Question: Accounting for Notes Receivable and Notes Payable On June 1, 2020, Tart Company borrowed $15,000 cash from Queen Corporation giving Queen a $15,000, 8%, 10-month

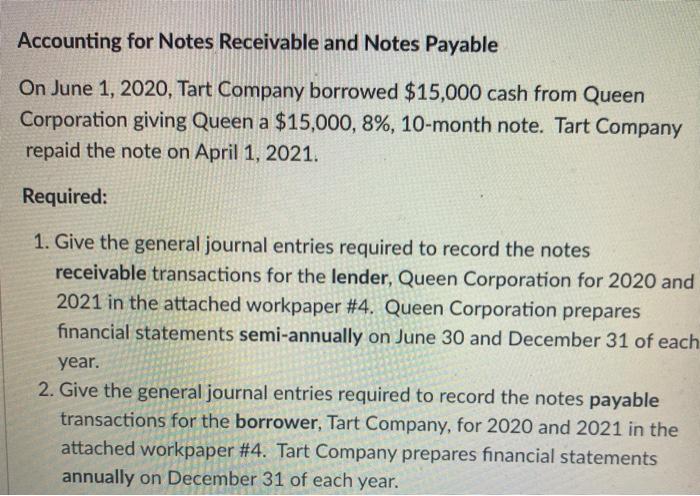

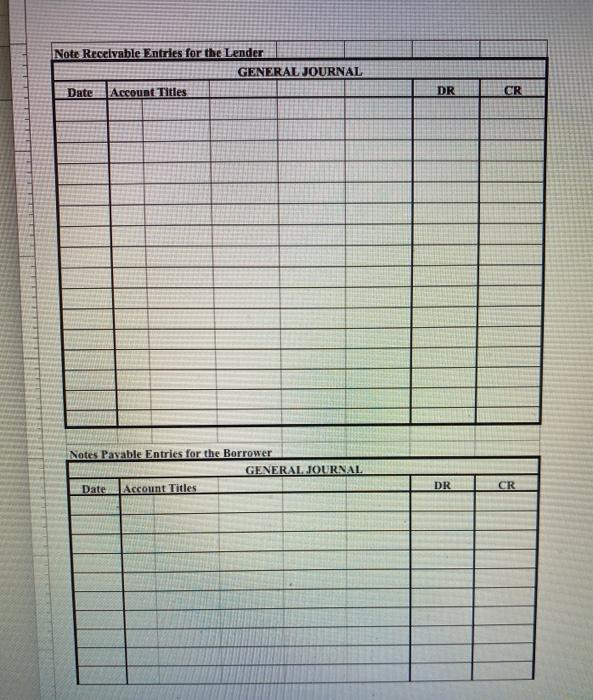

Accounting for Notes Receivable and Notes Payable On June 1, 2020, Tart Company borrowed $15,000 cash from Queen Corporation giving Queen a $15,000, 8%, 10-month note. Tart Company repaid the note on April 1, 2021. Required: 1. Give the general journal entries required to record the notes receivable transactions for the lender, Queen Corporation for 2020 and 2021 in the attached workpaper #4. Queen Corporation prepares financial statements semi-annually on June 30 and December 31 of each year. 2. Give the general journal entries required to record the notes payable transactions for the borrower, Tart Company, for 2020 and 2021 in the attached workpaper #4. Tart Company prepares financial statements annually on December 31 of each year. Note Receivable Entries for the Lender GENERAL JOURNAL Date Account Titles DR CR Notes Payable Entries for the Borrower GENERAL JOURNAL Date Account Titles DR CR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts