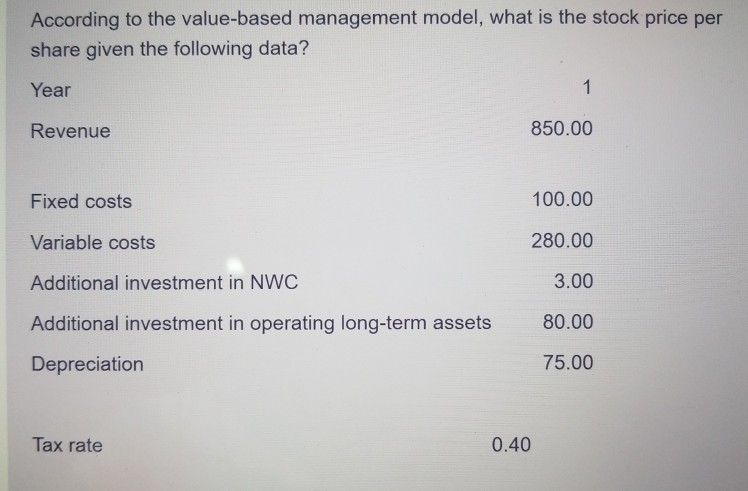

Question: According to the value-based management model, what is the stock price per share given the following data? Year Revenue 850.00 100.00 Fixed costs Variable costs

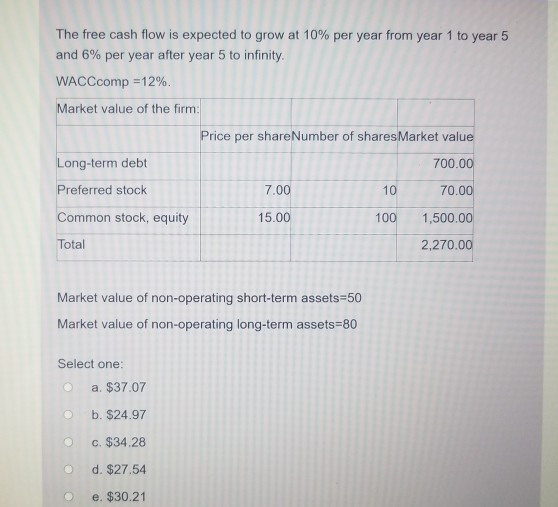

According to the value-based management model, what is the stock price per share given the following data? Year Revenue 850.00 100.00 Fixed costs Variable costs 280.00 Additional investment in NWC 3.00 Additional investment in operating long-term assets 80.00 Depreciation 75.00 Tax rate 0.40 The free cash flow is expected to grow at 10% per year from year 1 to year 5 and 6% per year after year 5 to infinity. WACCcomp=12% Market value of the firm: Price per shareNumber of shares Market value Long-term debt 700.00 Preferred stock 10 70.00 Common stock, equity 15.00 100 1,500.00 Total 2,270.00 7.00 Market value of non-operating short-term assets=50 Market value of non-operating long-term assets=80 Select one: a. $37.07 b. $24.97 c. $34.28 d. $27.54 e. $30.21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts