Question: Accounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yarnell engaged in the following activities involving notes receivable: a. On September

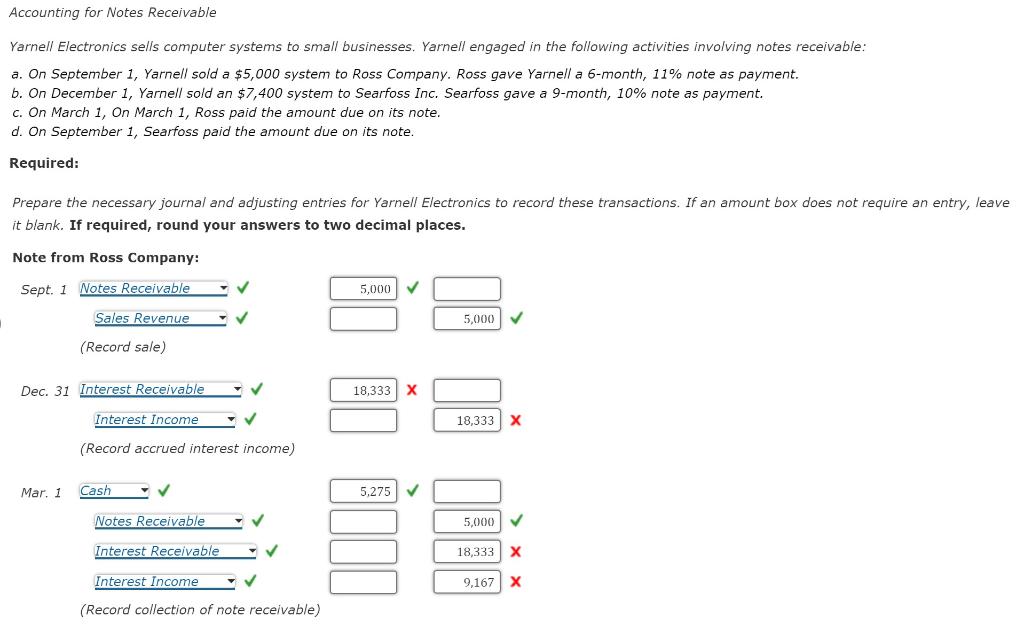

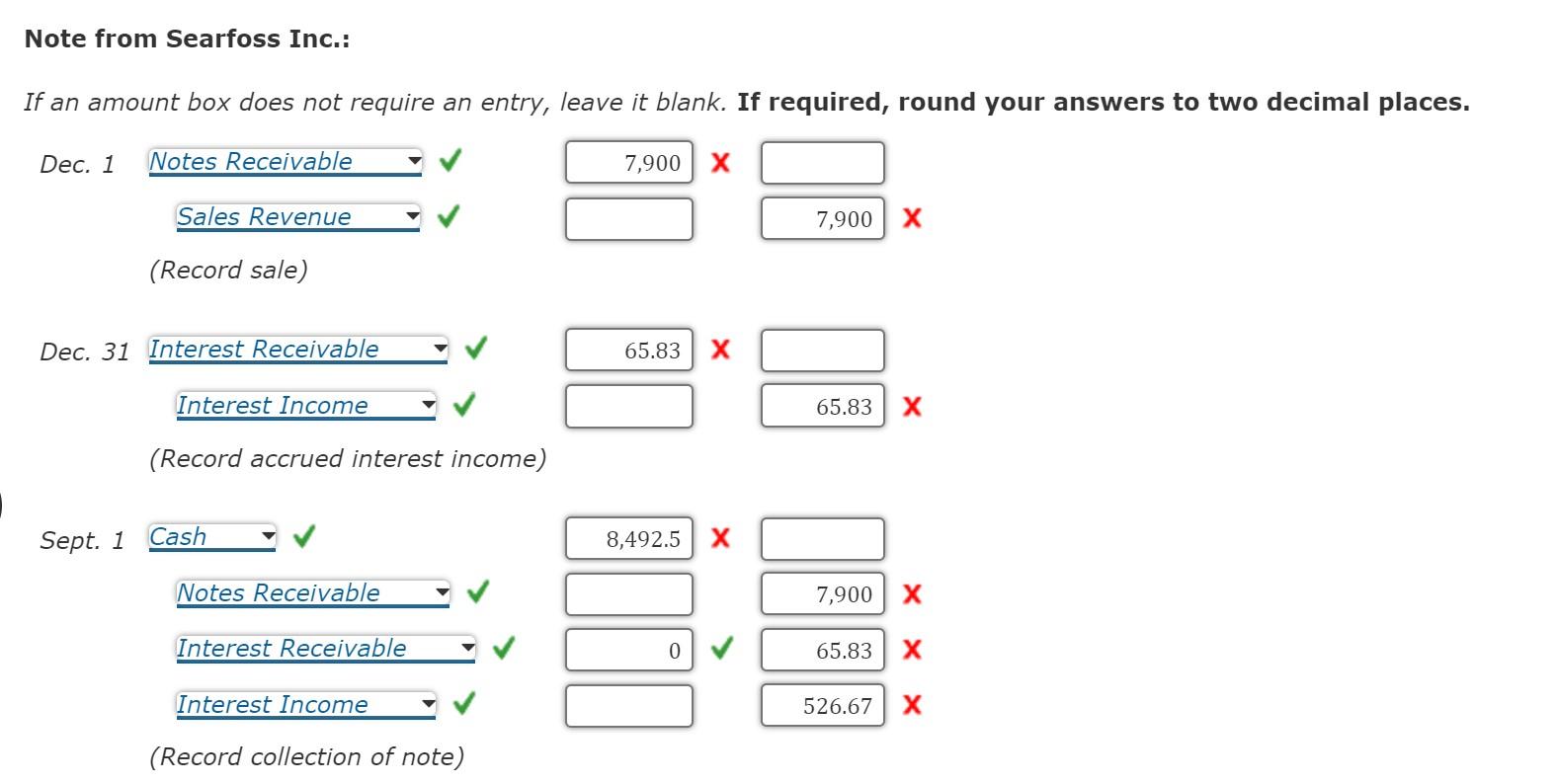

Accounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yarnell engaged in the following activities involving notes receivable: a. On September 1, Yarnell sold a $5,000 system to Ross Company. Ross gave Yarnell a 6-month, 11% note as payment. b. On December 1, Yarnell sold an $7,400 system to Searfoss Inc. Searfoss gave a 9-month, 10% note as payment. c. On March 1, On March 1, Ross paid the amount due on its note. d. On September 1, Searfoss paid the amount due on its note. Required: Prepare the necessary journal and adjusting entries for Yarnell Electronics to record these transactions. If an amount box does not require an entry, leave it blank. If required, round your answers to two decimal places. Note from Ross Company: Sept. 1 Notes Receivable Sales Revenue (Record sale) Dec. 31 Interest Receivable Interest Income (Record accrued interest income) 5,000 5,000 18,333 X 18,333 X Mar. 1 Cash Notes Receivable Interest Receivable Interest Income (Record collection of note receivable) 5,275 333 5,000 18,333 X 9,167 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts