Question: Accounting Intermediate II Practice questions: 21. A defined contribution plan: a. States the fixed amount the employer contributes b. The number of years the employee

Accounting Intermediate II Practice questions:

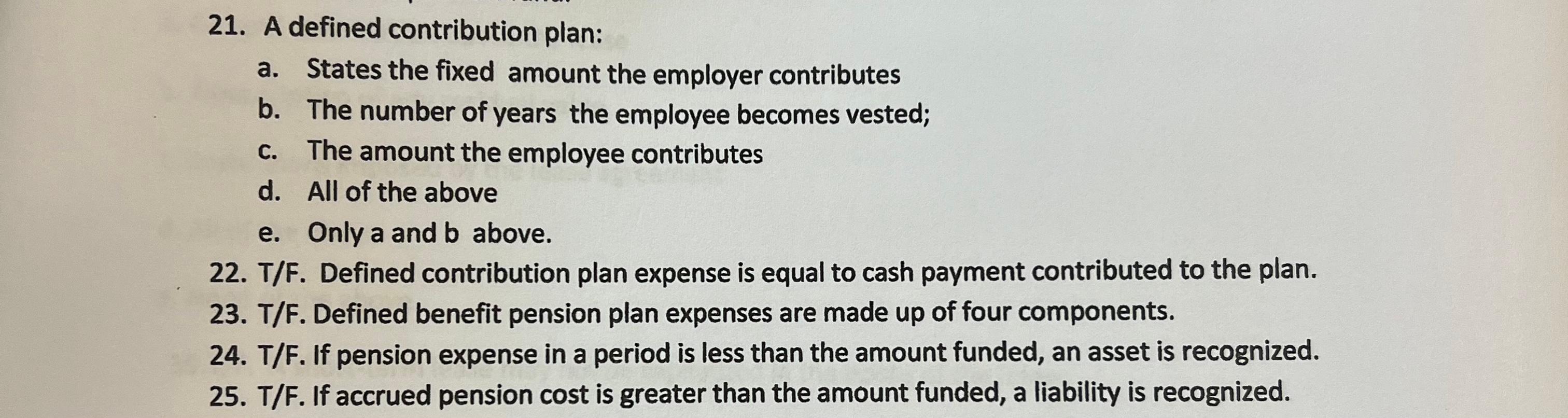

21. A defined contribution plan: a. States the fixed amount the employer contributes b. The number of years the employee becomes vested; c. The amount the employee contributes d. All of the above e. Only a and b above. 22. T/F. Defined contribution plan expense is equal to cash payment contributed to the plan. 23. T/F. Defined benefit pension plan expenses are made up of four components. 24. T/F. If pension expense in a period is less than the amount funded, an asset is recognized. 25. T/F. If accrued pension cost is greater than the amount funded, a liability is recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts