Question: Maple Leaf Accessories Ltd. created Bling Accessories Ltd., a foreign subsidiary, on April 1, 20X7. It exchanged FC 250,000 for all the newly issued

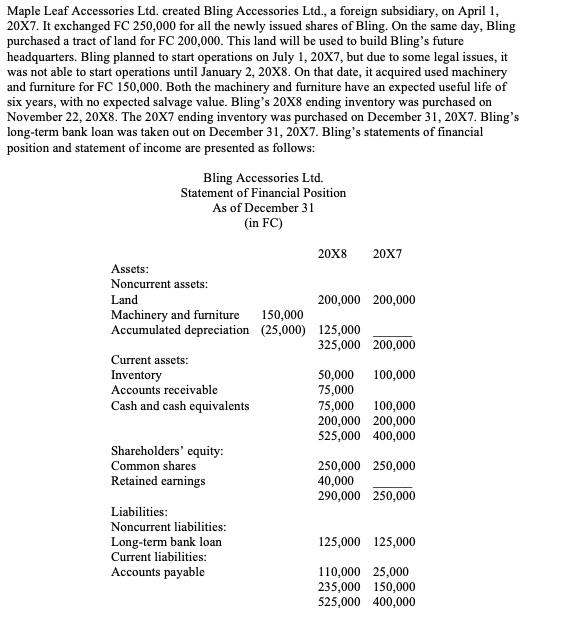

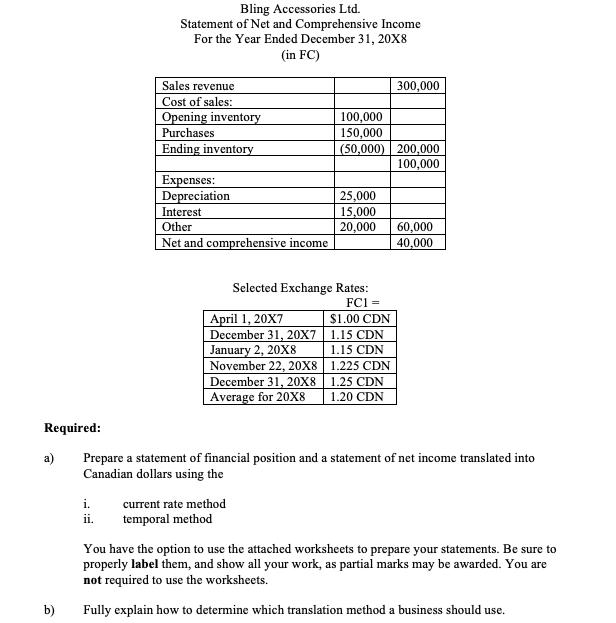

Maple Leaf Accessories Ltd. created Bling Accessories Ltd., a foreign subsidiary, on April 1, 20X7. It exchanged FC 250,000 for all the newly issued shares of Bling. On the same day, Bling purchased a tract of land for FC 200,000. This land will be used to build Bling's future headquarters. Bling planned to start operations on July 1, 20X7, but due to some legal issues, it was not able to start operations until January 2, 20X8. On that date, it acquired used machinery and furniture for FC 150,000. Both the machinery and furniture have an expected useful life of six years, with no expected salvage value. Bling's 20X8 ending inventory was purchased on November 22, 20X8. The 20X7 ending inventory was purchased on December 31, 20X7. Bling's long-term bank loan was taken out on December 31, 20X7. Bling's statements of financial position and statement of income are presented as follows: Bling Accessories Ltd. Statement of Financial Position As of December 31 (in FC) Assets: Noncurrent assets: Land Machinery and furniture 150,000 Accumulated depreciation (25,000) Current assets: Inventory Accounts receivable Cash and cash equivalents Shareholders' equity: Common shares Retained earnings Liabilities: Noncurrent liabilities: Long-term bank loan Current liabilities: Accounts payable 20X8 20X7 200,000 200,000 125,000 325,000 200,000 50,000 100,000 75,000 75,000 100,000 200,000 200,000 525,000 400,000 250,000 250,000 40,000 290,000 250,000 125,000 125,000 110,000 25,000 235,000 150,000 525,000 400,000 Required: a) b) Bling Accessories Ltd. Statement of Net and Comprehensive Income For the Year Ended December 31, 20X8 (in FC) i. ii. Sales revenue Cost of sales: Opening inventory Purchases Ending inventory Expenses: Depreciation Interest Other Net and comprehensive income Selected Exchange April 1, 20X7 December 31, 20X7 January 2, 20X8 November 22, 20X8 December 31, 20X8 Average for 20X8 current rate method temporal method 100,000 150,000 (50,000) 200,000 100,000 25,000 15,000 20,000 Rates: 300,000 FC1= $1.00 CDN 1.15 CDN 1.15 CDN 1.225 CDN 1.25 CDN 1.20 CDN Prepare a statement of financial position and a statement of net income translated into Canadian dollars using the 60,000 40,000 You have the option to use the attached worksheets to prepare your statements. Be sure to properly label them, and show all your work, as partial marks may be awarded. You are not required to use the worksheets. Fully explain how to determine which translation method a business should use.

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Question Current Method Bling Accessories Ltd Statement of Financial Position As of December 31 20X8 Assets Current assets Cash and cash equivalents93750 Accounts receivable93750 Inventory62500 Noncur... View full answer

Get step-by-step solutions from verified subject matter experts