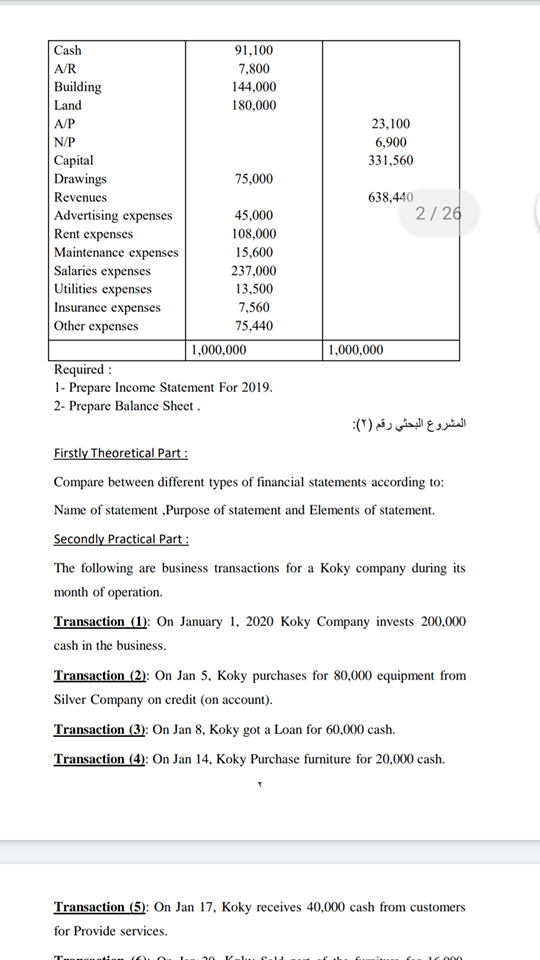

Question: () / ( Accounting ) (1): Firstly Theoretical Part: Discuss The Conceptual Framework of Accounting according to : -Definition of Accounting. -Purposes of Accounting. -Difference

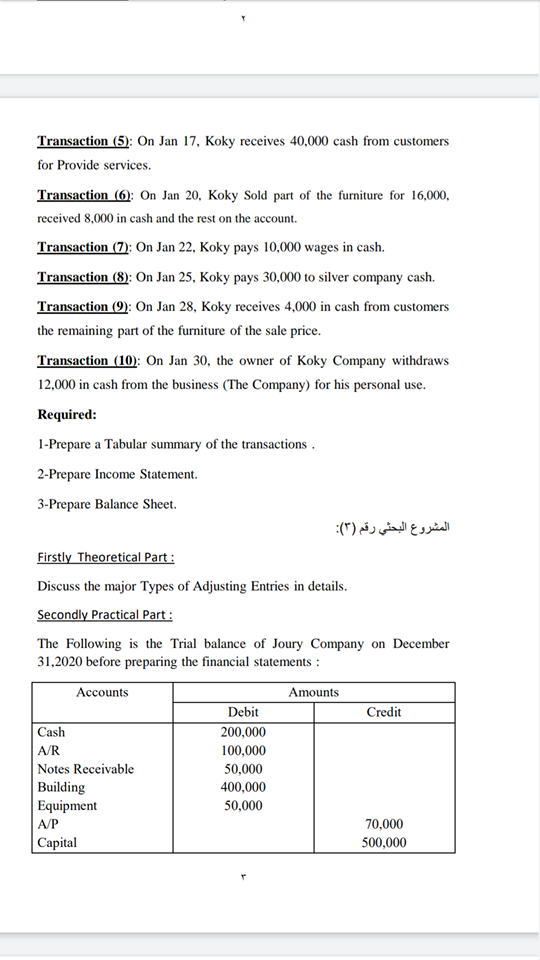

() / ( Accounting ) (1): Firstly Theoretical Part: Discuss The Conceptual Framework of Accounting according to : -Definition of Accounting. -Purposes of Accounting. -Difference between Bookkeeping and Accounting. -Users of Accounting information. -Accounting Assumptions. -Accounting principles. Secondly Practical Part: on The Following is the Trial balance of Jana Company December31,2019 before preparing the financial statements : Accounts Amounts Debit Credit Cash 91,100 7 ] 23,100 6,900 331,560 638,440 2/26 Cash 91,100 AR 7,800 Building 144,000 Land 180,000 | N/P Capital Drawings 75,000 Revenues Advertising expenses 45,000 Rent expenses 108,000 Maintenance expenses 15,600 Salaries expenses 237,000 Utilities expenses 13,500 Insurance expenses 7,560 Other expenses 75,440 1,000,000 Required: 1 - Prepare Income Statement For 2019. 2- Prepare Balance Sheet. 1,000,000 (): Firstly Theoretical Part: Compare between different types of financial statements according to: Name of statement Purpose of statement and Elements of statement. Secondly Practical Part: The following are business transactions for a Koky company during its month of operation. Transaction (1): On January 1, 2020 Koky Company invests 200,000 cash in the business. Transaction (2): On Jan 5, Koky purchases for 80,000 equipment from Silver Company on credit (on account). Transaction (3): On Jan 8, Koky got a Loan for 60,000 cash. Transaction (4): On Jan 14, Koky Purchase furniture for 20,000 cash. Transaction (5): On Jan 17, Koky receives 40,000 cash from customers for Provide services. Transaction (5): On Jan 17, Koky receives 40,000 cash from customers for Provide services. Transaction (6): On Jan 20, Koky Sold part of the furniture for 16,000, received 8,000 in cash and the rest on the account. Transaction (7): On Jan 22, Koky pays 10,000 wages in cash. Transaction (8): On Jan 25, Koky pays 30,000 to silver company cash. Transaction (9): On Jan 28, Koky receives 4,000 in cash from customers the remaining part of the furniture of the sale price. Transaction (10): On Jan 30, the owner of Koky Company withdraws 12,000 in cash from the business (The Company) for his personal use. Required: 1-Prepare a Tabular summary of the transactions 2-Prepare Income Statement. 3-Prepare Balance Sheet (): Firstly Theoretical Part: Discuss the major Types of Adjusting Entries in details. Secondly Practical Part : The Following is the Trial balance of Joury Company on December 31,2020 before preparing the financial statements : Accounts Amounts Credit Cash AR Notes Receivable Building Equipment AP Capital Debit 200,000 100,000 50,000 400,000 50,000 70,000 500,000 () / ( Accounting ) (1): Firstly Theoretical Part: Discuss The Conceptual Framework of Accounting according to : -Definition of Accounting. -Purposes of Accounting. -Difference between Bookkeeping and Accounting. -Users of Accounting information. -Accounting Assumptions. -Accounting principles. Secondly Practical Part: on The Following is the Trial balance of Jana Company December31,2019 before preparing the financial statements : Accounts Amounts Debit Credit Cash 91,100 7 ] 23,100 6,900 331,560 638,440 2/26 Cash 91,100 AR 7,800 Building 144,000 Land 180,000 | N/P Capital Drawings 75,000 Revenues Advertising expenses 45,000 Rent expenses 108,000 Maintenance expenses 15,600 Salaries expenses 237,000 Utilities expenses 13,500 Insurance expenses 7,560 Other expenses 75,440 1,000,000 Required: 1 - Prepare Income Statement For 2019. 2- Prepare Balance Sheet. 1,000,000 (): Firstly Theoretical Part: Compare between different types of financial statements according to: Name of statement Purpose of statement and Elements of statement. Secondly Practical Part: The following are business transactions for a Koky company during its month of operation. Transaction (1): On January 1, 2020 Koky Company invests 200,000 cash in the business. Transaction (2): On Jan 5, Koky purchases for 80,000 equipment from Silver Company on credit (on account). Transaction (3): On Jan 8, Koky got a Loan for 60,000 cash. Transaction (4): On Jan 14, Koky Purchase furniture for 20,000 cash. Transaction (5): On Jan 17, Koky receives 40,000 cash from customers for Provide services. Transaction (5): On Jan 17, Koky receives 40,000 cash from customers for Provide services. Transaction (6): On Jan 20, Koky Sold part of the furniture for 16,000, received 8,000 in cash and the rest on the account. Transaction (7): On Jan 22, Koky pays 10,000 wages in cash. Transaction (8): On Jan 25, Koky pays 30,000 to silver company cash. Transaction (9): On Jan 28, Koky receives 4,000 in cash from customers the remaining part of the furniture of the sale price. Transaction (10): On Jan 30, the owner of Koky Company withdraws 12,000 in cash from the business (The Company) for his personal use. Required: 1-Prepare a Tabular summary of the transactions 2-Prepare Income Statement. 3-Prepare Balance Sheet (): Firstly Theoretical Part: Discuss the major Types of Adjusting Entries in details. Secondly Practical Part : The Following is the Trial balance of Joury Company on December 31,2020 before preparing the financial statements : Accounts Amounts Credit Cash AR Notes Receivable Building Equipment AP Capital Debit 200,000 100,000 50,000 400,000 50,000 70,000 500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts