28.7A The owner of a small business selling and repairing cars which you patronise has just...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

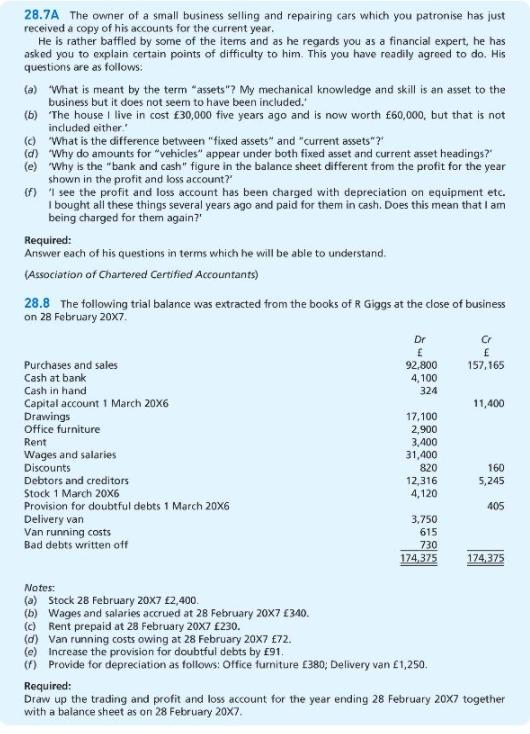

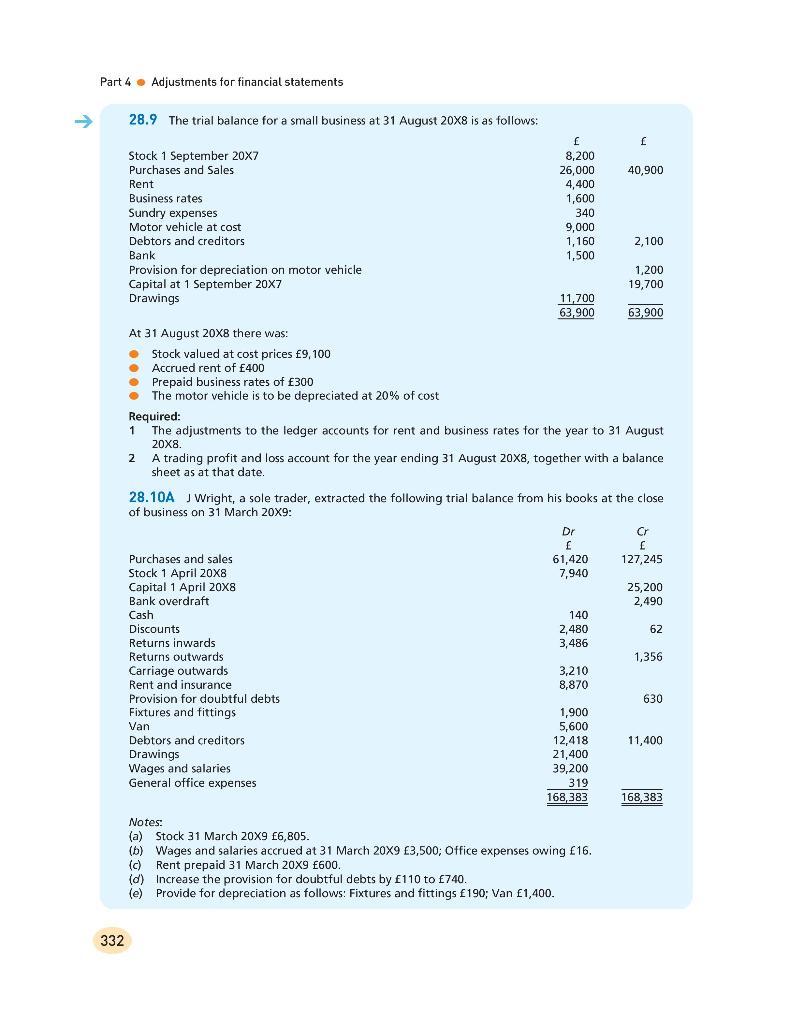

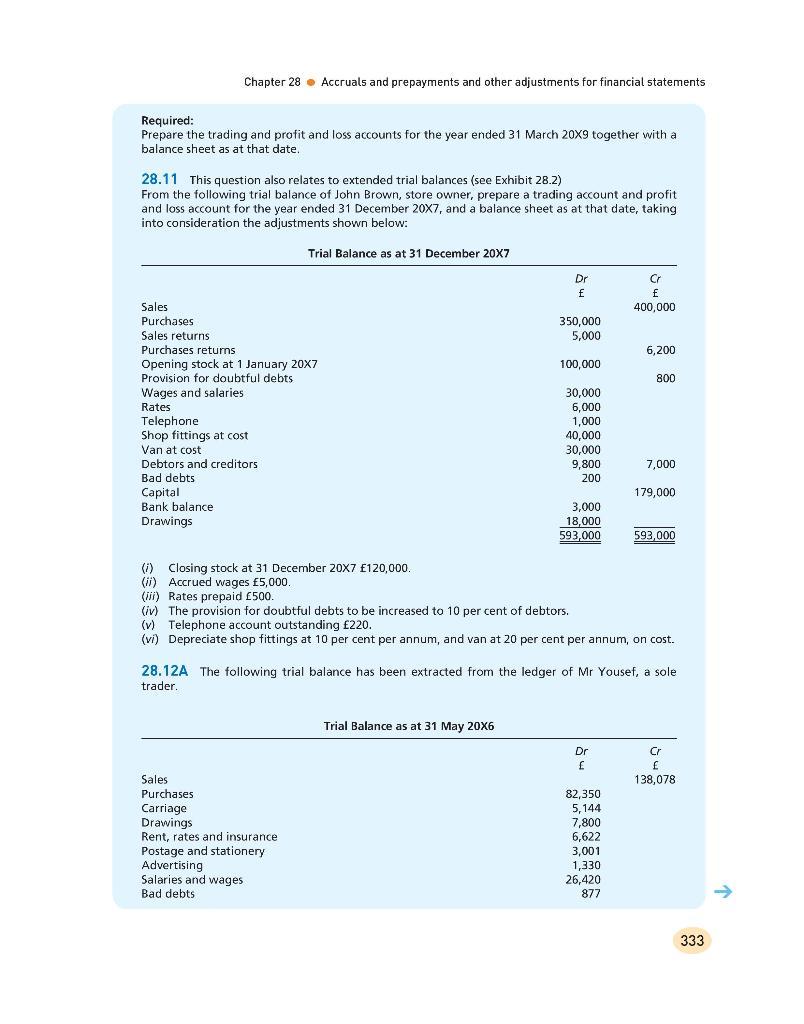

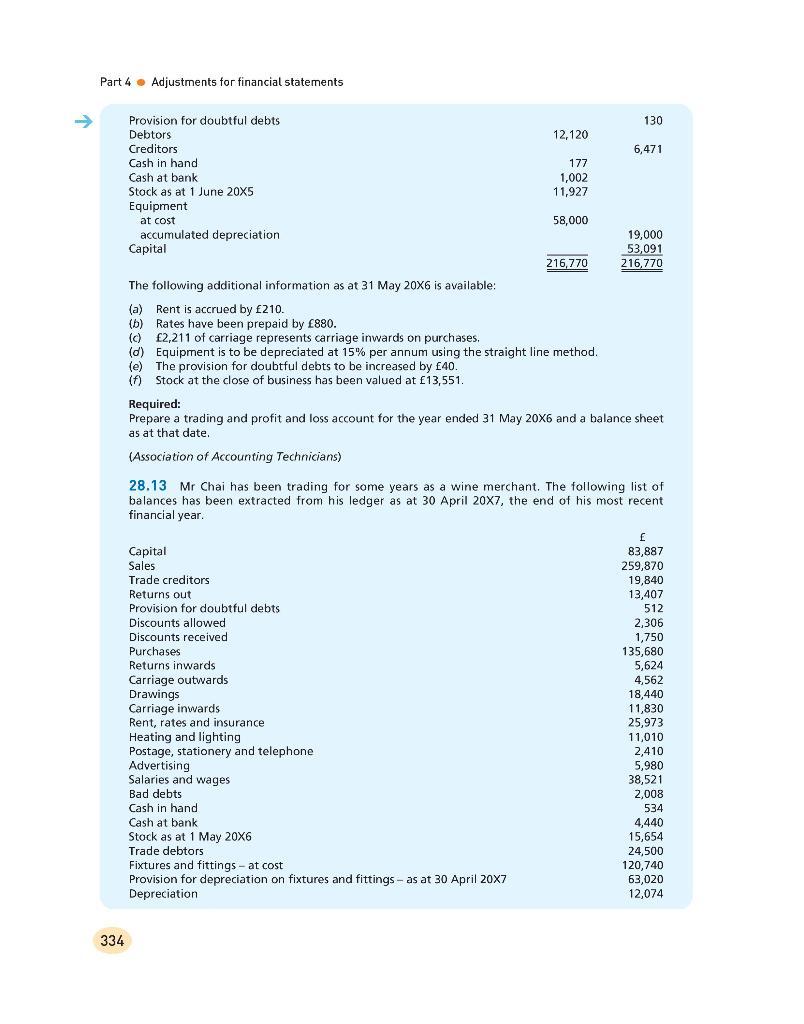

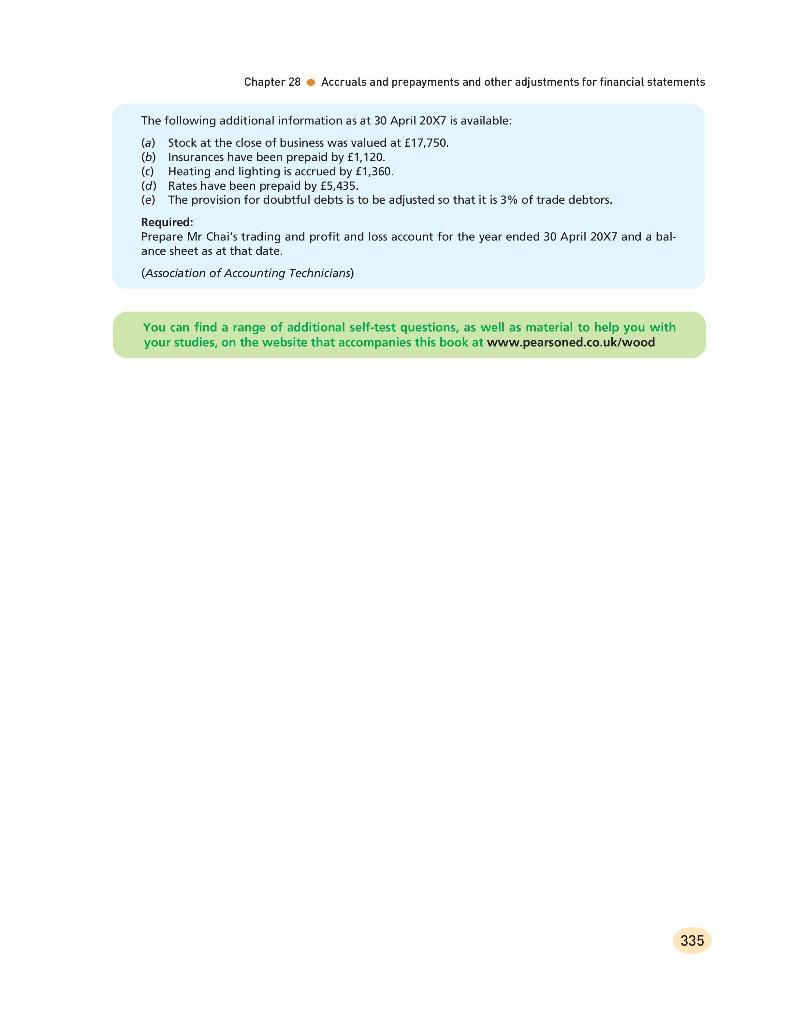

28.7A The owner of a small business selling and repairing cars which you patronise has just received a copy of his accounts for the current year. He is rather baffled by some of the items and as he regards you as a financial expert, he has asked you to explain certain points of difficulty to him. This you have readily agreed to do, His questions are as follows: (a) What is meant by the term "assets"? My mechanical knowledge and skill is an asset to the business but it does not seem to have been included." (b) The house I live in cost £30,000 five years ago and is now worth £60,000, but that is not included either (c) What is the difference between "fixed assets" and "current assets"? (d) Why do amounts for "vehicles" appear under both fixed asset and current asset headings?" (e) "Why is the "bank and cash" figure in the balance sheet different from the profit for the year shown in the profit and loss account? O 1 see the profit and loss account has been charged with depreciation on equipment etc. I bought all these things several years ago and paid for them in cash. Does this mean that I am being charged for them again? Required: Answer each of his questions in terms which he will be able to understand. (Association of Chartered Certified Accountants) 28.8 The following trial balance was extracted from the books of R Giggs at the dlose of business on 28 February 20X7. Dr Purchases and sales 92,800 4,100 157,165 Cash at bank Cash in hand 324 Capital account 1 March 20X6 Drawings Office furniture 11,400 17,100 2,900 3,400 31,400 820 Rent Wages and salaries Discounts 160 Debtors and creditors 12,316 4,120 5,245 Stock 1 March 20Xx6 Provision for doubtful debts 1 March 20x6 405 Delivery van Van running costs Bad debts written off 3,750 615 730 174,375 174,375 Nates: (a) Stock 28 February 20X7 £2,400. (b) Wages and salaries accrued at 28 February 20X7 £340. (c) Rent prepaid at 28 February 20x7 £230. (d) Van running costs owing at 28 February 20X7 £72. Increase the provision for doubtful debts by £91. () Provide for depreciation as follows: Office furniture £380; Delivery van £1,250. Required: Draw up the trading and profit and loss account for the year ending 28 February 20X7 together with a balance sheet as on 28 February 20x7. Part 4 • Adjustments for financial statements -> 28.9 The trial balance for a small business at 31 August 20X8 is as follows: Stock 1 September 20X7 Purchases and Sales 8,200 26,000 4,400 1,600 340 40,900 Rent Business rates Sundry expenses Motor vehicle at cost 9,000 1,160 1,500 Debtors and creditors 2,100 Bank Provision for depreciation on motor vehicle Capital at 1 September 20X7 Drawings 1,200 19,700 11,700 63,900 63,900 At 31 August 20X8 there was: • Stock valued at cost prices £9,100 Accrued rent of £400 Prepaid business rates of £300 • The motor vehicle is to be depreciated at 20% of cost Required: The adjustments to the ledger accounts for rent and business rates for the year to 31 August 20X8. A trading profit and loss account for the year ending 31 August 20x8, together with a balance sheet as at that date. 28.10A J Wright, a sole trader, extracted the following trial balance from his books at the close of business on 31 March 20X9: Dr Cr Purchases and sales 61,420 7,940 127,245 Stock 1 April 20X8 Capital 1 April 20X8 Bank overdraft 25,200 2,490 Cash 140 Discounts 2,480 3,486 62 Returns inwards Returns outwards Carriage outwards Rent and insurance Provision for doubtful debts Fixtures and fittings 1,356 3,210 8,870 630 1,900 5,600 12,418 21,400 39,200 Van Debtors and creditors 11,400 Drawings Wages and salaries General office expenses 319 168,383 168,383 Notes: (a) Stock 31 March 20X9 £6,805. (b) Wages and salaries accrued at 31 March 20X9 £3,500; Office expenses owing £16. (c) Rent prepaid 31 March 20X9 £600. (d) Increase the provision for doubtful debts by £110 to £740. (e) Provide for depreciation as follows: Fixtures and fittings £190; Van £1,400. 332 Chapter 28 • Accruals and prepayments and other adjustments for financial statements Required: Prepare the trading and profit and loss accounts for the year ended 31 March 20X9 together with a balance sheet as at that date. 28.11 This question also relates to extended trial balances (see Exhibit 28.2) From the following trial balance of John Brown, store owner, prepare a trading account and profit and loss account for the year ended 31 December 20X7, and a balance sheet as at that date, taking into consideration the adjustments shown below: Trial Balance as at 31 December 20X7 Dr Cr Sales 400,000 Purchases Sales returns Purchases returns 350,000 5,000 6,200 Opening stock at 1 January 20X7 Provision for doubtful debts Wages and salaries Rates 100,000 800 Telephone Shop fittings at cost Van at cost Debtors and creditors Bad debts Capital Bank balance Drawings 30,000 6,000 1,000 40,000 30,000 9,800 200 7,000 179,000 3,000 18,000 593,000 593,000 (i) Closing stock at 31 December 20X7 £120,000. (ii) Accrued wages £5,000. (i) Rates prepaid £500. (iv) The provision for doubtful debts to be increased to 10 per cent of debtors. (v) Telephone account outstanding £220. (vi) Depreciate shop fittings at 10 per cent per annum, and van at 20 per cent per annum, on cost. 28.12A The following trial balance has been extracted from the ledger of Mr Yousef, a sole trader. Trial Balance as at 31 May 20X6 Dr Cr 3. Sales 138,078 Purchases Carriage Drawings Rent, rates and insurance Postage and stationery Advertising Salaries and wages 82,350 5,144 7,800 6,622 3,001 1,330 26,420 877 Bad debts 333 Part 4 • Adjustments for financial statements Provision for doubtful debts 130 Debtors Creditors 12,120 6,471 Cash in hand 177 Cash at bank 1,002 11,927 Stock as at 1 June 20X5 Equipment at cost 58,000 accumulated depreciation Capital 19,000 53,091 216,770 216,770 The following additional information as at 31 May 20X6 is available: (a) Rent is accrued by £210. (b) Rates have been prepaid by £880. (c) £2,211 of carriage represents carriage inwards on purchases. (d) Equipment is to be depreciated at 15% per annum using the straight line method. (e) The provision for doubtful debts to be increased by £40. (f) Stock at the close of business has been valued at £13,551. Required: Prepare a trading and profit and loss account for the year ended 31 May 20X6 and a balance sheet as at that date. (Association of Accounting Technicians) 28.13 Mr Chai has been trading for some years as a wine merchant. The following list of balances has been extracted from his ledger as at 30 April 20X7, the end of his most recent financial year. 83,887 259,870 19,840 13,407 Capital Sales Trade creditors Returns out Provision for doubtful debts 512 Discounts allowed 2,306 1,750 135,680 5,624 Discounts received Purchases Returns inwards Carriage outwards Drawings Carriage inwards Rent, rates and insurance Heating and lighting Postage, stationery and telephone Advertising Salaries and wages Bad debts Cash in hand 4,562 18,440 11,830 25,973 11,010 2,410 5,980 38,521 2,008 534 Cash at bank Stock as at 1 May 20X6 Trade debtors Fixtures and fittings - at cost Provision for depreciation on fixtures and fittings - as at 30 April 20x7 Depreciation 4,440 15,654 24,500 120,740 63,020 12,074 334 Chapter 28 • Accruals and prepayments and other adjustments for financial statements The following additional information as at 30 April 20X7 is available: (a) Stock at the close of business was valued at £17,750. (b) Insurances have been prepaid by £1,120. (c) Heating and lighting is accrued by £1,360. (d) Rates have been prepaid by £5,435. (e) The provision for doubtful debts is to be adjusted so that it is 3% of trade debtors. Required: Prepare Mr Chai's trading and profit and loss account for the year ended 30 April 20X7 and a bal- ance sheet as at that date. (Association of Accounting Technicians) You can find a range of additional self-test questions, as well as material to help you with your studies, on the website that accompanies this book at www.pearsoned.co.uk/wood 335 28.7A The owner of a small business selling and repairing cars which you patronise has just received a copy of his accounts for the current year. He is rather baffled by some of the items and as he regards you as a financial expert, he has asked you to explain certain points of difficulty to him. This you have readily agreed to do, His questions are as follows: (a) What is meant by the term "assets"? My mechanical knowledge and skill is an asset to the business but it does not seem to have been included." (b) The house I live in cost £30,000 five years ago and is now worth £60,000, but that is not included either (c) What is the difference between "fixed assets" and "current assets"? (d) Why do amounts for "vehicles" appear under both fixed asset and current asset headings?" (e) "Why is the "bank and cash" figure in the balance sheet different from the profit for the year shown in the profit and loss account? O 1 see the profit and loss account has been charged with depreciation on equipment etc. I bought all these things several years ago and paid for them in cash. Does this mean that I am being charged for them again? Required: Answer each of his questions in terms which he will be able to understand. (Association of Chartered Certified Accountants) 28.8 The following trial balance was extracted from the books of R Giggs at the dlose of business on 28 February 20X7. Dr Purchases and sales 92,800 4,100 157,165 Cash at bank Cash in hand 324 Capital account 1 March 20X6 Drawings Office furniture 11,400 17,100 2,900 3,400 31,400 820 Rent Wages and salaries Discounts 160 Debtors and creditors 12,316 4,120 5,245 Stock 1 March 20Xx6 Provision for doubtful debts 1 March 20x6 405 Delivery van Van running costs Bad debts written off 3,750 615 730 174,375 174,375 Nates: (a) Stock 28 February 20X7 £2,400. (b) Wages and salaries accrued at 28 February 20X7 £340. (c) Rent prepaid at 28 February 20x7 £230. (d) Van running costs owing at 28 February 20X7 £72. Increase the provision for doubtful debts by £91. () Provide for depreciation as follows: Office furniture £380; Delivery van £1,250. Required: Draw up the trading and profit and loss account for the year ending 28 February 20X7 together with a balance sheet as on 28 February 20x7. Part 4 • Adjustments for financial statements -> 28.9 The trial balance for a small business at 31 August 20X8 is as follows: Stock 1 September 20X7 Purchases and Sales 8,200 26,000 4,400 1,600 340 40,900 Rent Business rates Sundry expenses Motor vehicle at cost 9,000 1,160 1,500 Debtors and creditors 2,100 Bank Provision for depreciation on motor vehicle Capital at 1 September 20X7 Drawings 1,200 19,700 11,700 63,900 63,900 At 31 August 20X8 there was: • Stock valued at cost prices £9,100 Accrued rent of £400 Prepaid business rates of £300 • The motor vehicle is to be depreciated at 20% of cost Required: The adjustments to the ledger accounts for rent and business rates for the year to 31 August 20X8. A trading profit and loss account for the year ending 31 August 20x8, together with a balance sheet as at that date. 28.10A J Wright, a sole trader, extracted the following trial balance from his books at the close of business on 31 March 20X9: Dr Cr Purchases and sales 61,420 7,940 127,245 Stock 1 April 20X8 Capital 1 April 20X8 Bank overdraft 25,200 2,490 Cash 140 Discounts 2,480 3,486 62 Returns inwards Returns outwards Carriage outwards Rent and insurance Provision for doubtful debts Fixtures and fittings 1,356 3,210 8,870 630 1,900 5,600 12,418 21,400 39,200 Van Debtors and creditors 11,400 Drawings Wages and salaries General office expenses 319 168,383 168,383 Notes: (a) Stock 31 March 20X9 £6,805. (b) Wages and salaries accrued at 31 March 20X9 £3,500; Office expenses owing £16. (c) Rent prepaid 31 March 20X9 £600. (d) Increase the provision for doubtful debts by £110 to £740. (e) Provide for depreciation as follows: Fixtures and fittings £190; Van £1,400. 332 Chapter 28 • Accruals and prepayments and other adjustments for financial statements Required: Prepare the trading and profit and loss accounts for the year ended 31 March 20X9 together with a balance sheet as at that date. 28.11 This question also relates to extended trial balances (see Exhibit 28.2) From the following trial balance of John Brown, store owner, prepare a trading account and profit and loss account for the year ended 31 December 20X7, and a balance sheet as at that date, taking into consideration the adjustments shown below: Trial Balance as at 31 December 20X7 Dr Cr Sales 400,000 Purchases Sales returns Purchases returns 350,000 5,000 6,200 Opening stock at 1 January 20X7 Provision for doubtful debts Wages and salaries Rates 100,000 800 Telephone Shop fittings at cost Van at cost Debtors and creditors Bad debts Capital Bank balance Drawings 30,000 6,000 1,000 40,000 30,000 9,800 200 7,000 179,000 3,000 18,000 593,000 593,000 (i) Closing stock at 31 December 20X7 £120,000. (ii) Accrued wages £5,000. (i) Rates prepaid £500. (iv) The provision for doubtful debts to be increased to 10 per cent of debtors. (v) Telephone account outstanding £220. (vi) Depreciate shop fittings at 10 per cent per annum, and van at 20 per cent per annum, on cost. 28.12A The following trial balance has been extracted from the ledger of Mr Yousef, a sole trader. Trial Balance as at 31 May 20X6 Dr Cr 3. Sales 138,078 Purchases Carriage Drawings Rent, rates and insurance Postage and stationery Advertising Salaries and wages 82,350 5,144 7,800 6,622 3,001 1,330 26,420 877 Bad debts 333 Part 4 • Adjustments for financial statements Provision for doubtful debts 130 Debtors Creditors 12,120 6,471 Cash in hand 177 Cash at bank 1,002 11,927 Stock as at 1 June 20X5 Equipment at cost 58,000 accumulated depreciation Capital 19,000 53,091 216,770 216,770 The following additional information as at 31 May 20X6 is available: (a) Rent is accrued by £210. (b) Rates have been prepaid by £880. (c) £2,211 of carriage represents carriage inwards on purchases. (d) Equipment is to be depreciated at 15% per annum using the straight line method. (e) The provision for doubtful debts to be increased by £40. (f) Stock at the close of business has been valued at £13,551. Required: Prepare a trading and profit and loss account for the year ended 31 May 20X6 and a balance sheet as at that date. (Association of Accounting Technicians) 28.13 Mr Chai has been trading for some years as a wine merchant. The following list of balances has been extracted from his ledger as at 30 April 20X7, the end of his most recent financial year. 83,887 259,870 19,840 13,407 Capital Sales Trade creditors Returns out Provision for doubtful debts 512 Discounts allowed 2,306 1,750 135,680 5,624 Discounts received Purchases Returns inwards Carriage outwards Drawings Carriage inwards Rent, rates and insurance Heating and lighting Postage, stationery and telephone Advertising Salaries and wages Bad debts Cash in hand 4,562 18,440 11,830 25,973 11,010 2,410 5,980 38,521 2,008 534 Cash at bank Stock as at 1 May 20X6 Trade debtors Fixtures and fittings - at cost Provision for depreciation on fixtures and fittings - as at 30 April 20x7 Depreciation 4,440 15,654 24,500 120,740 63,020 12,074 334 Chapter 28 • Accruals and prepayments and other adjustments for financial statements The following additional information as at 30 April 20X7 is available: (a) Stock at the close of business was valued at £17,750. (b) Insurances have been prepaid by £1,120. (c) Heating and lighting is accrued by £1,360. (d) Rates have been prepaid by £5,435. (e) The provision for doubtful debts is to be adjusted so that it is 3% of trade debtors. Required: Prepare Mr Chai's trading and profit and loss account for the year ended 30 April 20X7 and a bal- ance sheet as at that date. (Association of Accounting Technicians) You can find a range of additional self-test questions, as well as material to help you with your studies, on the website that accompanies this book at www.pearsoned.co.uk/wood 335

Expert Answer:

Answer rating: 100% (QA)

Question 1 a Term asset is a value that company use for running the business for operation purpose It comes in the balance sheet side It can be short term asset or long term asset b The house I live i... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

The owner of a small business has asked you to prepare a statement that will show him where his firm's cash came from and how it was used this year. He gives you the following information based on...

-

The owner of a small business is considering purchasing production equipment having a total cost of $470,000. The new equipment will allow the owner to reduce labor and material cost; measured in...

-

The owner of a small business felt an obligation to pay $15,000 to a subcontractor even though because of an oversight the subcontractor had never submitted a bill Can willingness to pay under these...

-

For the increasing marginal-extraction-cost model of the allocation of a depletable resource, how would the ultimate cumulative amount taken out of the ground be affected by (a) An increase in the...

-

Find the area of the region that lies inside both of the circles r = 2 sin ( and r = sin ( + cos (?

-

Does empowerment imply the loss of control? Why or why not?

-

Discuss the historical role of HR benchmarking and its strengths and weaknesses as part of a metrics and analytics program in organizations today.

-

George Hunting Lodge has the following internal control procedures over cash disbursements. Identify the internal control principle that is applicable to each procedure. 1. Company checks are...

-

What is the CAPM? RsRf+Bs (Rm - Rf) WACC = V(levered) V(unlevered) + TCB Rs R0+ (BSL) (R0 - RB) ORS RO+ (B/SL) (RB - R0)

-

FIT ($1,200.58 - $221.15 = $979.43 taxable)...................... (86.00)* how did you get the answer 86

-

In fiscal 2017, ruthilda inc. (ruthilda) decided to exercise its option to redeem its outstanding bond issue before the maturity date in 2024. the bonds had a face value of $7,300,000 and ruthilda...

-

What is prime movers? Discuss its importance in energy conversion.

-

What are requirements of a good boiler?

-

Explain the principle of working of nuclear power plant.

-

Explain the principle of working of the hydroelectric power plant.

-

Explain the principle of working of a gas power plant.

-

C. With a particular outcome in mind, construct a scoring rubric - holistic and analytic. (BSEd and BPEd students should focus on their field of concentration)

-

Is it a breach of fiduciary duty for a director of a real estate investment trust (REIT) negotiating a joint venture on behalf of the REIT with another director for the development of a portfolio of...

-

RJR Nabisco, in response to stockholder pressure in 1996, announced a significant increase in dividends paid to stockholders financed by the sale of some of its assets. What would you expect the...

-

Genting Berhad is a Malaysian conglomerate with holdings in plantations and tourist resorts. The beta estimated for the firm, relative to the Malaysian stock exchange, is 1.15, and the longterm local...

-

Cello is a manufacturer of pianos. It earned an aftertax return on capital of 10% last year and expects to maintain this return next year. If the current years aftertax operating income is $100...

-

How can we effectively analyze a firm's financial ratios?

-

In 2019, Italia Mining Corporation had sales of \($69\) million, total assets of \($45\) million, and total liabilities of \($23\) million. The interest rate on the debt is 6.5 percent, and its tax...

-

Tsingtao Companys balance sheet shows a stockholders equity book value (total common equity) of \($800,500.\) The firms earnings per share were \($3.50,\) resulting in a price/earnings ratio of...

Study smarter with the SolutionInn App