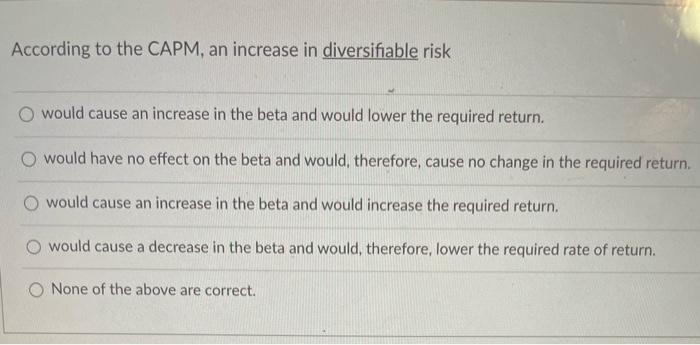

Question: According to the CAPM, an increase in diversifiable risk would cause an increase in the beta and would lower the required return. O would have

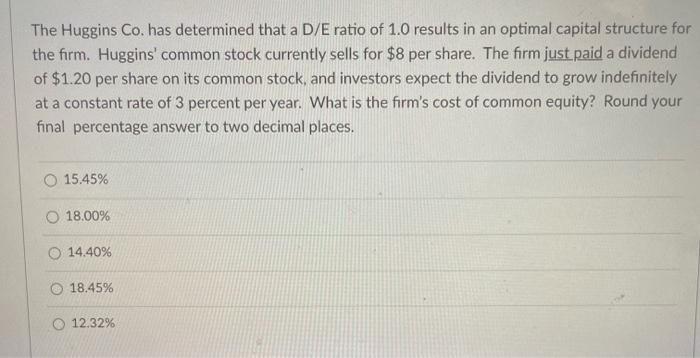

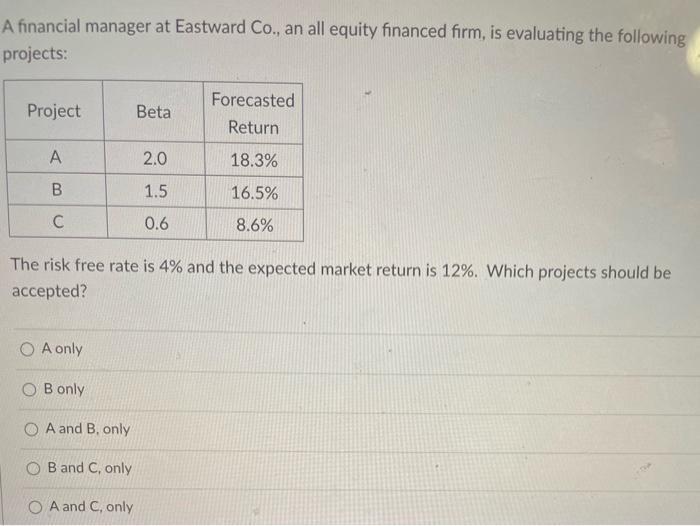

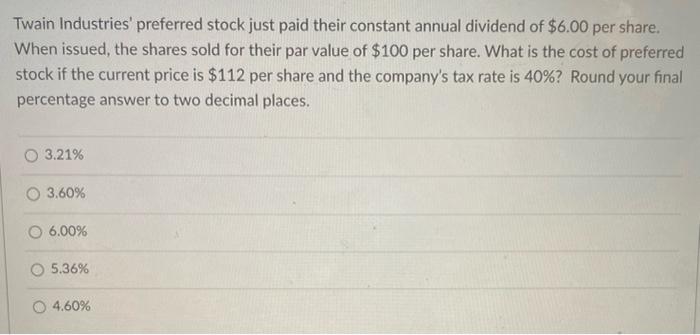

According to the CAPM, an increase in diversifiable risk would cause an increase in the beta and would lower the required return. O would have no effect on the beta and would, therefore, cause no change in the required return O would cause an increase in the beta and would increase the required return. would cause a decrease in the beta and would, therefore, lower the required rate of return. None of the above are correct. The Huggins Co. has determined that a D/E ratio of 1.0 results in an optimal capital structure for the firm. Huggins' common stock currently sells for $8 per share. The firm just paid a dividend of $1.20 per share on its common stock, and investors expect the dividend to grow indefinitely at a constant rate of 3 percent per year. What is the firm's cost of common equity? Round your final percentage answer to two decimal places. O 15.45% 18.00% 14.40% 18.45% 12.32% A financial manager at Eastward Co., an all equity financed firm, is evaluating the following projects: Project Beta Forecasted Return A 2.0 18.3% B 1.5 16.5% 0.6 8.6% The risk free rate is 4% and the expected market return is 12%. Which projects should be accepted? O A only B only A and B. only B and C, only O A and C, only Twain Industries' preferred stock just paid their constant annual dividend of $6.00 per share. When issued, the shares sold for their par value of $100 per share. What is the cost of preferred stock if the current price is $112 per share and the company's tax rate is 40%? Round your final percentage answer to two decimal places. 0 3.21% 3,60% 6.00% 5.36% 0 4.60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts