Question: accounting 101, major assignment. need help with adjusted trial balance, income statement, statement of retained earnings, balance sheet, closing journal, and post closing trial balance.

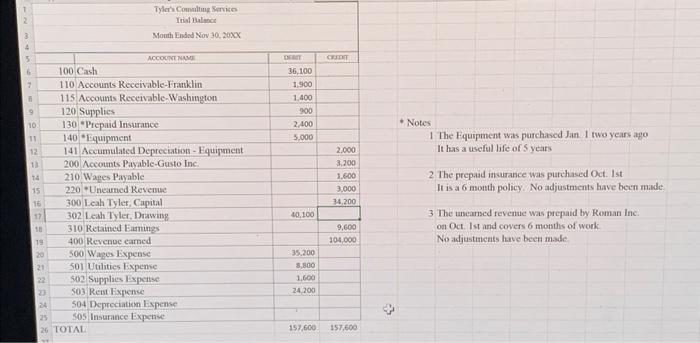

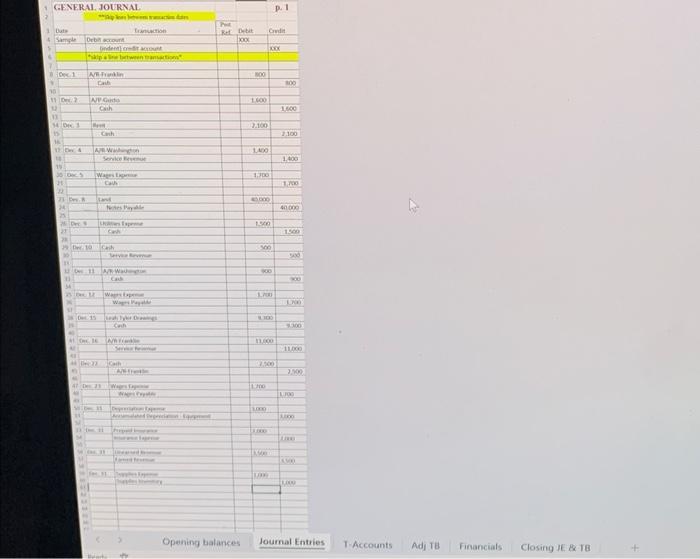

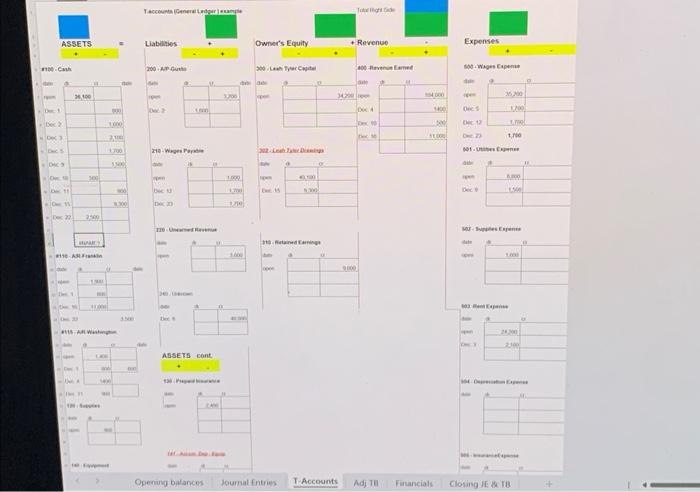

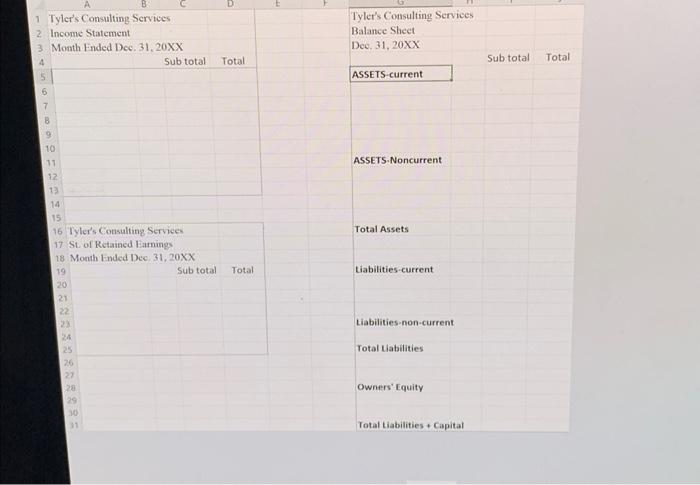

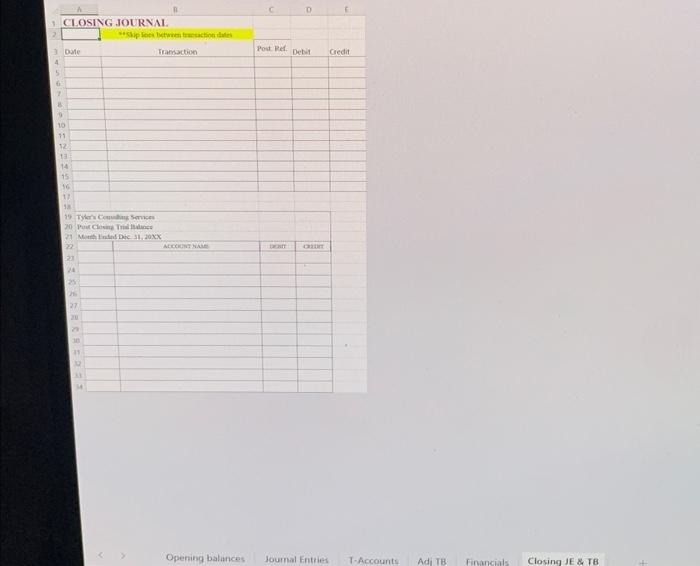

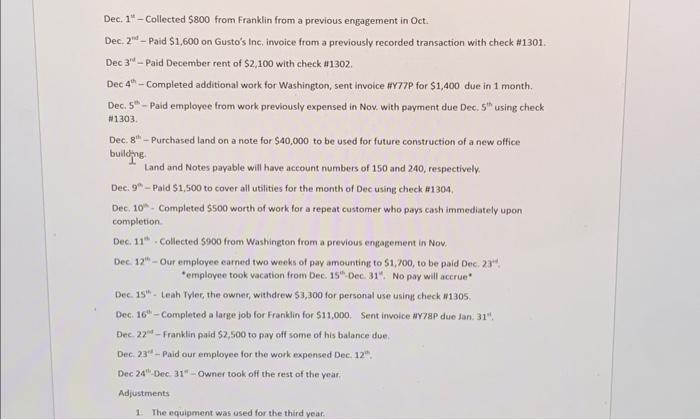

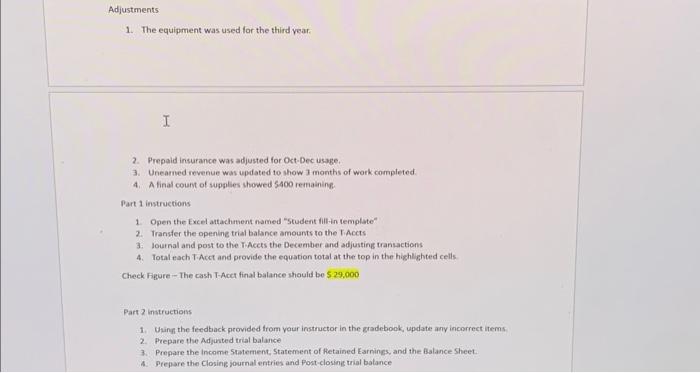

1 The Equipment was purchased Jan I two years ago It has a useful life of 5 vears 2. The prepad insurance was putchased Oct. Ist It is a 6 month policy. No adjustments bave been made. 3 The uneared revenue was prepaid by Roman lne: on Oct. Ist and covers 6 months of woek No adjustments hive been made GFNERAI, JOURVAI p. 1 Duts Simple b bit Condit (1) intrit) Aprentas 1) coin Gincuction trox. tores 114 34 t= 18 if 1. 1 +1 12 7 +4 i4 1 in Sonke Eequituot ax51 Wapes tikonery cant tans 4 1 1 cank +1 in +1 that if MRWaverio: 4 +1 inti) ctan. Hinticte 10 1 1 1 1,sin 1.560 46 0 + 1 r) Lne inn and 13,000 11000 3.002 thro 1100 tione Inm intore tinas kes: pin inin. ininy Opening talances Joumal Entries T-Accounts Adj 18 Financials Closing IE \& 18 Tyler's Consulting Servives Tyler's Consulting Services Income Statement Balance Sheet Month Finded Dec, 31, 20XX Dee, 