Question: Compute the Net Pay for each employee. Employee pay will be disbursed on December 4, 2019. Update the Employees' Earnings Record with the November 30

Compute the Net Pay for each employee. Employee pay will be disbursed on December 4, 2019. Update the Employees' Earnings Record with the November 30 pay and the new YTD amount.

The company is closed and pays for the Friday following Thanksgiving. The employees will receive holiday pay for Thanksgiving and the Friday following. All the hours over 80 are eligible for overtime for non-exempt employees as they were worked during the non-holiday week.

- Complete the Employee Gross Pay tab.

- Complete the Payroll Register for November 30.

- You must update the Employee Earnings Record Forms for each employee with the ending YTD amounts from November 15 (the prior pay period) in the "Prior Period YTD" rows. Amounts from the current period are auto-populated from the Payroll Register on the row for November 30.

- Complete the General Journal entries for the November 30 payroll.

- Update General Ledger with the ending ledger balances from the November 15 pay period ledger accounts first, and then post the journal entries from the current period to General Ledger.

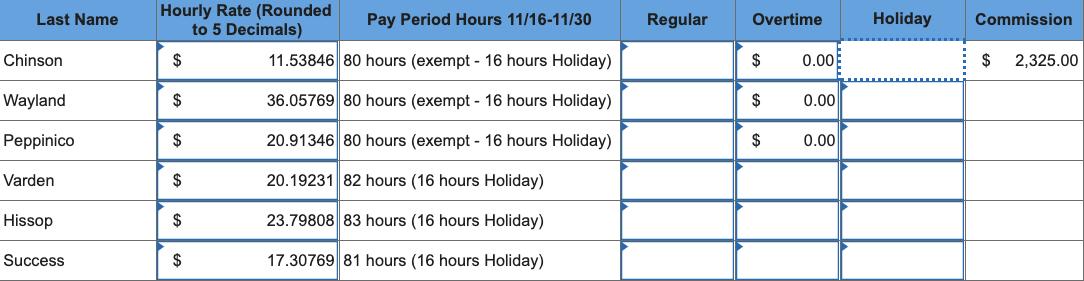

Last Name Chinson Wayland Peppinico Varden Hissop Success Hourly Rate (Rounded to 5 Decimals) $ $ $ $ $ $ Pay Period Hours 11/16-11/30 11.53846 80 hours (exempt - 16 hours Holiday) 36.05769 80 hours (exempt - 16 hours Holiday) 20.91346 80 hours (exempt - 16 hours Holiday) 20.19231 82 hours (16 hours Holiday) 23.79808 83 hours (16 hours Holiday) 17.30769 81 hours (16 hours Holiday) Regular Overtime $ 0.00 $ $ 0.00 0.00 Holiday Commission $ 2,325.00

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

ANSWER Employee Gross Pay To compute for the employee gross pay we need to determine the regular pay ... View full answer

Get step-by-step solutions from verified subject matter experts