Question: How does the Weighted average common stock get filled out and is this a multiple statement income? (Transactions) December 4: Bought back 18,000 shares of

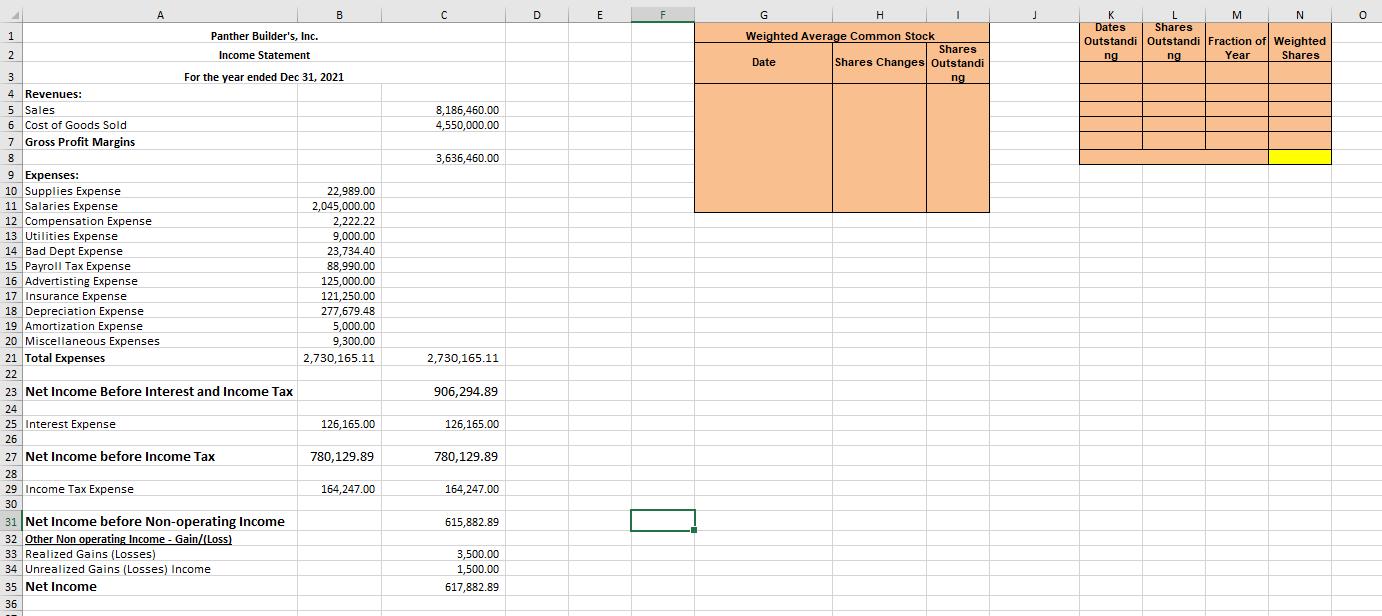

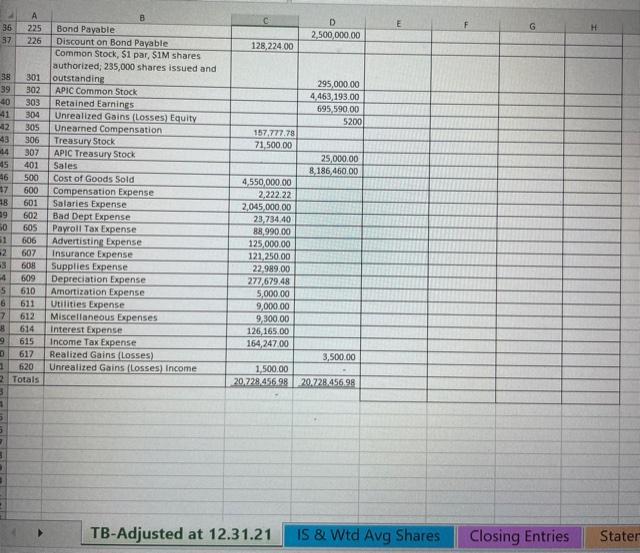

How does the Weighted average common stock get filled out and is this a multiple statement income?

(Transactions)

December 4: Bought back 18,000 shares of stock for $13 per share.

December 5: Issued 10,000 shares of restricted stock to its CFO. The stock has a fair value of $160,000. The service period related to this restricted stock is 6 years. Vesting occurs if the CFO stays with the company for 6 years. The par value of the stock is $1.

December 12: Issued 50,000 shares of common stock at $17.50 per share.

December 21: Sold 12,500 shares of Treasury Stock for $15 per share.

(adjustments)

- Declared dividends of $350,000 on December 31.

(additional information)

1. Issued 35,000 shares of common stock, $1 par, for $700,000 on June 30, 2021.

2. Some equipment was sold (original cost $10,000, book value $3,000) for $6,500 !

3. All amortization and depreciation is recorded once a year on December 31.

4. Market price per share of stock at 12/31/2021 was $18.75.

A B D G H K Dates N Panther Builder's, Inc. Shares Outstandi Outstandi Fraction of Weighted Weighted Average Common Stock Shares 2 Income Statement Shares Changes Outstandi ng ng Year Shares Date 3 For the year ended Dec 31, 2021 ng 4 Revenues: 5 Sales 6 Cost of Goods Sold 8,186,460.00 4,550,000.00 7 Gross Profit Margins 8 3,636,460.00 9 Expenses: 10 Supplies Expense 11 Salaries Expense 12 Compensation Expense 13 Utilities Expense 14 Bad Dept Expense 15 Payroll Tax Expense 16 Advertisting Expense 17 Insurance Expens 18 Depreciation Expense 19 Amortization Expense 20 Miscellaneous Expenses 21 Total Expenses 22,989.00 2,045,000.00 2,222.22 9,000.00 23,734.40 88,990.00 125,000.00 121,250.00 277,679.48 5,000.00 9,300.00 2,730,165.11 2.730,165.11 22 23 Net Income Before Interest and Income Tax 906,294.89 24 25 Interest Expense 126,165.00 126,165.00 26 27 Net Income before Income Tax 780,129.89 780,129.89 28 29 Income Tax Expense 164,247.00 164,247.00 30 31 Net Income before Non-operating Income 32 Other Non operating Income - Gain/(Loss) 33 Realized Gains (Losses) 34 Unrealized Gains (Losses) Income 35 Net Income 615,882.89 3,500.00 1,500.00 617,882.89 36

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

WA Common share is 25502473 You must create a chart that ... View full answer

Get step-by-step solutions from verified subject matter experts