Question: On 1 July 2019, Marcus Ltd acquired 80% of the issued shares of Jett Ltd for $264 800. On that date, the statement of

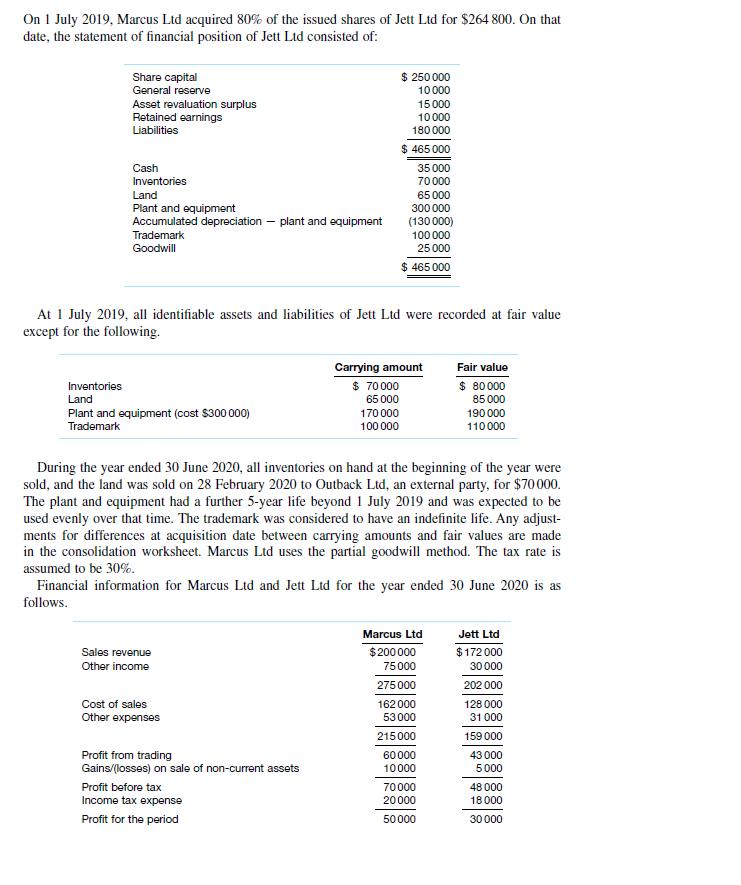

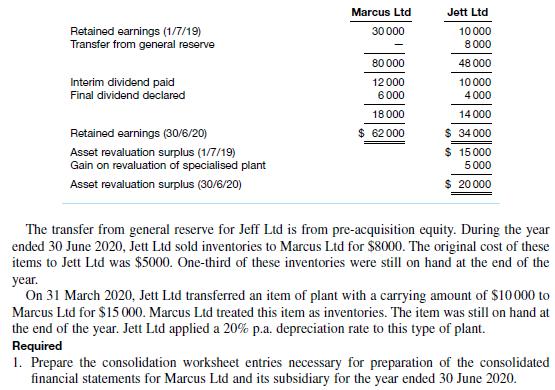

On 1 July 2019, Marcus Ltd acquired 80% of the issued shares of Jett Ltd for $264 800. On that date, the statement of financial position of Jett Ltd consisted of: Share capital General reserve Asset revaluation surplus Retained earnings Liabilities Cash Inventories Land Plant and equipment Accumulated depreciation - plant and equipment Trademark Goodwill Inventories Land Plant and equipment (cost $300 000) Trademark At 1 July 2019, all identifiable assets and liabilities of Jett Ltd were recorded at fair value except for the following. Sales revenue Other income Cost of sales Other expenses Profit from trading Gains/(losses) on sale of non-current assets $ 250 000 10 000 15 000 10000 180 000 $ 465 000 35 000 70 000 65 000 300 000 (130 000) 100 000 25 000 $ 465 000 Profit before tax Income tax expense Profit for the period During the year ended 30 June 2020, all inventories on hand at the beginning of the year were sold, and the land was sold on 28 February 2020 to Outback Ltd, an external party, for $70000. The plant and equipment had a further 5-year life beyond 1 July 2019 and was expected to be used evenly over that time. The trademark was considered to have an indefinite life. Any adjust- ments for differences at acquisition date between carrying amounts and fair values are made in the consolidation worksheet. Marcus Ltd uses the partial goodwill method. The tax rate is assumed to be 30%. Financial information for Marcus Ltd and Jett Ltd for the year ended 30 June 2020 is as follows. Carrying amount $ 70000 65 000 170 000 100 000 Marcus Ltd $200 000 75000 275000 162 000 53 000 215000 60000 10000 Fair value $ 80000 85 000 190 000 110000 70000 20000 50000 Jett Ltd $172 000 30 000 202 000 128 000 31 000 159 000 43 000 5000 48 000 18 000 30 000 Retained earnings (1/7/19) Transfer from general reserve Interim dividend paid Final dividend declared Retained earnings (30/6/20) Asset revaluation surplus (1/7/19) Gain on revaluation of specialised plant Asset revaluation surplus (30/6/20) Marcus Ltd 30 000 80 000 12 000 6000 18 000 $ 62000 Jett Ltd 10000 8000 48 000 10000 4000 14 000 $ 34000 $ 15000 5000 $ 20000 The transfer from general reserve for Jeff Ltd is from pre-acquisition equity. During the year ended 30 June 2020, Jett Ltd sold inventories to Marcus Ltd for $8000. The original cost of these items to Jett Ltd was $5000. One-third of these inventories were still on hand at the end of the year. On 31 March 2020, Jett Ltd transferred an item of plant with a carrying amount of $10000 to Marcus Ltd for $15 000. Marcus Ltd treated this item as inventories. The item was still on hand at the end of the year. Jett Ltd applied a 20% p.a. depreciation rate to this type of plant. Required 1. Prepare the consolidation worksheet entries necessary for preparation of the consolidated financial statements for Marcus Ltd and its subsidiary for the year ended 30 June 2020.

Step by Step Solution

There are 3 Steps involved in it

Based on the given financial information for Marcus Ltd and Jett Ltd and the additional details provided I will prepare the consolidation worksheet en... View full answer

Get step-by-step solutions from verified subject matter experts