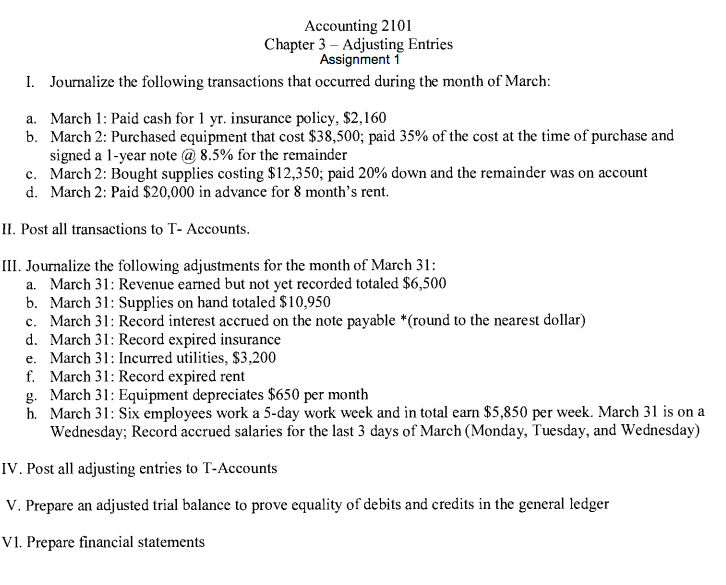

Question: Accounting 2101 Chapter 3- Adjusting Entries Assignment 1 I. Journalize the following transactions that occurred during the month of March March 1: Paid cash for

Accounting 2101 Chapter 3- Adjusting Entries Assignment 1 I. Journalize the following transactions that occurred during the month of March March 1: Paid cash for 1 yr. insurance policy, $2,160 March 2: Purchased equipment that cost $38,500; paid 35% of the cost at the time of purchase and signed a 1-year note @ 8.5% for the remainder March 2 : Bought supplies costing $12,350, paid 20% down and the remainder was on account March 2: Paid $20,000 in advance for 8 month's rent. a. b. c. d. II. Post all transactions to T- Accounts III. Journalize the following adjustments for the month of March 31 a. March 31: Revenue earned but not yet recorded totaled $6,500 b. March 31: Supplies on hand totaled $10,950 c. March 31: Record interest accrued on the note payable *"(round to the nearest dollar) d. March 31: Record expired insurance e. March 31: Incurred utilities, $3,200 f. March 31: Record expired rent g. March 31: Equipment depreciates $650 per month h. March 31: Six employees work a 5-day work week and in total earn $5,850 per week. March 31 is on a Wednesday; Record accrued salaries for the last 3 days of March (Monday, Tuesday, and Wednesday) IV. Post all adjusting entries to T-Account:s V. Prepare an adjusted trial balance to prove equality of debits and credits in the general ledger V1. Prepare financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts