Question: Accounting Cycle problem Your Name Accounting 201 Assessment Cycle Problem City Park Yoga, Inc. Wren Bliss teaches yoga and meditation. Because she likes the quiet

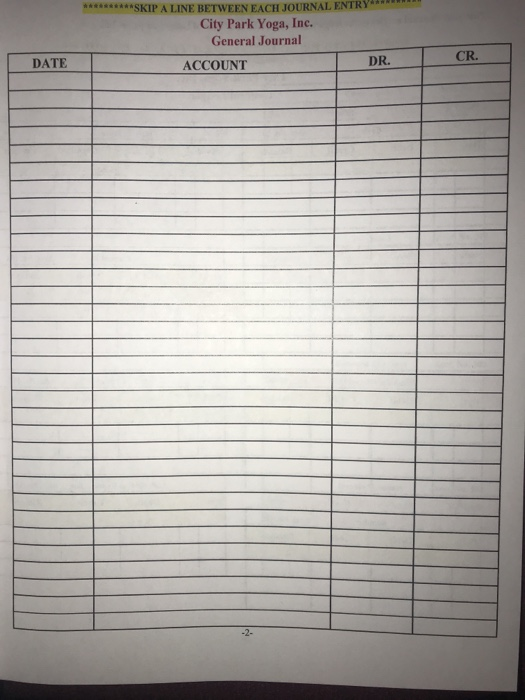

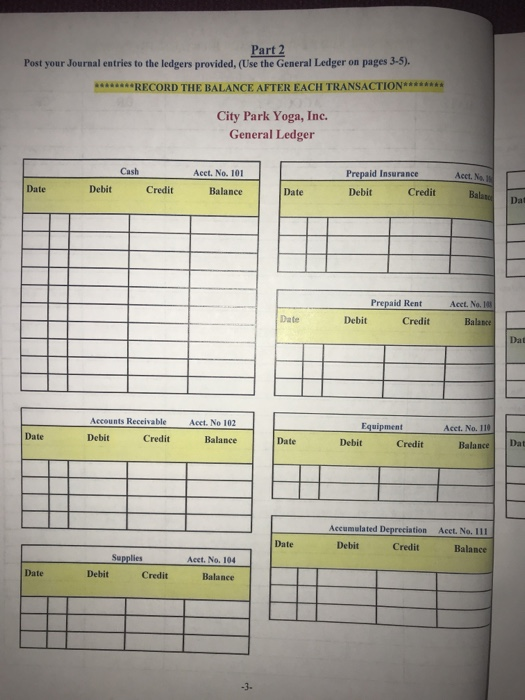

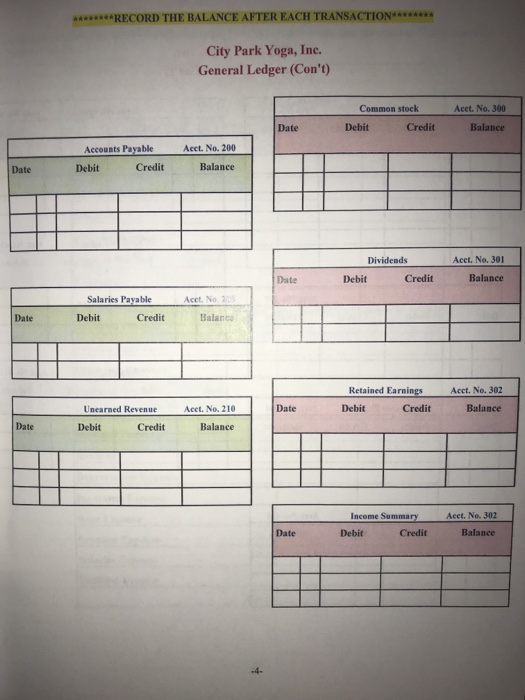

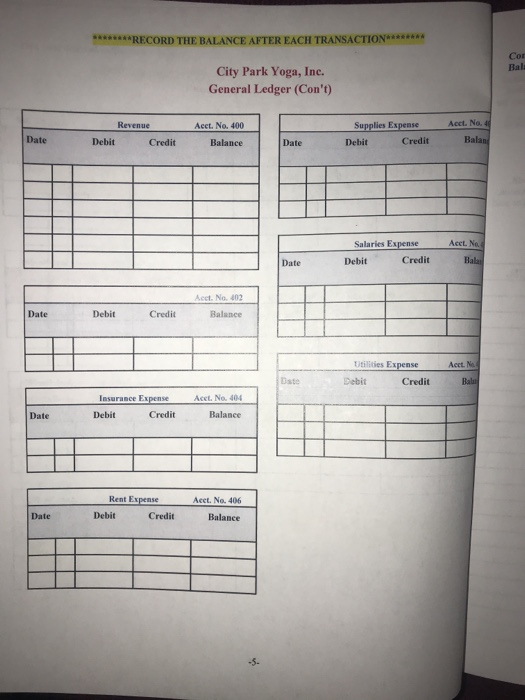

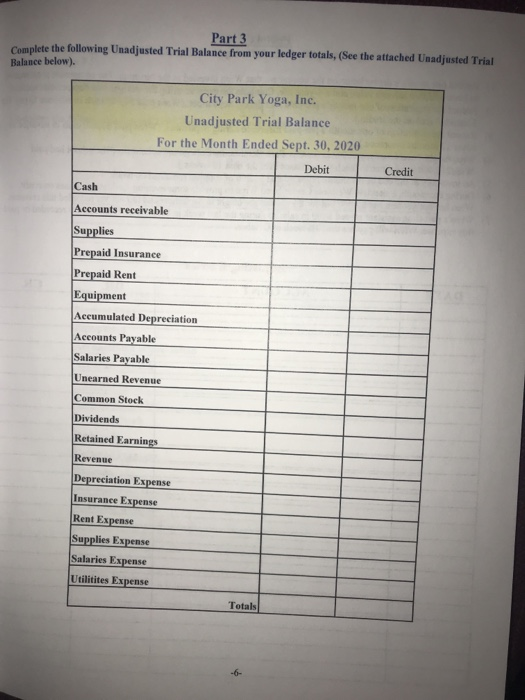

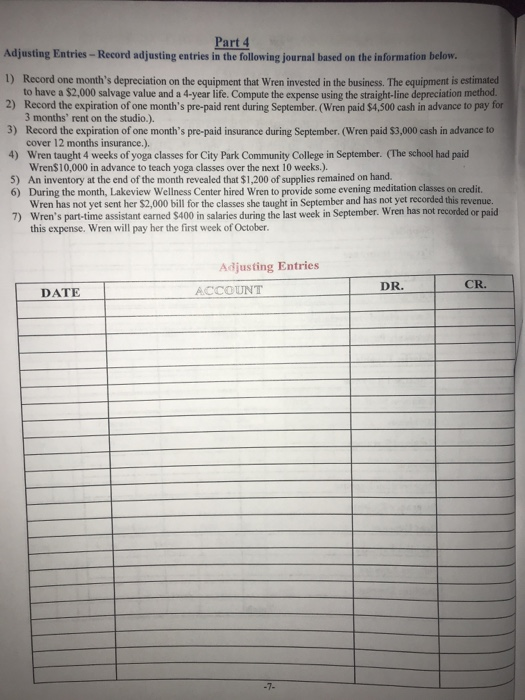

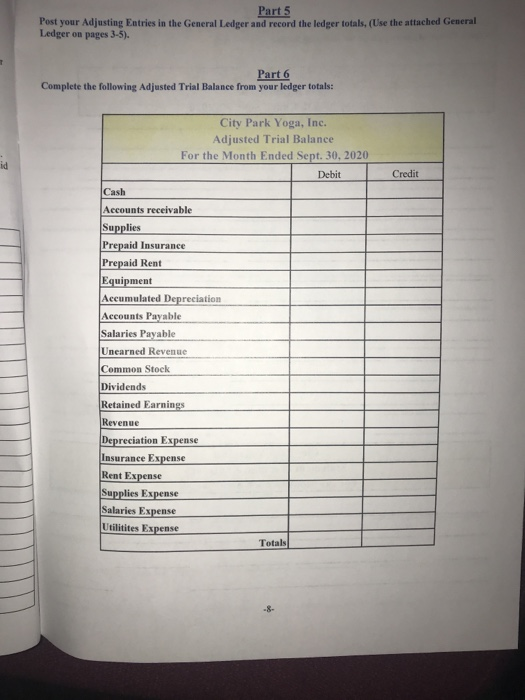

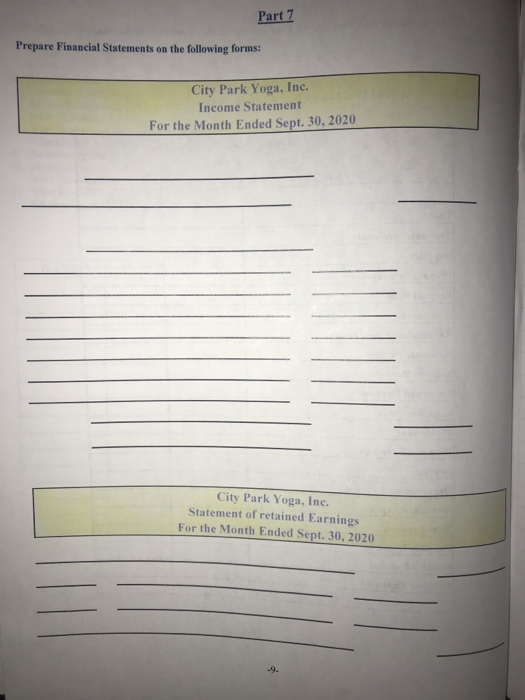

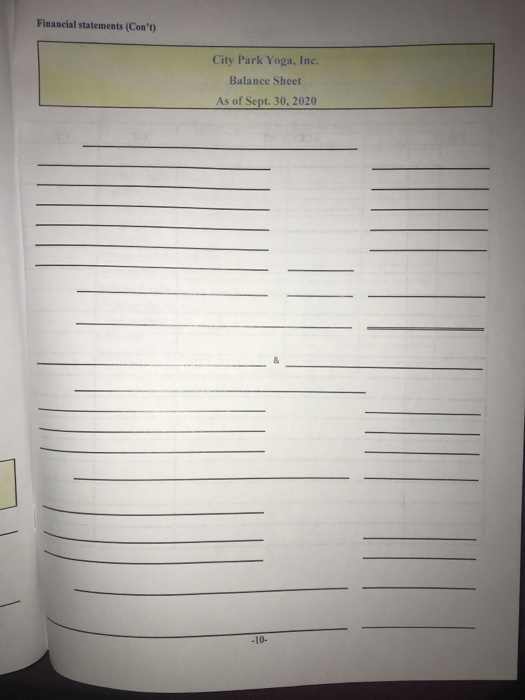

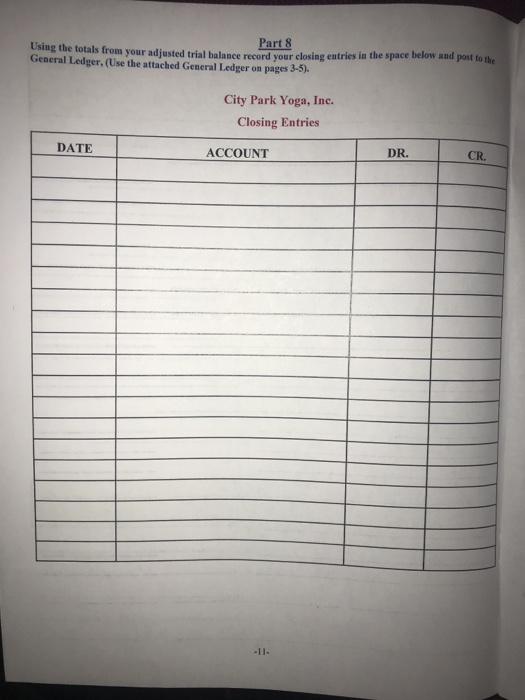

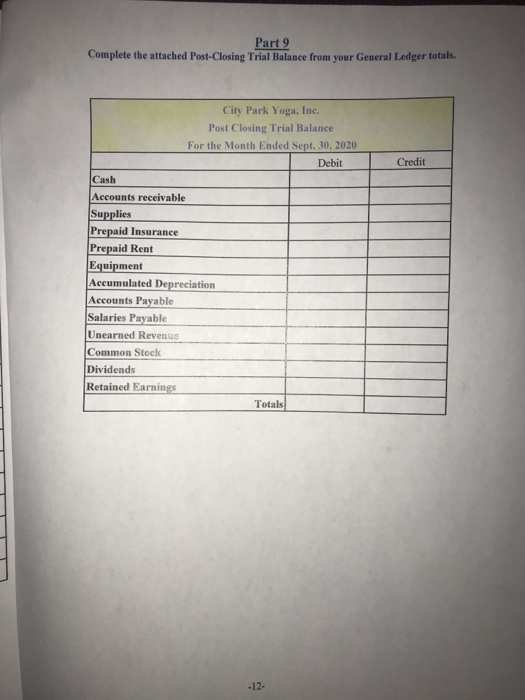

Your Name Accounting 201 Assessment Cycle Problem City Park Yoga, Inc. Wren Bliss teaches yoga and meditation. Because she likes the quiet and contemplative outdoor environment, she opened her new spacious studio in a building overlooking City Park. She named her new business, City Park Yoga, Inc. and opened her studio for classes in the beginning of September of 2020, Instructions: Complete Parts 1 - 9 as listed in this packet. Part 1 Record your journal entries in the general journal provided from the descriptions of each individual event. ********SKIP A LINE BETWEEN EACH JOURNAL ENTRY********* Sept 1. Wren Bliss opened her business by investing 20,000 cash and $14,000 of equipment in exchange for common stock Sept. 1. Wren paid $4,500 cash in advance to pay for three months' rent on the studio. Sept. 1. Wren paid $3,000 cash in advance to pay for 12 months of insurance for her business. Sept. 2. City Park Community College paid Wren $10,000 in advance to teach yoga classes over the next 10 weeks. Wren is to begin teaching classes immediately Sept. 3 Wren bought $2,500 of supplies on account. Sept. 4. A City Park Community College professor hired Wren to provide meditation sessions with her accounting students so all the students could all make an "A" on their Accounting Cycle Problems. Wren completed the classes and was paid $1,000 in cash. Sept. 5. The NOLA Foundation hired Wren to teach yoga classes for expectant mothers. The agreement between Wren and the NOLA Foundation stated that Wren would bill for her services after the classes we completed. Sept. 17. Wren completed teaching 20 classes for the NOLA Foundation for expectant mothers for $125.00 each and sent a bill to the NOLA Foundation Sept. 19. Wren paid $500 towards her account incurred previously for supplies purchased on September 3rd. Sept. 21. The NOLA Foundation sent Wren a check for $1,000 in partial payment of the bill sent previously for yoga classes for expectant mothers Sept. 27. Wren paid $300 in cash for the studio's monthly utility bill. Sept. 30. The corporation paid Wren a $5,000 dividend. ***SKIP A LINE BETWEEN EACH JOURNAL ENTRY City Park Yoga, Inc. General Journal DR. ACCOUNT 'R. DATE Part 2 Post your Journal entries to the ledgers provided, (Use the General Ledger on pages 3-9) ********RECORD THE BALANCE AFTER EACH TRANSACTION******** City Park Yoga, Inc. General Ledger Cash Acct. No. 101 Balance Prepaid Insurance Debit Credit Acct. Balang Date Debit Credit Date Da Prepaid Rent Debit Credit Acet. No.1 Balance - ACN Accounts Receivable Debit Credit Acct. Ne 102 Balance Equipment Debit Credit Date Date Balance Da Accumulated Depreciation Debit Credit Acct. No. 111 Balance Date Supplies Debit Credit Acct. No. 104 Balance Date ********RECORD THE BALANCE AFTER EACH TRANSACTION******** City Park Yoga, Inc. General Ledger (Con't) Date Common stock Debit Credit Acct. No. 300 Balance Acct. No. 200 Accounts Payable Debit Credit Date Balance Dividends Debit Credit Acct. No. 301 Balance Date Acces Salaries Payable Debit Credit Date Balance Retained Earnings Debit Credit Acct. No. 302 Balance Date Uncarned Revenue Debit Credit Acct. No. 210 Balance Date Income Summary Debit Credit Acct. No. 302 Balance Date ********RECORD THE BALANCE AFTER EACH TRANSACTION******** City Park Yoga, Inc. General Ledger (Con't) Revenue Debit Credit Acct. No. 400 Balance Supplies Expense Debit Credit Acct. No. 4 Balan Date Date Salaries Expense Debit Credit Acet. Na Bala Date Date Debit Credit Balance Utilities Expense Debit Credit Acct. No. Bala ste Insurance Expense Debit Credit Acet. No. 404 Balance Date Rent Expense Debit Credit Acet. No. 406 Balance Date Part 3 Complete the following Unadjusted Trial Balance from your ledger totals, (See the attached Unadjusted Trial Balance below). City Park Yoga, Inc. Unadjusted Trial Balance For the Month Ended Sept. 30, 2020 Debit Credit Cash Accounts receivable Supplies Prepaid Insurance Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Revenue Common Stock Dividends Retained Earnings Revenue Depreciation Expense Insurance Expense Rent Expense Supplies Expense Salaries Expense Utilities Expense Totals Part 4 Adjusting Entries -Record adjusting entries in the following journal based on the information below. 1) Record one month's depreciation on the equipment that Wren invested in the business. The equipment is estimated to have a $2,000 salvage value and a 4-year life. Compute the expense using the straight-line depreciation method 2) Record the expiration of one month's pre-paid rent during September. (Wren paid $4,500 cash in advance to pay for 3 months' rent on the studio.). 3) Record the expiration of one month's pre-paid insurance during September. (Wren paid $3,000 cash in advance to cover 12 months insurance.). 4) Wren taught 4 weeks of yoga classes for City Park Community College in September. (The school had paid Wren$10,000 in advance to teach yoga classes over the next 10 weeks.). 5) An inventory at the end of the month revealed that $1.200 of supplies remained on hand 6) During the month, Lakeview Wellness Center hired Wren to provide some evening meditation classes on credit Wren has not yet sent her $2,000 bill for the classes she taught in September and has not yet recorded this revenue. 7) Wren's part-time assistant earned $400 in salaries during the last week in September. Wren has not recorded or paid this expense. Wren will pay her the first week of October. Adjusting Entries ACCOUNT DR. CR. DATE Part 5 Post your Adjusting Entries in the General Ledger and record the ledger totals. (Use the attached General Ledger on pages 3-5). Part 6 Complete the following Adjusted Trial Balance from your ledger totals: City Park Yoga, Inc. Adjusted Trial Balance For the Month Ended Sept. 30, 2020 Debit Credit Cash Accounts receivable Supplies Prepaid Insurance Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Revenue Common Stock Dividends Retained Earnings Revenue Depreciation Expense Insurance Expense Rent Expense Supplies Expense Salaries Expense Utilities Expense Totals Part 8 Using the totals from your adiusted trial balance mend your closing entries in the space below and post to the General Ledger, (Use the attached General Ledger on pages 3-5). City Park Yoga, Inc. Closing Entries DATE ACCOUNT DR. CR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts