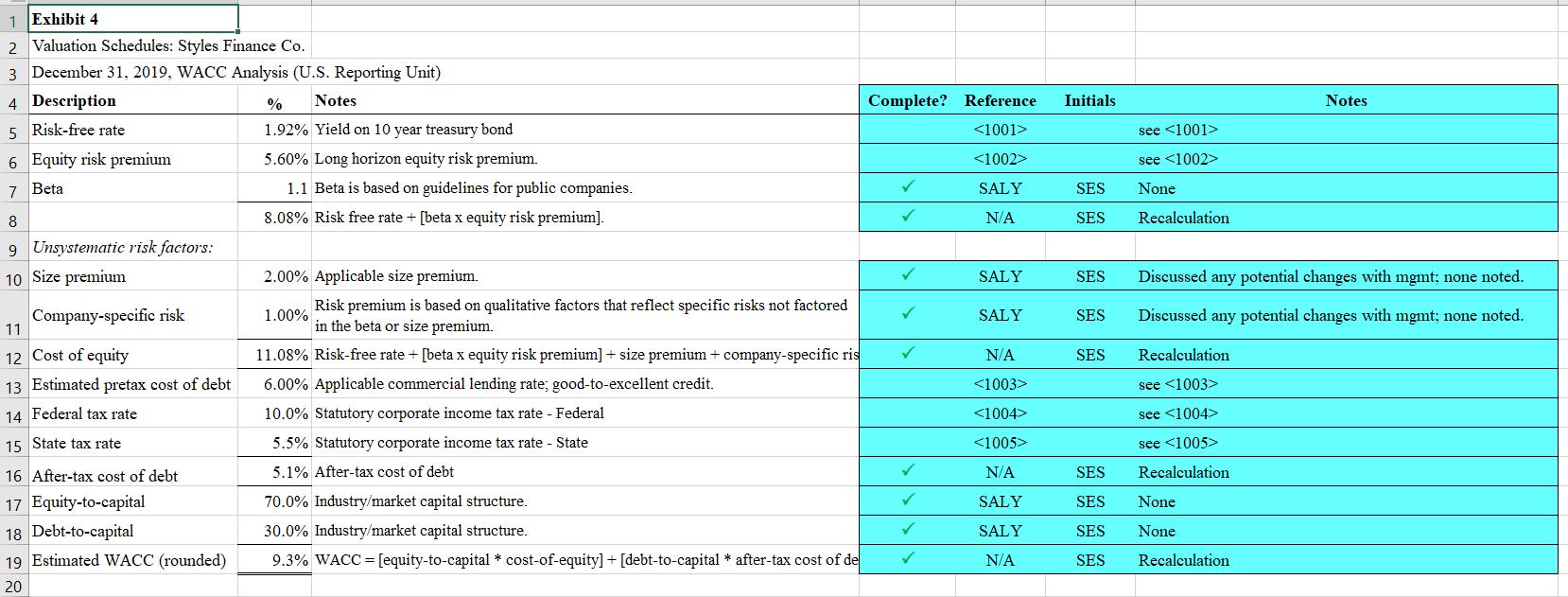

Question: Complete the audit worksheet. 1 Exhibit 4 2 Valuation Schedules: Styles Finance Co. 3 December 31, 2019, WACC Analysis (U.S. Reporting Unit) 4 Description 5

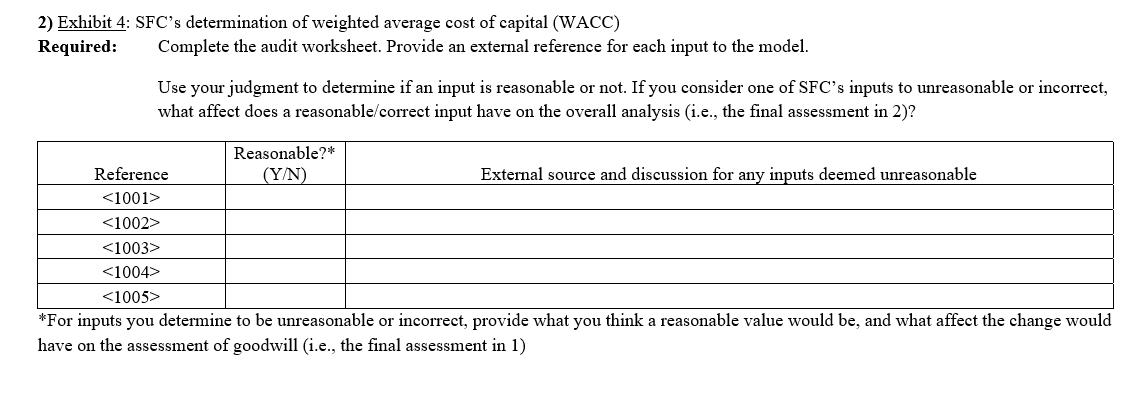

Complete the audit worksheet.

1 Exhibit 4 2 Valuation Schedules: Styles Finance Co. 3 December 31, 2019, WACC Analysis (U.S. Reporting Unit) 4 Description 5 Risk-free rate 6 Equity risk premium 7 Beta 8 9 Unsystematic risk factors: 10 Size premium Company-specific risk 11 12 Cost of equity 13 Estimated pretax cost of debt 14 Federal tax rate 15 State tax rate 16 After-tax cost of debt 17 Equity-to-capital 18 Debt-to-capital 19 Estimated WACC (rounded) 20 % Notes 1.92% Yield on 10 year treasury bond 5.60% Long horizon equity risk premium. 1.1 Beta is based on guidelines for public companies. 8.08% Risk free rate + [beta x equity risk premium]. 2.00% Applicable size premium. 1.00% Risk premium is based on qualitative factors that reflect specific risks not factored in the beta or size premium. 11.08% Risk-free rate + [beta x equity risk premium] + size premium + company-specific ris 6.00% Applicable commercial lending rate; good-to-excellent credit. 10.0% Statutory corporate income tax rate - Federal 5.5% Statutory corporate income tax rate - State 5.1% After-tax cost of debt 70.0% Industry/market capital structure. 30.0% Industry/market capital structure. 9.3% WACC = [equity-to-capital * cost-of-equity] + [debt-to-capital * after-tax cost of de Complete? Reference SALY N/A SALY SALY N/A N/A SALY SALY N/A Initials SES SES SES SES SES see see None Recalculation Discussed any potential changes with mgmt; none noted. Discussed any potential changes with mgmt; none noted. Recalculation see see see Recalculation SES SES SES SES Recalculation Notes None None

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Value Schedule Audit Worksheet for Styles Finance Co Safety rate in Yen 192 10year Treasury bond yield as an example Discount for equities at 560 Y Lo... View full answer

Get step-by-step solutions from verified subject matter experts