31, 20XX Sub total Total Sub total Total 4 5 ASSETS-current 6 7 b 9 10 11 ASSETS.Noncurrent 12 13 14 15 16 Tyler's Consulting Services 17 St. of Retained Eamings 18 Month Ended Deo, 31, 20XX 19 Sub total Total Total Assets 20 21 22 22 24 Liabilities-non-current 25 Total tuabilities 26 27 20 Owners' Equity 29 Total Liabilities-current 10 11 Total tiabilities + Capital CLOSING JOURVAL Dec. 1"t - Collected $800 from Franklin from a previous engagement in Oct. Dec. 2nd - Paid $1,600 on Gusto's Inc, invoice from a previously recorded transaction with check \#1301. Dec 3rd - Paid December rent of $2,100 with check 41302 . Dec 4th-Completed additional work for Washington, sent invoice HY77P for $1,400 due in 1 month. Dec. 5ti - Paid employee from work previously expensed in Nov. with parment due Dec. 5th using check \#1303. Dec. 8th - Purchased land on a note for $40,000 to be used for future construction of a new office buildong. Land and Notes payable will have account numbers of 150 and 240, respectively. Dec. 96 - Paid $1,500 to cover all ublities for the month of Dec using check #1304 Dec. 10 - Completed 5500 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11th. Collected 5900 from Washington from a previous engagement in Nov. Dec. 12 - Our employee earned two weeks of pay amounting to 51,700 , to be paid Dec. 234 "employee took vacation from Dec. 15th-Dec. 31".. No pay will accrue* Dec. 154h - Leah Tylec, the owner, withdrew 53,300 for personal use using check 11305. Dec. 164: - Completed a large job for Franklin for $11,000. Sent invoice ar7ap due Jan. 31. Dee 224 - Franktin paid $2,500 to pay off some of his balance due Dec. 23a - Paid our employee for the work expensed Dec. 12th. Dec 24tb Dec 31"f - Owner took off the rest of the year. Adjustments 1. The equipment was used for the third vear: 2. Prepaid insurance was adjusted for Oct-Dec usage. 3. Unearned revenue was updated to show 3 months of work completed 4. A final count of supplies showed S400 reanaining. Part 1 instructions 1. Open the fxe+l attachment named "Student filf-in template" 2. Transfer the opening trial balance amounts to the TiAccts 3. Journal and post to the T.Accts the December and adjusting transactions 4. Total each T.Acct and provide the equation total at the top in the highlighted cells Check Figure - The cash T-Acct final balance should be $29,000 Part 2 instructions 1. Waing the feeclasck provided from vaur instructor in the gradebook, update any incorrect items 2. Prepare the Adjuted trial balance 3. Prepare the income Statement, Statement of Hetained Earnings, and the Balance Sheet. 4. Prepare the Closing journal entries and Fost-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts