Question: accounting 101 Chapter 2 T Account Problem Surfside uses the following accounts: Directions: 1. Open T-accounts for the above accounts 2. Analyze the following transactions

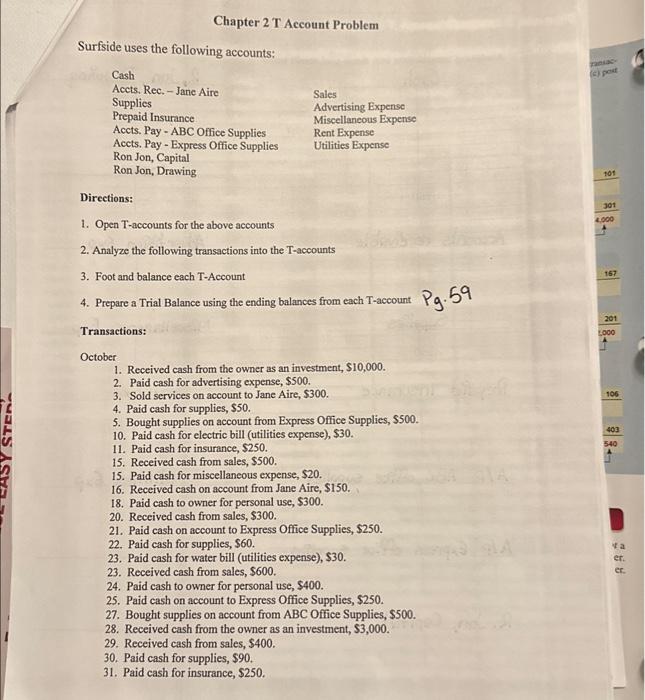

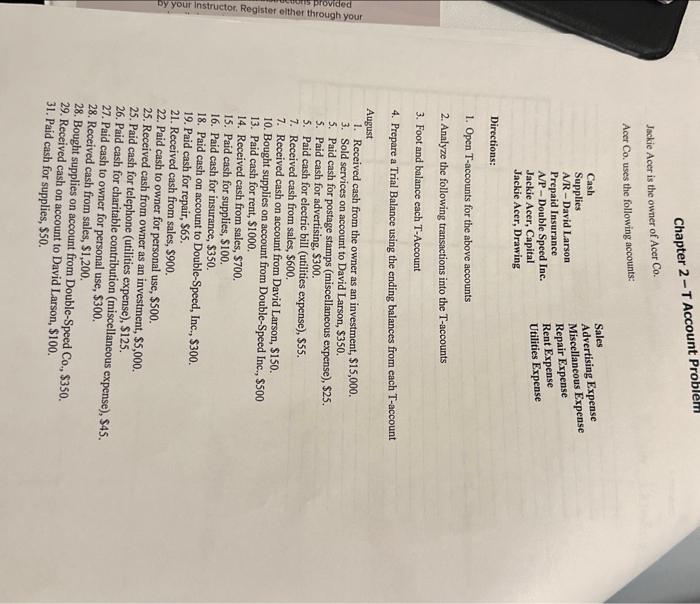

Chapter 2 T Account Problem Surfside uses the following accounts: Directions: 1. Open T-accounts for the above accounts 2. Analyze the following transactions into the T-accounts 3. Foot and balance each T-Account 4. Prepare a Trial Balance using the ending balances from each T-account Pg.59 Transactions: October 1. Received cash from the owner as an investment, $10,000. 2. Paid cash for advertising expense, $500. 3. Sold services on account to Jane Aire, $300. 4. Paid cash for supplies, $50. 5. Bought supplies on account from Express Office Supplies, $500. 10. Paid cash for electric bill (utilities expense), $30. 11. Paid cash for insurance, $250. 15. Received cash from sales, $500. 15. Paid cash for miscellaneous expense, $20. 16. Received cash on account from Jane Aire, $150. 18. Paid cash to owner for personal use, $300. 20. Received cash from sales, $300. 21. Paid cash on account to Express Office Supplies, \$250. 22. Paid cash for supplies, $60. 23. Paid cash for water bill (utilities expense), $30. 23. Received cash from sales, $600. 24. Paid cash to owner for personal use, $400. 25. Paid cash on account to Express Office Supplies, $250. 27. Bought supplies on account from ABC Office Supplies, $500. 28. Received cash from the owner as an investment, $3,000. 29. Received cash from sales, $400. 30. Paid cash for supplies, $90. 31. Paid cash for insurance, $250. Chapter 2-T Account Problem Jackie Acer is the owner of Acer Co. Acer Co, uses the following accounts: Directions: 1. Open T-accounts for the above accounts 2. Analyze the following transactions into the T-accounts 3. Foot and balance each T-Account 4. Prepare a Trial Balance using the ending balances from each T-account August 1. Received cash from the owner as an investment, $15,000. 3. Sold services on account to David Larson, $350. 5. Paid cash for postage stamps (miscellaneous expense), $25. 5. Paid cash for advertising, $300. 5. Paid cash for electric bill (utilities expense), $55. 7. Received cash from sales, $600. 7. Received cash on account from David Larson, $150. 10. Bought supplies on account from Double-Speed Inc, $500 13. Paid cash for rent, $1000. 14. Received cash from sales, $700. 15. Paid cash for supplies, $100. 16. Paid cash for insurance, $350. 18. Paid cash on account to Double-Speed, Inc, $300. 19. Paid cash for repair, $65. 21. Received cash from sales, $900. 22. Paid cash to owner for personal use, $500. 25 . Received cash from owner as an investment, $5,000. 25. Paid cash for telephone (utilities expense), $125. 26. Paid cash for charitable contribution (miscellaneous expense), $45. 27. Paid cash to owner for personal use, $300. 28. Received cash from sales, $1,200. 28. Bought supplies on account from Double-Speed Coo,$350. 29. Received cash on account to David Larson, $100. 31. Paid cash for supplies, $50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts