Question: and they share profits and see in the ratio of $2 deed to adm) Acton in a partner and a tith interest in the

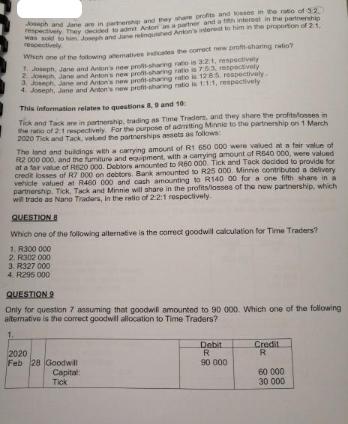

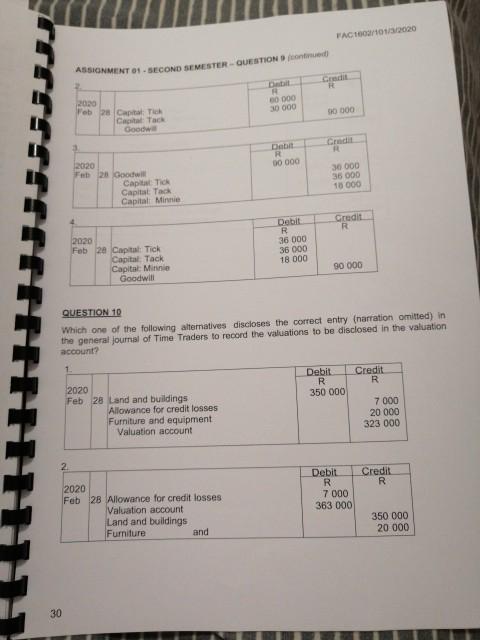

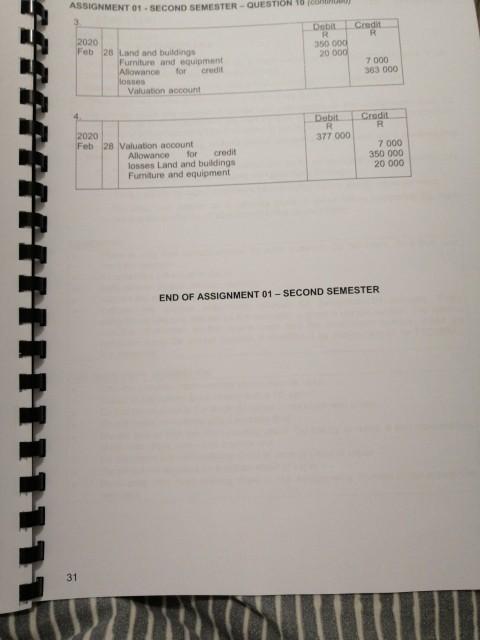

and they share profits and see in the ratio of $2 deed to adm) Acton in a partner and a tith interest in the partnership Joph and Jae relinquered Anton's interest to him in the propertion of 21, and Jane are in parter respectively. They was do respectively Which one of the following amalives cates the correct new proft-sharing natio J 2 Joe Jane and Anton's new prof-sharing rate is 3:21, respectively Jane and Anton's new prodt-sharing ratios 7:53, spectively Joseph Jane and Arton's new profit sharing ratio is 1285, respectively 4. Joseph, Jane and Anton's new profit-sharing ratio is 1:1:1, respectively This information relates to questions 8, 9 and 10 Tick and Tack are in partnership, trading as Time Traders, and they share the profitsfosses in the ratio of 2:1 respectively. For the purpose of admitting Minnie to the partnership on 1 March 2020 Tick and Tack, valued the partnerships assets as follows: The land and buildings with a carrying amount of R1 650 000 were valued at a fair value of R2 000 000, and the fumiture and equipment, with a carrying amount of R540 000, were valued at a fair value of R20 000. Debtors amounted to R60 000. Tick and Tack decided to provide for credit losses of R7 000 on debtors. Bank amounted to R25 000 Minnie contributed a delivery vehicle valued at R460 000 and cash amounting to R140 00 for a one fifth share in a partnership. Tick. Tack and Minnie will share in the profits/losses of the new partnership, which will trade as Nano Traders, in the ratio of 2:2:1 respectively. QUESTION B Which one of the following alternative is the correct goodwill calculation for Time Traders? 1. R300 000 2. R302 000 3. R327 000 4. R295 000 QUESTION 9 Only for question 7 assuming that goodwill amounted to 90 000. Which one of the following alternative is the correct goodwill allocation to Time Traders? 2020 Feb 28 Goodwill Capital Tick Debit R 90 000 Credil R 60.000 30 000 30 ASSIGNMENT 01-SECOND SEMESTER-QUESTION 9 (continued) 1. 2 2020 Feb 28 Capital Tick Capital Tack Goodwill 2020 Feb 28 Goodwill Capital Tick Capital Tack Capital Minnie 2020 Feb 28 Capital: Tick Capital Tack Capital: Minnie Goodwill 2020 Feb 28 Land and buildings Allowance for credit losses Furniture and equipment Valuation account 2020 Feb 28 Allowance for credit losses Valuation account Land and buildings Furniture R and 60 30 000 000 Debit R 00 000 Debit R 36 000 36 000 18 000 FAC1002/101/3/2020 QUESTION 10 Which one of the following alternatives discloses the correct entry (narration omitted) in the general journal of Time Traders to record the valuations to be disclosed in the valuation account? Credit R 90 000 Credit R 30 000 36 000 10 000 Credit R 90 000 Debit R 350 000 Debit R 7 000 363 000 Credit R 7.000 20 000 323 000 Credit R 350 000 20 000 ASSIGNMENT 01-SECOND SEMESTER-QUESTION O Debit R 350 000 20 000 31 2020 Feb 28 Land and buildings Furniture and equipment Allowance for credit losses Valuation account 2020 Feb 28 Valuation account Allowance for credit losses Land and buildings Furniture and equipment Dubit R 377 000 Credit R 7.000 363 000 Credit R 7.000 350 000 20 000 END OF ASSIGNMENT 01-SECOND SEMESTER

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts