Question: Accounting 211 Chapter 9: Depreciation Homework Problem Spring 2020 On January 1, 2019 ABC Construction purchased equipment at a cost of $4,800,000. The useful life

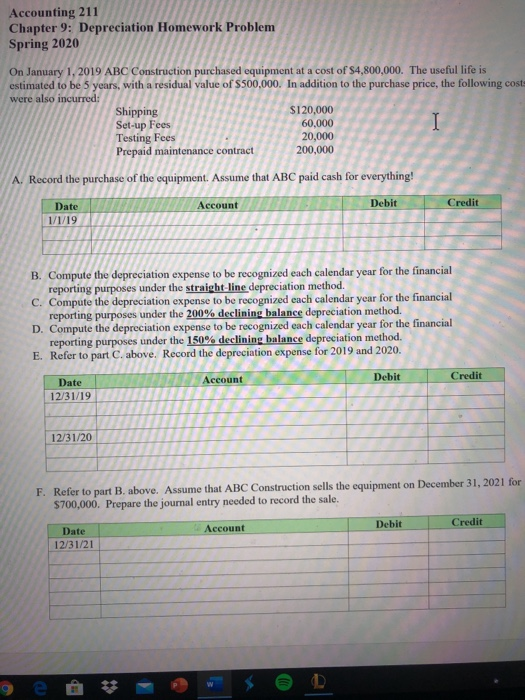

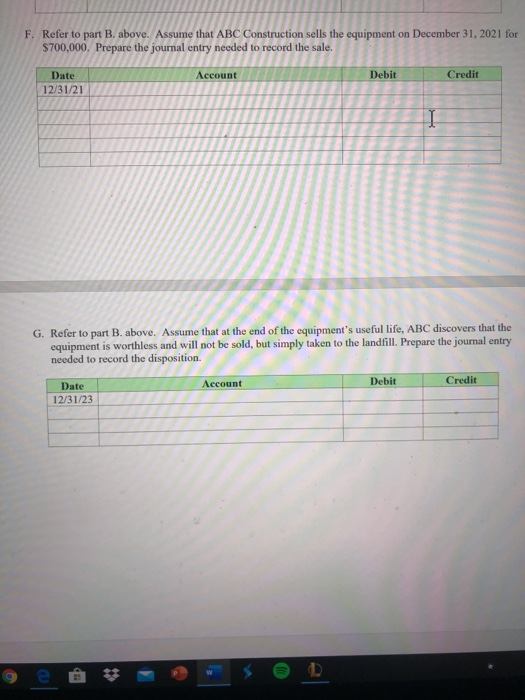

Accounting 211 Chapter 9: Depreciation Homework Problem Spring 2020 On January 1, 2019 ABC Construction purchased equipment at a cost of $4,800,000. The useful life is estimated to be 5 years, with a residual value of $500,000. In addition to the purchase price, the following cost were also incurred: Shipping $120,000 Set-up Fees 60,000 Testing Fees Prepaid maintenance contract 200,000 20,000 A. Record the purchase of the equipment. Assume that ABC paid cash for everything! Date Account Debit Credit B. Compute the depreciation expense to be recognized each calendar year for the financial reporting purposes under the straight-line depreciation method. C. Compute the depreciation expense to be recognized each calendar year for the financial reporting purposes under the 200% declining balance depreciation method. D. Compute the depreciation expense to be recognized each calendar year for the financial reporting purposes under the 150% declining balance depreciation method. E. Refer to part C. above. Record the depreciation expense for 2019 and 2020. LED Account Debit Credit Date 12/31/19 12/31/20 F. Refer to part B. above. Assume that ABC Construction sells the equipment on December 31, 2021 for $700,000. Prepare the journal entry needed to record the sale. Debit Credit Account Date 12/31/21 F. Refer to part B. above. Assume that ABC Construction sells the equipment on December 31, 2021 for $700,000. Prepare the journal entry needed to record the sale. Date Account Debit Credit 12/31/21 G. Refer to part B. above. Assume that at the end of the equipment's useful life, ABC discovers that the equipment is worthless and will not be sold, but simply taken to the landfill. Prepare the journal entry needed to record the disposition. Account Debit Credit Date 12/31/23 Accounting 211 Chapter 9: Depreciation Homework Problem Spring 2020 On January 1, 2019 ABC Construction purchased equipment at a cost of $4,800,000. The useful life is estimated to be 5 years, with a residual value of $500,000. In addition to the purchase price, the following cost were also incurred: Shipping $120,000 Set-up Fees 60,000 Testing Fees Prepaid maintenance contract 200,000 20,000 A. Record the purchase of the equipment. Assume that ABC paid cash for everything! Date Account Debit Credit B. Compute the depreciation expense to be recognized each calendar year for the financial reporting purposes under the straight-line depreciation method. C. Compute the depreciation expense to be recognized each calendar year for the financial reporting purposes under the 200% declining balance depreciation method. D. Compute the depreciation expense to be recognized each calendar year for the financial reporting purposes under the 150% declining balance depreciation method. E. Refer to part C. above. Record the depreciation expense for 2019 and 2020. LED Account Debit Credit Date 12/31/19 12/31/20 F. Refer to part B. above. Assume that ABC Construction sells the equipment on December 31, 2021 for $700,000. Prepare the journal entry needed to record the sale. Debit Credit Account Date 12/31/21 F. Refer to part B. above. Assume that ABC Construction sells the equipment on December 31, 2021 for $700,000. Prepare the journal entry needed to record the sale. Date Account Debit Credit 12/31/21 G. Refer to part B. above. Assume that at the end of the equipment's useful life, ABC discovers that the equipment is worthless and will not be sold, but simply taken to the landfill. Prepare the journal entry needed to record the disposition. Account Debit Credit Date 12/31/23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts