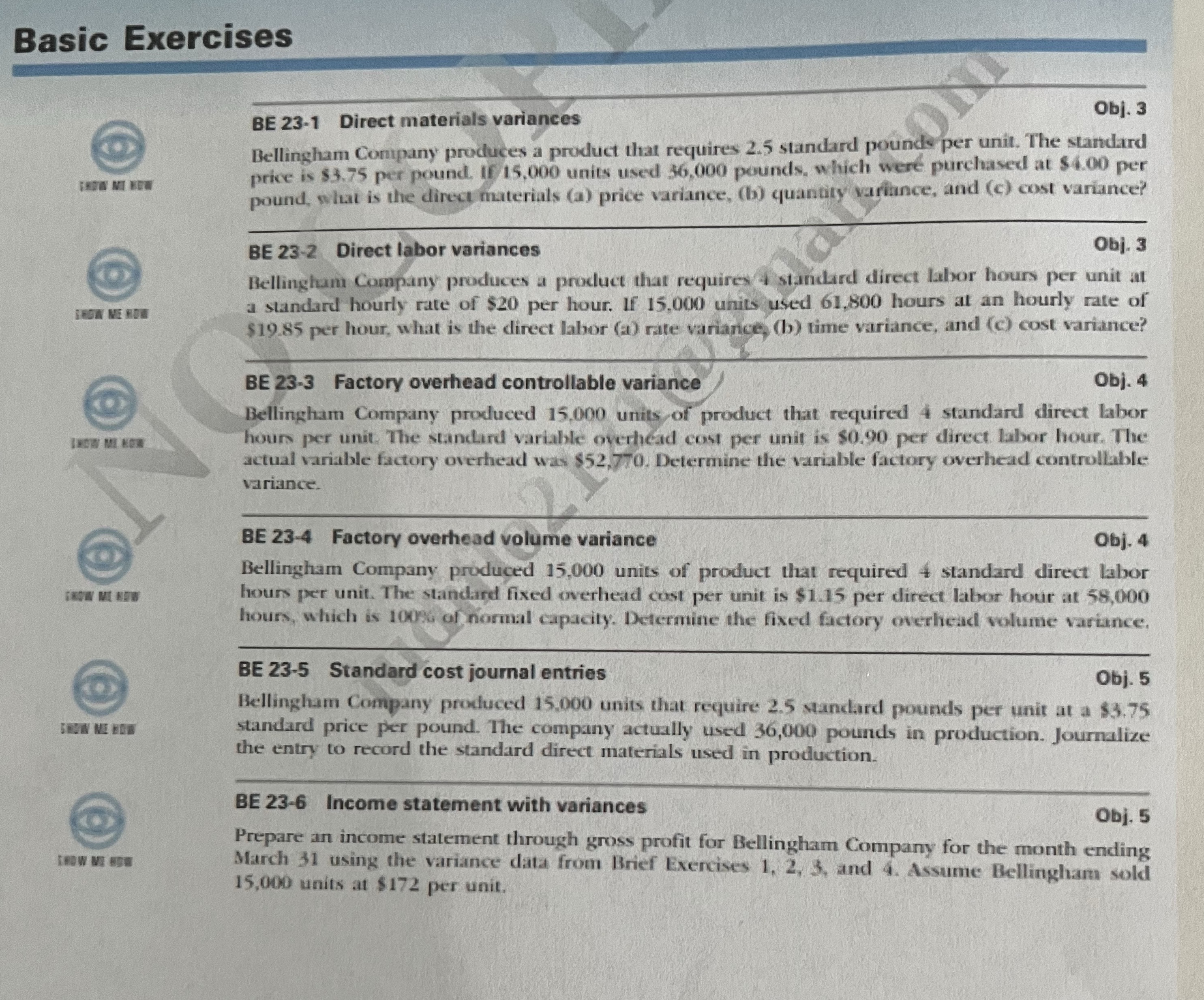

Basic Exercises BE 23-1 Direct materials variances Obj. 3 Bellingham Company produces a product that requires 2.5 standard pounds per unit. The standard price is $3.75 per pound, If 15,000 units used 36,000 pounds, which were purchased at $4.00 per HOW MI KEW pound, what is the direct materials (a) price variance, (b) quantity variance, and (c) cost variance? BE 23-2 Direct labor variances Obj. 3 Bellingham Company produces a product that requires 4 standard direct labor hours per unit at SHOW ME HOW a standard hourly rate of $20 per hour. If 15,000 units used 61,800 hours at an hourly rate of $19.85 per hour, what is the direct labor (@) rate variance, (b) time variance, and (c) cost variance? BE 23-3 Factory overhead controllable variance Obj. 4 Bellingham Company produced 15,090 units of product that required 4 standard direct labor INOW MI KOW hours per unit. The standard variable overhead cost per unit is $0.90 per direct labor hour. The actual variable factory overhead was $52,770. Determine the variable factory overhead controllable variance. BE 23-4 Factory overhead volume variance Obj. 4 Bellingham Company produced 15,000 units of product that required 4 standard direct labor NOW WE NOW hours per unit. The standard fixed overhead cost per unit is $1.15 per direct labor hour at 58,000 hours, which is 100% of normal capacity. Determine the fixed factory overhead volume variance. BE 23-5 Standard cost journal entries Obj. 5 Bellingham Company produced 15,000 units that require 2.5 standard pounds per unit at a $3.75 standard price per pound. The company actually used 36,000 pounds in production. Journalize the entry to record the standard direct materials used in production. BE 23-6 Income statement with variances Obj. 5 Prepare an income statement through gross profit for Bellingham Company for the month ending March 31 using the variance data from Brief Exercises 1, 2, 3, and 4. Assume Bellingham sold 15,000 units at $172 per unit