Question: Q Sierra Fishing Co. enters into a 15-year lease of a fishing boat. Lease payments are $30,000 per year payable at the end of

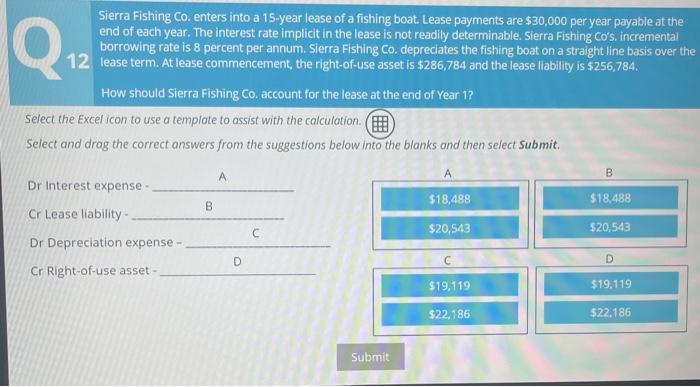

Q Sierra Fishing Co. enters into a 15-year lease of a fishing boat. Lease payments are $30,000 per year payable at the end of each year. The interest rate implicit in the lease is not readily determinable. Sierra Fishing Co's. incremental borrowing rate is 8 percent per annum. Sierra Fishing Co. depreciates the fishing boat on a straight line basis over the 12 lease term. At lease commencement, the right-of-use asset is $286,784 and the lease liability is $256,784. How should Sierra Fishing Co. account for the lease at the end of Year 1? Select the Excel icon to use a template to assist with the calculation. Select and drag the correct answers from the suggestions below into the blanks and then select Submit. A $18,488 $20,543 Dr Interest expense - Cr Lease liability. Dr Depreciation expense - Cr Right-of-use asset- B A D Submit C $19,119 $22,186 B $18,488 $20,543 D $19,119 $22.186

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

A Dr Interest expense 18488 or 20543 Answer At the en... View full answer

Get step-by-step solutions from verified subject matter experts