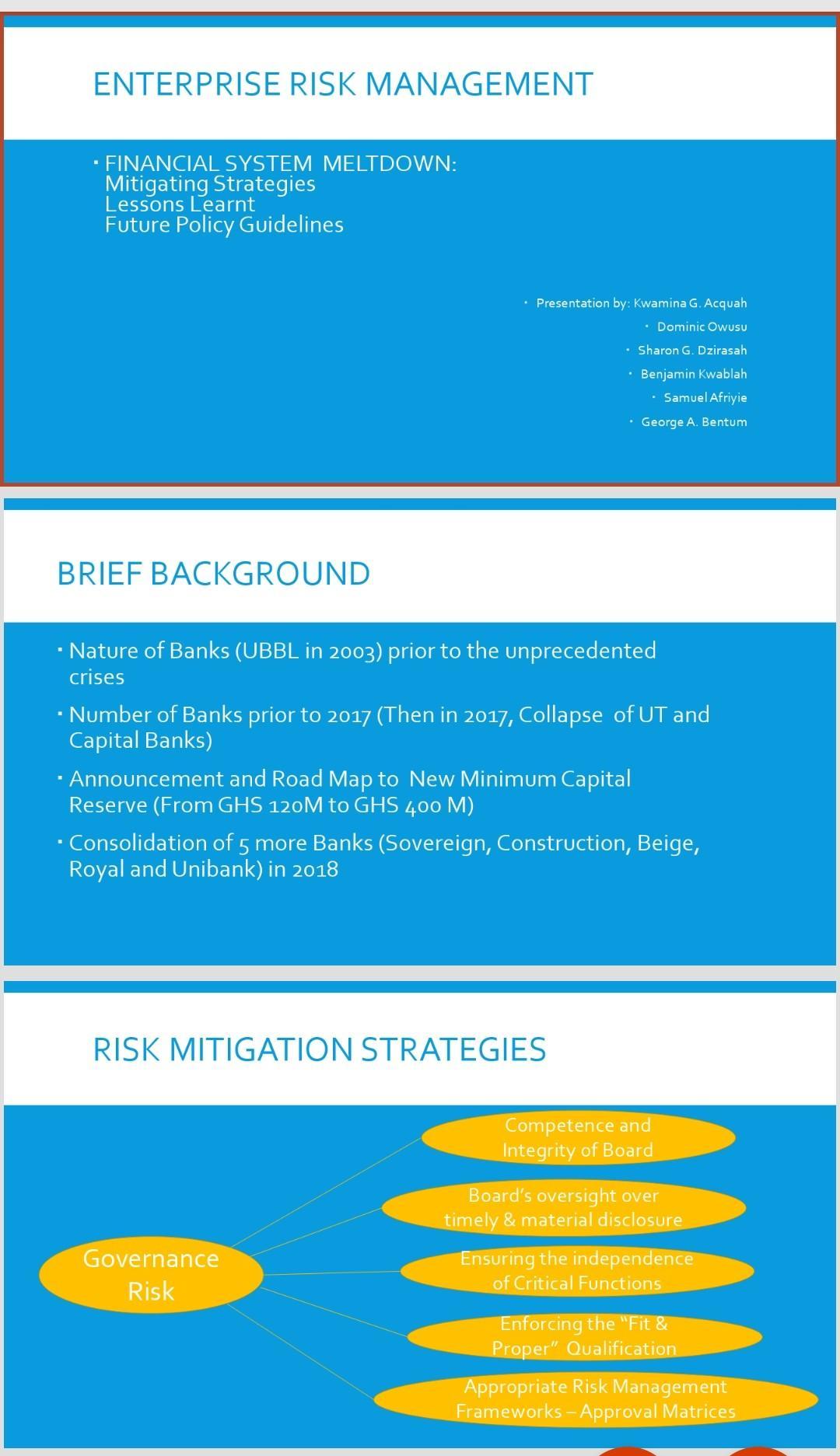

Question: After reading the two attachments: Financial System Meltdown: Mitigating Strategies Lessons Learnt Future Policy Guidelines,Presentation by: Kwamina G. Acquah, Dominic Owusu, Sharon G. Dzirasah, Benjamin

After reading the two attachments: Financial System Meltdown: Mitigating Strategies Lessons Learnt Future Policy Guidelines,Presentation by: Kwamina G. Acquah, Dominic Owusu, Sharon G. Dzirasah, Benjamin Kwablah, Samuel Afriyie and George A. Bentum.

AND

Liquidity Risk Management: An area of Increased focus for insurers by Claire Both, FIA, CERA, Paul Fulcher, FIA, CERA, Fred Vosvenieks, FIA, CERA, and Russell Ward, FIA.

You have been appointed as the Government Risk Czar for Ghana, after reading the above pieces, write a risk policy paper to the Bank of Ghana, Ministry of Finance and the Presidency convincing these three key stakeholders why Ghc 400 million required bank capital for tier one bank is inadequate. Any supporting outside materials should be helpful.

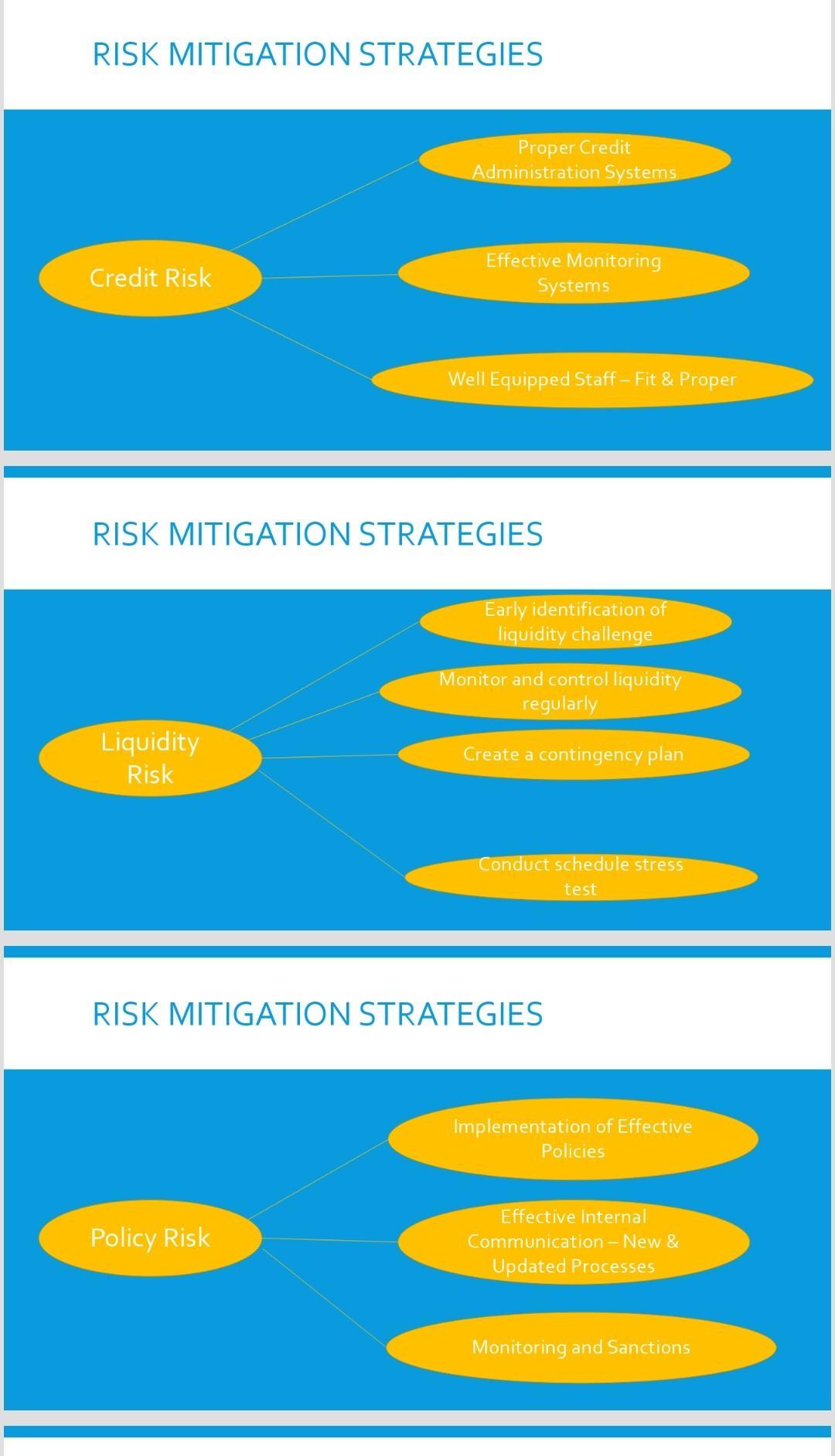

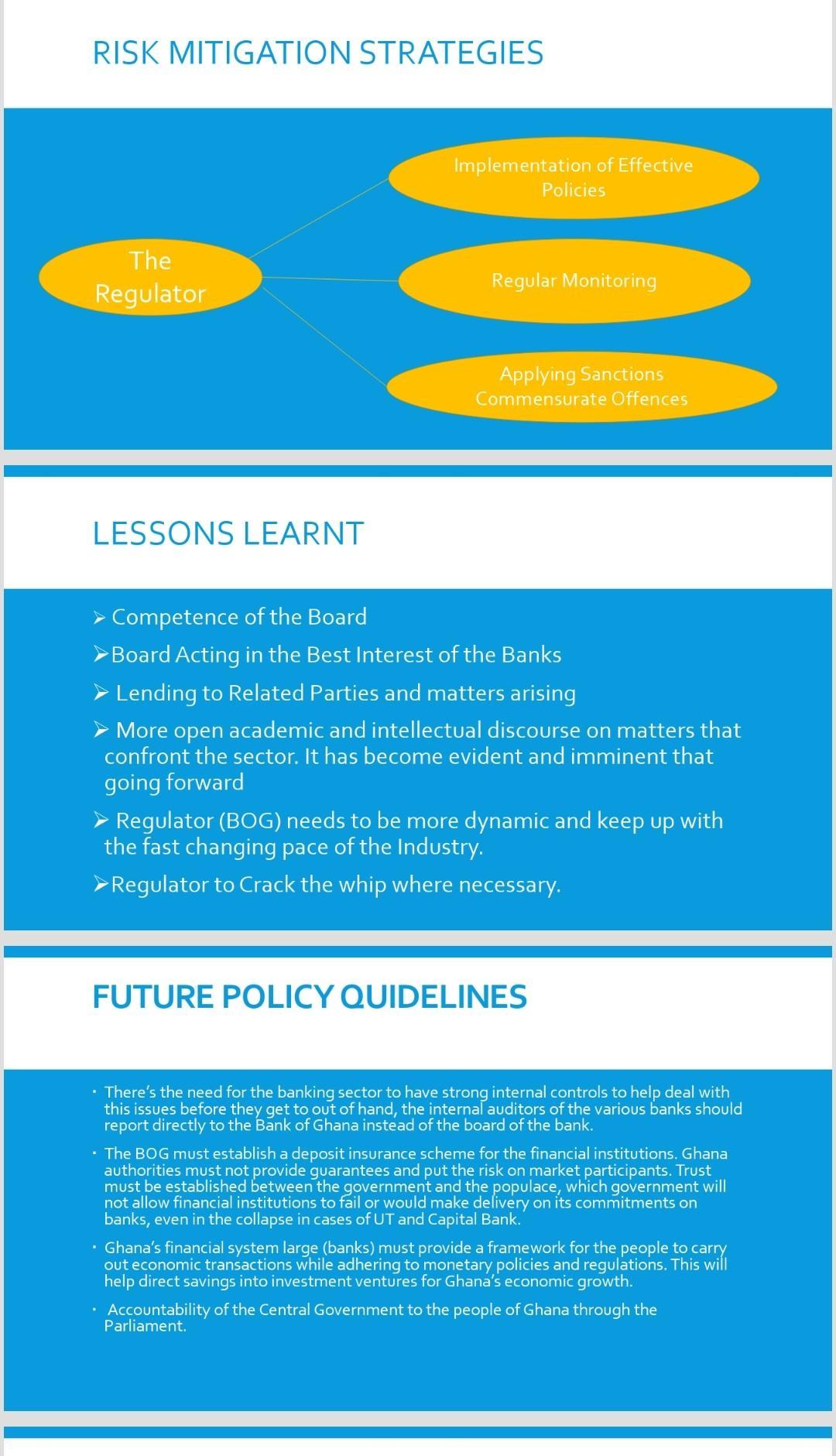

ENTERPRISE RISK MANAGEMENT . FINANCIAL SYSTEM MELTDOWN: Mitigating Strategies Lessons Learnt Future Policy Guidelines BRIEF BACKGROUND Presentation by: Kwamina G. Acquah Dominic Owusu Nature of Banks (UBBL in 2003) prior to the unprecedented crises Sharon G. Dzirasah Benjamin Kwablah Samuel Afriyie George A. Bentum Number of Banks prior to 2017 (Then in 2017, Collapse of UT and Capital Banks) Announcement and Road Map to New Minimum Capital Reserve (From GHS 120M to GHS 400 M) Consolidation of 5 more Banks (Sovereign, Construction, Beige, Royal and Unibank) in 2018 RISK MITIGATION STRATEGIES Governance Risk Competence and Integrity of Board Board's oversight over timely & material disclosure Ensuring the independence of Critical Functions Enforcing the "Fit & Proper" Qualification Appropriate Risk Management Frameworks - Approval Matrices

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Title Enhancing Bank Capital Requirements for Tier One Banks in Ghana A Case for Increased Adequacy Executive Summary As the newly appointed Government Risk Czar for Ghana it is my duty to assess and ... View full answer

Get step-by-step solutions from verified subject matter experts