Question: Fill in the blank choices for questions 22-26: Administrative Beginning Contribution Cost driver Direct labor Direct labor-hours Direct materials Dollars of direct labor cost Ending

Fill in the blank choices for questions 22-26:

Administrative

Beginning

Contribution

Cost driver

Direct labor

Direct labor-hours

Direct materials

Dollars of direct labor cost

Ending

Expensed

Fixed

Fixed manufacturing overhead

For the period ended

Income statement

Indirect labor

Indirect materials

Job cost

Level of activity

Machine-hours

Manufacturing

Manufacturing overhead

Margin

Name of company

Overapplied

Period

Predetermined overhead rate

Process cost

Selling

Statement of cost of goods manufactured

Total budgeted overhead

Underapplied

Variable costing

Work inprocess inventory

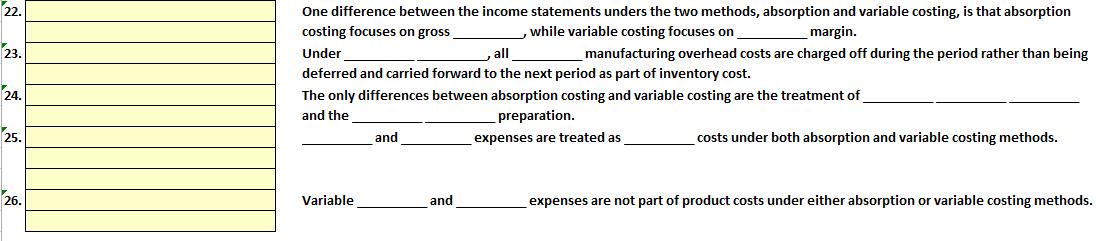

22. One difference between the income statements unders the two methods, absorption and variable costing, is that absorption costing focuses on gross while variable costing focuses on margin. 23. Under ,all manufacturing overhead costs are charged off during the period rather than being deferred and carried forward to the next period as part of inventory cost. 24. The only differences between absorption costing and variable costing are the treatment of and the preparation. 25. and costs under both absorption and variable costing methods. expenses are treated as 26. Variable and expenses are not part of product costs under either absorption or variable costing methods.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts