Question: (b) Suppose the expected return on an asset j is 10%, the expected return on the market portfolio is 12% and the risk free

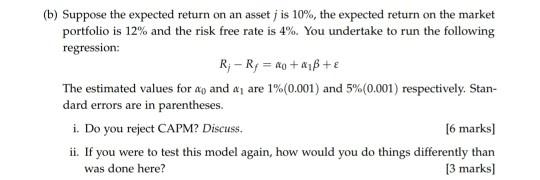

(b) Suppose the expected return on an asset j is 10%, the expected return on the market portfolio is 12% and the risk free rate is 4%. You undertake to run the following regression: R-R = ao+ate The estimated values for ao and a are 1% (0.001) and 5% (0.001) respectively. Stan- dard errors are in parentheses. i. Do you reject CAPM? Discuss. [6 marks] ii. If you were to test this model again, how would you do things differently than was done here? [3 marks]

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

i Do you reject CAP M Discuss 6 marks ANS WER No the CAP M model is not rejecte... View full answer

Get step-by-step solutions from verified subject matter experts