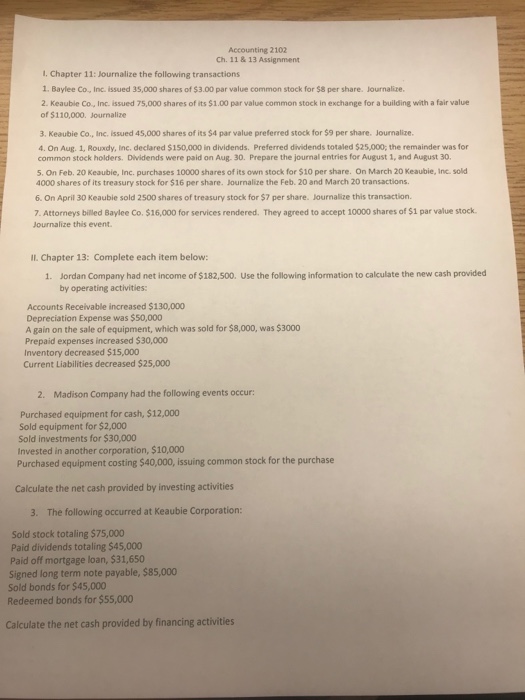

Question: Accounting 2102 Ch. 11& 13 Assignment I. Chapter 11: Journalize the following transactions 1. Baylee Co, Inc. issued 35,000 shares of $3.00 par value common

Accounting 2102 Ch. 11& 13 Assignment I. Chapter 11: Journalize the following transactions 1. Baylee Co, Inc. issued 35,000 shares of $3.00 par value common stock for $8 per share. Journalize 2. Keauble Co., Inc. issued 75,000 shares of its $1.00 par value common stock in exchange for a building with a fair value of $110,000. Journalize 3. Keaubie Co, Inc, issued 45,000 shares of its $4 par value preferred stock for $9 per share. Journalize 4. On Aug. 1, Rouxdy, Inc. declared $150,000 in dividends. Preferred dividends totaled $25,000, the remainder was for common stock holders. Dividends were paid on Aug. 30. Prepare the journal entries for August 1, and August 30. 5. On Feb. 20 Keaubie, Inc. purchases 10000 shares of its own stock for $10 per share. On March 20 Keaubie, Inc. sold 4000 shares of its treasury stock for $16 per share. Journalize the Feb. 20 and March 20 transactions. 6. On April 30 Keaubie sold 2500 shares of treasury stock for $7 per share. Journalize this transaction 7. Attorneys billed Baylee Co. $16,000 for services rendered. They agreed to accept 10000 shares of $1 par value stock Journalize this event. Il. Chapter 13: Complete each item below: Jordan Company had net income of $182,500. Use the following information to calculate the new cash provided by operating activities: 1. Accounts Receivable increased $130,000 Depreciation Expense was $50,000 A gain on the sale of equipment, which was sold for $8,000, was $3000 Prepaid expenses increased $30,000 Inventory decreased $15,000 Current Liabilities decreased $25,000 2. Madison Company had the following events occur Purchased equipment for cash, $12,000 Sold equipment for $2,000 Sold investments for $30,000 Invested in another corporation, $10,000 Purchased equipment costing $40,000, issuing common stock for the purchase Calculate the net cash provided by investing activities 3. The following occurred at Keaubie Corporation: Sold stock totaling $75,000 Paid dividends totaling $45,000 Paid off mortgage loan, $31,650 Signed lons erm note payable,$5,000 Sold bonds for $45,000 Redeemed bonds for $55,000 Calculate the net cash provided by financing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts