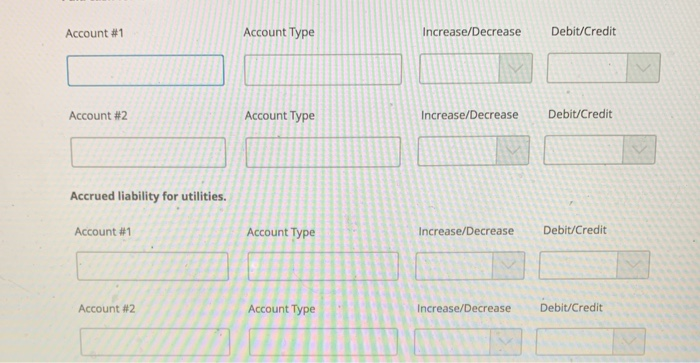

Question: Account #1 Account Type Increase/Decrease Debit/Credit Account #2 Account Type Increase/Decrease Debit/Credit Accrued liability for utilities. Account #1 Account Type Increase/Decrease Debit/Credit Account #2 Account

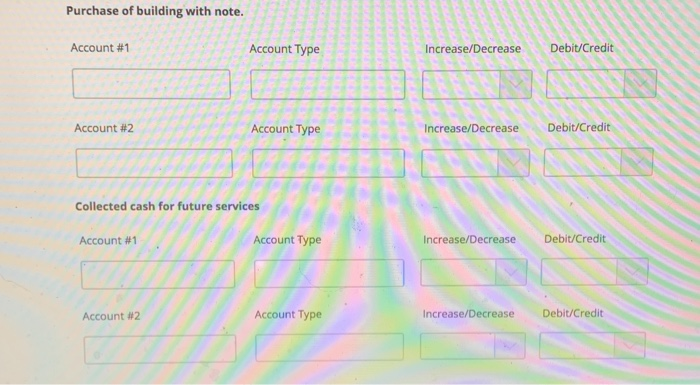

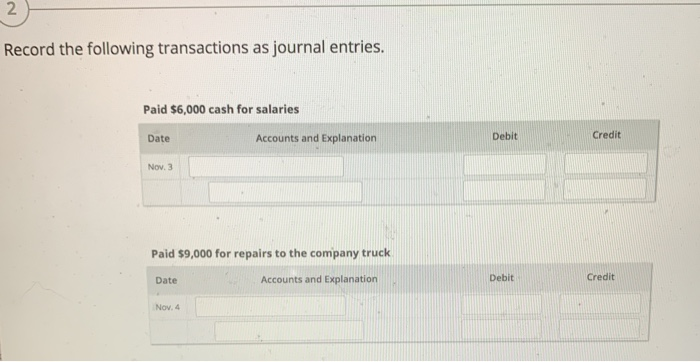

Account #1 Account Type Increase/Decrease Debit/Credit Account #2 Account Type Increase/Decrease Debit/Credit Accrued liability for utilities. Account #1 Account Type Increase/Decrease Debit/Credit Account #2 Account Type Increase/Decrease Debit/Credit Purchase of building with note. Account #1 Account Type Increase/Decrease Debit/Credit Account #2 Account Type Increase/Decrease Debit/Credit Collected cash for future services Account #1 Account Type Increase/Decrease Debit/Credit Account #2 Account Type Increase/Decrease Debit/Credit 2 Record the following transactions as journal entries. Paid $6,000 cash for salaries Date Accounts and explanation Debit Credit Nov. 3 Paid $9,000 for repairs to the company truck Date Accounts and Explanation Debit Credit Nov. 4 Received $7,000 for services rendered to a client Accounts and Explanation Date Debit Credit Nov.5 Purchased $5,000 of office supplies on account. Date Accounts and explanation Debit Credit Nov. 5 Made a $7,000 payment on notes payable Accounts and explanation Debit Credit Date Nov.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts