Question: ACCOUNT 701: Weekly Assignment B (Module 2) This weekly assignment is made up of two parts. This document has been created to provide a summary

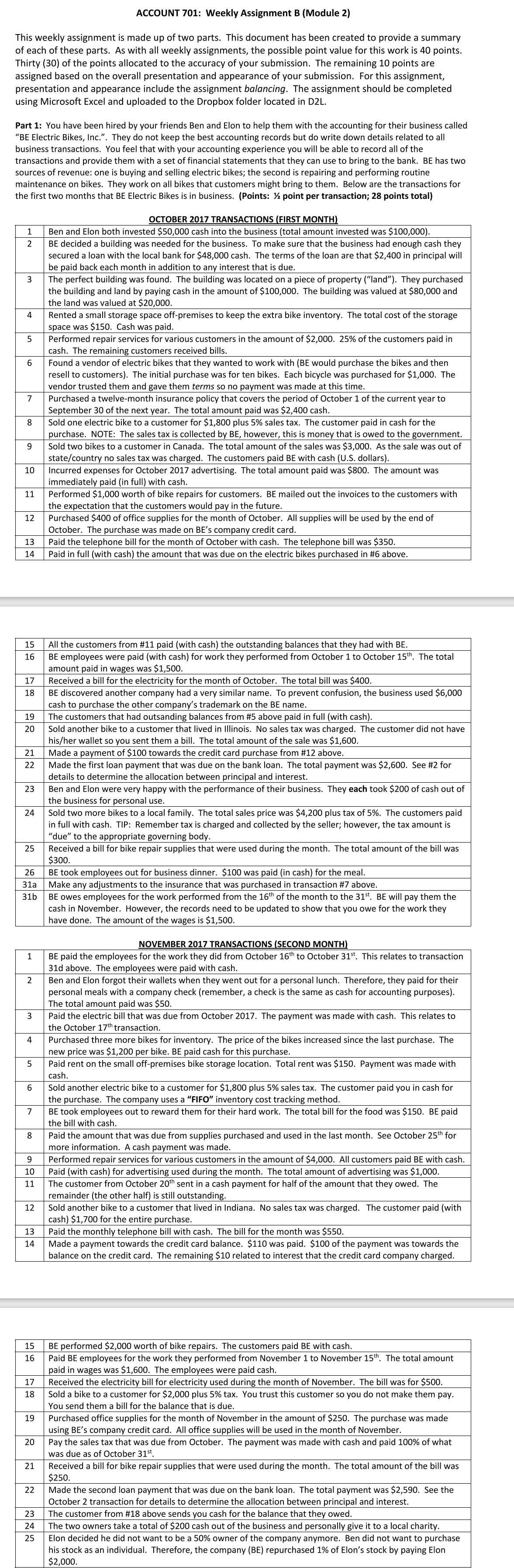

ACCOUNT 701: Weekly Assignment B (Module 2) This weekly assignment is made up of two parts. This document has been created to provide a summary of each of these parts. As with all weekly assignments, the possible point value for this work is 40 points. Thirty (30) of the points allocated to the accuracy of your submission. The remaining 10 points are assigned based on the overall presentation and appearance of your submission. For this assignment, presentation and appearance include the assignment balancing. The assignment should be completed using Microsoft Excel and uploaded to the Dropbox folder located in D2L. Part 1: You have been hired by your friends Ben and Elon to help them with the accounting for their business called \"BE Electric Bikes, Inc.\". They do not keep the best accounting records but do write down details related to all business transactions. You feel that with your accounting experience you will be able to record all of the transactions and provide them with a set of financial statements that they can use to bring to the bank. BE has two sources of revenue: one is buying and selling electric bikes; the second is repairing and performing routine maintenance on bikes. They work on all bikes that customers might bring to them. Below are the transactions for the first two months that BE Electric Bikes is in business. (Points: % point per transaction; 28 points total) OCTOBER 2017 TRANSACTIONS (FIRST MONTH) 1 | Ben and Elon both invested $50,000 cash into the business (total amount invested was $100,000). 2| BE decided a building was needed for the business. To make sure that the business had enough cash they secured a loan with the local bank for $48,000 cash. The terms of the loan are that $2,400 in principal will be paid back each month in addition to any interest that is due. 3 The perfect building was found. The building was located on a piece of property (\"land\"). They purchased the building and land by paying cash in the amount of $100,000. The building was valued at $80,000 and the land was valued at $20,000. 4| Rented a small storage space off-premises to keep the extra bike inventory. The total cost of the storage space was $150. Cash was paid. 5 | Performed repair services for various customers in the amount of $2,000. 25% of the customers paid in cash. The remaining customers received bills. 6 | Found a vendor of electric bikes that they wanted to work with (BE would purchase the bikes and then resell to customers). The initial purchase was for ten bikes. Each bicycle was purchased for $1,000. The vendor trusted them and gave them terms so no payment was made at this time. 7 | Purchased a twelve-month insurance policy that covers the period of October 1 of the current year to September 30 of the next year. The total amount paid was $2,400 cash. 8 | Sold one electric bike to a customer for $1,800 plus 5% sales tax. The customer paid in cash for the purchase. NOTE: The sales tax s collected by BE, however, this is money that is owed to the government. 9 | Sold two bikes to a customer in Canada. The total amount of the sales was $3,000. As the sale was out of state/country no sales tax was charged. The customers paid BE with cash (U.S. dollars). 10 | Incurred expenses for October 2017 advertising. The total amount paid was $800. The amount was immediately paid (in full) with cash. 11 | Performed $1,000 worth of bike repairs for customers. BE mailed out the invoices to the customers with the expectation that the customers would pay in the future. 12| Purchased $400 of office supplies for the month of October. All supplies will be used by the end of October. The purchase was made on BE's company credit card. 13 | Paid the telephone bill for the month of October with cash. The telephone bill was $350. 14 | Paid in full (with cash) the amount that was due on the electric bikes purchased in #6 above. 15 [ All the customers from #11 paid (with cash) the outstanding balances that they had with BE. 16 | BE employees were paid (with cash) for work they performed from October 1 to October 157 The total amount paid in wages was $1,500. 17 | Received a bill for the electricity for the month of October. The total bill was $400. 18 | BE discovered another company had a very similar name. To prevent confusion, the business used $6,000 cash to purchase the other company's trademark on the BE name. 19| The customers that had outsanding balances from #5 above paid in full (with cash). 20 | Sold another bike to a customer that lived in Illinois. No sales tax was charged. The customer did not have his/her wallet so you sent them a bill. The total amount of the sale was $1,600. 21 | Made a payment of $100 towards the credit card purchase from #12 above. 22 | Made the first loan payment that was due on the bank loan. The total payment was $2,600. See #2 for details to determine the allocation between principal and interest. 23| Ben and Elon were very happy with the performance of their business. They each took $200 of cash out of the business for personal use. 24| Sold two more bikes to a local family. The total sales price was $4,200 plus tax of 5%. The customers paid in full with cash. TIP: Remember tax is charged and collected by the seller; however, the tax amount is \"due\" to the appropriate governing body. 25 | Received a bill for bike repair supplies that were used during the month. The total amount of the bill was $300. 26 | BE took employees out for business dinner. $100 was paid (in cash) for the meal. 31a | Make any adjustments to the insurance that was purchased in transaction #7 above. 31b | BE owes employees for the work performed from the 16" of the month to the 31, BE will pay them the cash in November. However, the records need to be updated to show that you owe for the work they have done. The amount of the wages is $1,500. NOVEMBER 2017 TRANSACTIONS (SECOND MONTH) 1 | BE paid the employees for the work they did from October 16" to October 31%. This relates to transaction 31d above. The employees were paid with cash. 2 | Ben and Elon forgot their wallets when they went out for a personal lunch. Therefore, they paid for their personal meals with a company check (remember, a check is the same as cash for accounting purposes). The total amount paid was $50. 3 | Paid the electric bill that was due from October 2017. The payment was made with cash. This relates to the October 17" transaction. 4 | Purchased three more bikes for inventory. The price of the bikes increased since the last purchase. The new price was $1,200 per bike. BE paid cash for this purchase. 5 | Paid rent on the small off-premises bike storage location. Total rent was $150. Payment was made with cash. 6 Sold another electric bike to a customer for $1,800 plus 5% sales tax. The customer paid you in cash for the purchase. The company uses a \"FIFO\" inventory cost tracking method. 7 | BE took employees out to reward them for their hard work. The total bill for the food was $150. BE paid the bill with cash. 8 | Paid the amount that was due from supplies purchased and used in the last month. See October 25 for more information. A cash payment was made. 9 | Performed repair services for various customers in the amount of $4,000. All customers paid BE with cash. 10 | Paid (with cash) for advertising used during the month. The total amount of advertising was $1,000. 11 | The customer from October 20" sent in a cash payment for half of the amount that they owed. The remainder (the other half) is still outstanding. 12 | Sold another bike to a customer that lived in Indiana. No sales tax was charged. The customer paid (with cash) $1,700 for the entire purchase. 13 | Paid the monthly telephone bill with cash. The bill for the month was $550. 14 | Made a payment towards the credit card balance. $110 was paid. $100 of the payment was towards the balance on the credit card. The remaining $10 related to interest that the credit card company charged. 15 | BE performed $2,000 worth of bike repairs. The customers paid BE with cash. 16 | Paid BE employees for the work they performed from November 1 to November 15%. The total amount paid in wages was $1,600. The employees were paid cash. 17 | Received the electricity bill for electricity used during the month of November. The bill was for $500. 18 | Sold a bike to a customer for $2,000 plus 5% tax. You trust this customer so you do not make them pay. You send them a bill for the balance that is due. 19 | Purchased office supplies for the month of November in the amount of $250. The purchase was made using BE's company credit card. All office supplies will be used in the month of November. 20 | Pay the sales tax that was due from October. The payment was made with cash and paid 100% of what was due as of October 31, 21 | Received a bill for bike repair supplies that were used during the month. The total amount of the bill was $250. 22 | Made the second loan payment that was due on the bank loan. The total payment was $2,590. See the October 2 transaction for details to determine the allocation between principal and interest. 23| The customer from #18 above sends you cash for the balance that they owed. 24| The two owners take a total of 5200 cash out of the business and personally give it to a local charity. 25 | Elon decided he did not want to be a 50% owner of the company anymore. Ben did not want to purchase his stock as an individual. Therefore, the company (BE) repurchased 1% of Elon's stock by paying Elon $2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts