Question: Accounting: Longterm Receivables - Show Complete Solution / Explain: 1. In return for property sold, an entity got a 7-year zero-interest-bearing note on February 1,

Accounting: Longterm Receivables - Show Complete Solution / Explain:

1. In return for property sold, an entity got a 7-year zero-interest-bearing note on February 1, 2020. The property had no fixed exchange price, and the note had no ready market. The prevailing interest rate on a note of this kind was 7% on February 1, 2020, 6% on December 31, 2020, 8% on February 1, 2021, and 9% on December 31, 2021. What interest rate should be utilized to compute the transaction's interest revenue for the financial year ending December 31, 2020 and 2021, respectively?

a. 6% and 9%

b. 0% and 0%

c. 7% and 9%

d. 7% and 7%

2. An business acquired a two-year 8% note receivable for services provided on July 1 of the current year. The market rate of interest at the time was 10%. The face amount of the note, as well as the full amount of interest, is payable on the maturity date. What is the interest receivable on December 31st of the current year?

a. 4% of the face amount of note

b. 5% of the face amount of note

c. 4% of the PV of note

d. 5% of the PV of note

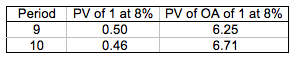

3. On December 31, 2019, Boy Company sold a machine to Abunda Company in return for a non-interest bearing note with 10 yearly installments of $20,000.The first payment was paid by Abunda Company on December 31, 2019. At the time of issue, the market interest rate for similar notes was 8%. The following is information on present value factors:

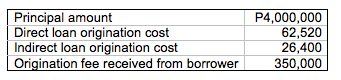

Period PV of 1 at 8% PV of OA of 1 at 8% 9 0.50 6.25 10 0.46 6.71Principal amount P4,000,000 Direct loan origination cost 62,520 Indirect loan origination cost 26,400 Origination fee received from borrower 350,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts