Question: According to the CAPM , the expected return on a zero-beta stock is equal to: a.) Group of answer choices b.) zero c.) the market

According to the CAPM, the expected return on a zero-beta stock is equal to:

a.) Group of answer choices

b.) zero

c.) the market risk premium

d.) one

e.) the risk-free rate

f.) the market return

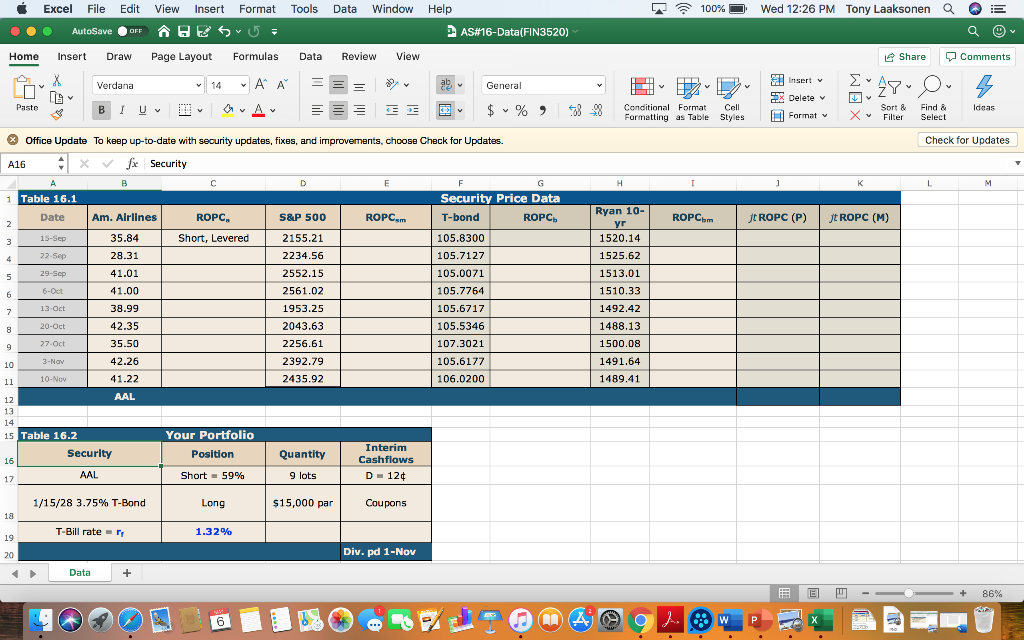

Insert Format Tools Data Window 100% Wed 12:26 PM Tony Laaksonen Q E Excel File Edit View AutoSave OFFE Help PAS#16-Data(FIN3520) .. Home Insert View Draw Verdana Page Layout 14 Formulas A A Data = Review = = ab General Insert X Delete Share 2 470 Sort & Find & X V Filter Select Comments 47 Ideas Formatting as Table Styles ||| Format V Check for Updates * Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates A16 X fx Security 1 Table 16.1 Date S&P 500 ROPC ROPC J E ROPC (P) ROPC (M) ROPC, Short, Levered 15-Sep 22-Sep 29-Sep - 6-Oct Am. Airlines 35.84 28.31 41.01 41.00 38.99 42.35 35.50 42.26 Security Price Data T-bond ROPC. 105.8300 105.7127 105.0071 105.7764 105.6717 105.5346 107.3021 105.6177 106.0200 2155.21 2234.56 2552.15 2561.02 1953.25 2043.63 2256.61 2392.79 2435.92 Ryan 10- yr 1520.14 1525.62 1513.01 1510.33 1492.42 1488.13 1500.08 1491.64 1489.41 13 Oct 20-Oct 27 Oct 3-Nov 10-Nov 41.22 AAL Table 16.2 Security AAL Your Portfolio Position Quantity Interim Cashflows D=124 Short = 59% 9 lots 1/15/28 3.75% T-Bond Long $15,000 par Coupons T-Bill rate= 1.32% Div. pd 1-Nov Data + E E - O + 86%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts