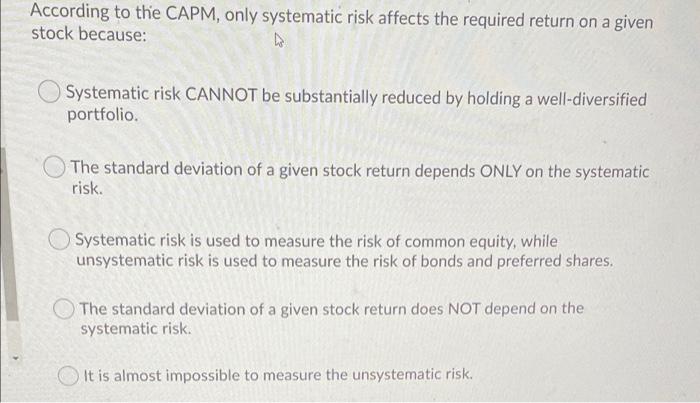

Question: According to the CAPM, only systematic risk affects the required return on a given stock because: to Systematic risk CANNOT be substantially reduced by holding

According to the CAPM, only systematic risk affects the required return on a given stock because: to Systematic risk CANNOT be substantially reduced by holding a well-diversified portfolio. The standard deviation of a given stock return depends ONLY on the systematic risk. Systematic risk is used to measure the risk of common equity, while unsystematic risk is used to measure the risk of bonds and preferred shares. The standard deviation of a given stock return does NOT depend on the systematic risk. It is almost impossible to measure the unsystematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts