Question: Accounting 2102 Chapter 10-Long Term Liabilities Sample Problems 1. On Jan. 1 Keaubie Co. signed a $300,000, 4 % , 3- year note payable. The

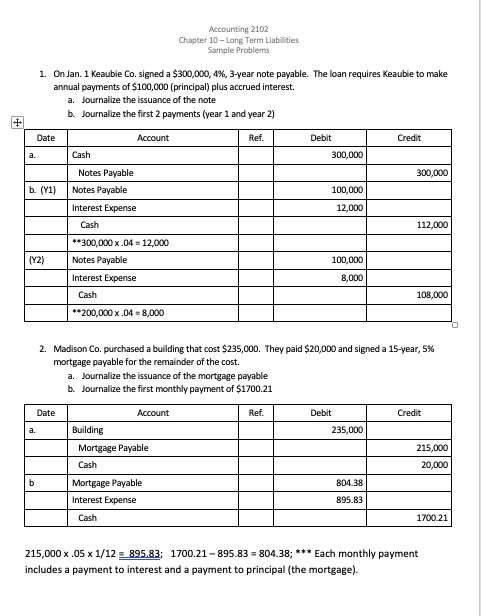

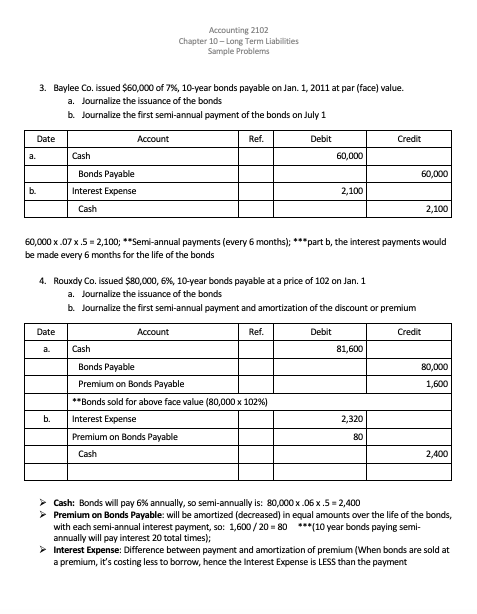

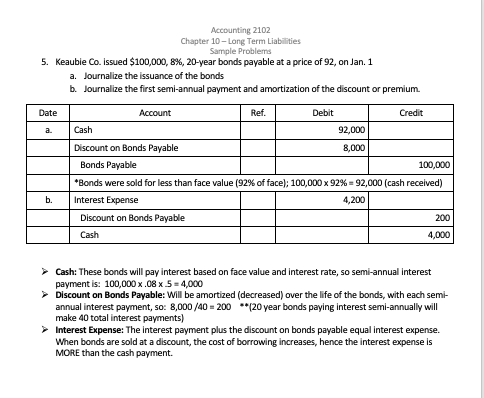

Accounting 2102 Chapter 10-Long Term Liabilities Sample Problems 1. On Jan. 1 Keaubie Co. signed a $300,000, 4 % , 3- year note payable. The loan requires Keaubie to make annual payments of $100,000 (principal) plus accrued interest. Journalize the issuance of the note a. b. Journalize the first 2 payments (year 1 and year 2) Date Account Ref. Debit Credit Cash 300,000 a. Notes Payable 300,000 Notes Payable 100,000 b. (Y1) Interest Expense 12,000 Cash 112,000 300,000 x.04 12,000 Notes Payable (Y2) 100,000 Interest Expense 8,000 108,000 Cash 200,000 x.04 8,000 Madison Co. purchased a building that cost $235,000. They paid $20,000 and signed a 15-year, 5 % mortgage payable for the remainder of the cost 2. a. Journalize the issuance of the mortgage payable b. Journalize the first monthly payment of $1700.21 Date Account Ref. Debit Credit a. Building 235,000 Mortgage Payable 215,000 Cash 20,000 Mortgage Payable 804.38 Interest Expense 895.83 Cash 1700.21 215,000 x .05 x 1/12- 895.83 1700.21-895.83 804.38 ; *** Each monthly payment includes a payment to interest and a payment to principal (the mortgage). Accounting 2102 Chapter 10-Long Term Liabilities Sample Problems 3. Baylee Co. issued $60,000 of 7 % , 10- year bonds payable on Jan. 1, 2011 at par (face) value. Journalize the issuance of the bonds a. b. Journalize the first semi-annual payment of the bonds on July 1 Date Account Ref. Debit Credit Cash 60,000 a. Bonds Payable 60,000 Interest Expense b. 2,100 Cash 2,100 60,000 x.07 x.5 2,100;Semi-annual payments (every 6 months);"part b, the interest payments would be made every 6 months for the life of the bonds 4. Rouxdy Co. issued $80,000, 6 % , 10- year bonds payable at a price of 102 on Jan. 1 Journalize the issuance of the bonds a. b. Journalize the first semi-annual payment and amortization of the discount or premium Date Account Ref. Debit Credit Cash 81,600 a Bonds Payable 80,000 Premium on Bonds Payable 1,600 Bonds sold for above face value (80,000 x 102 % ) b. Interest Expense 2,320 Premium on Bonds Payable 80 Cash 2,400 Cash: Bonds will pay 6 % annually, so semi-annually is: 80,000 x.06x.5 2,400 Premium on Bonds Payable: will be amortized (decreased) in equal amounts over the life of the bonds, with each semi-annual interest payment, so: 1,600/20 80 (10 year bonds paying semi- annually will pay interest 20 total times) Interest Expense: Difference between payment and amortization of premium (When bonds are sold at a premium, it's costing less to borrow, hence the Interest Expense is LESS than the payment Accounting 2102 Chapter 10-Long Term Liabilities Sample Problems Keaubie Co. issued $100,000, 8 % , 20- year bonds payable at a price of 92, on Jan. 1. 5. Journalize the issuance of the bonds a. b. Journalize the first semi-annual payment and amortization of the discount or premium. Date Account Ref. Debit Credit Cash 92,000 a. Discount on Bonds Payable 8,000 Bonds Payable 100,000 Bonds were sold for less than face value (92 % of face); 100,000 x 92% - 92,000 ( cash received) b. Interest Expense 4,200 Discount on Bonds Payable 200 Cash 4,000 Cash: These bonds will pay interest based on face value and interest rate, so semi-annual interest payment is: 100,000 x.08 x 5= 4,000 Discount on Bonds Payable: Will be amortized (decreased) over the life of the bonds, with each semi annual interest payment, so: 8,000 /40 200(20 year bonds paying interest semi-annually will make 40 total interest payments) Interest Expense: The interest payment plus the discount on bonds payable equal interest expense. When bonds are sold at a discount, the cost of borrowing increases, hence the interest expense is MORE than the cash payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts