Question: Accounting Intermediate II ACT 420 Additional Assessment Question ONE On December 31, 2010, Texas Group borrowed USD$600,000 at 10% payable annually to finance the construction

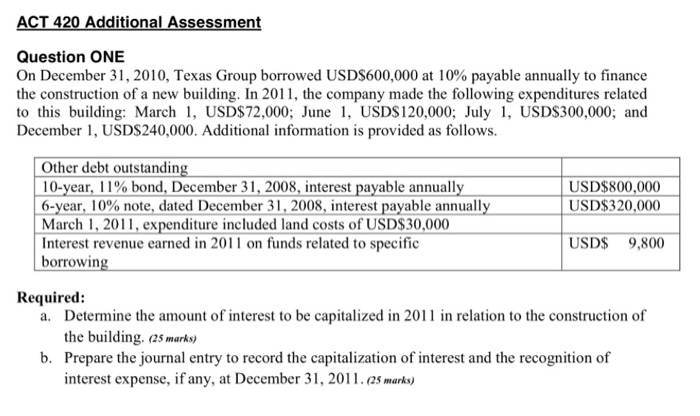

ACT 420 Additional Assessment Question ONE On December 31, 2010, Texas Group borrowed USD$600,000 at 10% payable annually to finance the construction of a new building. In 2011, the company made the following expenditures related to this building: March 1, USD$72,000; June 1, USD$120,000; July 1, USD$300,000; and December 1, USD$240,000. Additional information is provided as follows. Other debt outstanding 10-year, 11% bond, December 31, 2008, interest payable annually USD$800,000 6-year, 10% note, dated December 31, 2008, interest payable annually USD$320,000 March 1, 2011, expenditure included land costs of USD$30,000 Interest revenue earned in 2011 on funds related to specific USD$ 9,800 borrowing Required: a. Determine the amount of interest to be capitalized in 2011 in relation to the construction of the building. (25 marks) b. Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2011. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts